S&P 500 Climbs as Hiring Surges and Wage Growth Moderates, Fueling Optimism on Fed's Interest Rate Pause

The S&P 500 rose by 1.2% on Friday, October 6, 2023, following Labor Department data showing a strong increase in hiring alongside a slowdown in wage growth, sparking hopes that the Federal Reserve may ease off further interest rate hikes aimed at curbing inflation.

Bill McColl brings over 25 years of expertise as a senior producer and writer across TV, radio, and digital platforms, leading teams in delivering impactful news coverage on major events.

Highlights

- On October 6, 2023, the S&P 500 surged 1.2% after Labor Department figures revealed a robust jump in employment coupled with slower wage growth, boosting expectations that the Fed might pause interest rate increases to manage inflation.

- Shares of Pioneer Natural Resources soared following reports that Exxon Mobil is nearing a $60 billion acquisition deal.

- Walmart's stock declined as the retailer reported a drop in food sales, attributed to the rising popularity of weight-loss medications.

U.S. stock markets posted strong gains after the Labor Department announced a significant rise in hiring alongside a larger-than-expected deceleration in year-over-year wage growth for September. This data increased investor confidence that the Federal Reserve could hold off on additional interest rate hikes designed to control inflation. The S&P 500 climbed 1.2%, while the Dow Jones Industrial Average and Nasdaq Composite also closed higher. Over the week, the S&P 500 and Nasdaq saw gains, whereas the Dow experienced a decline.

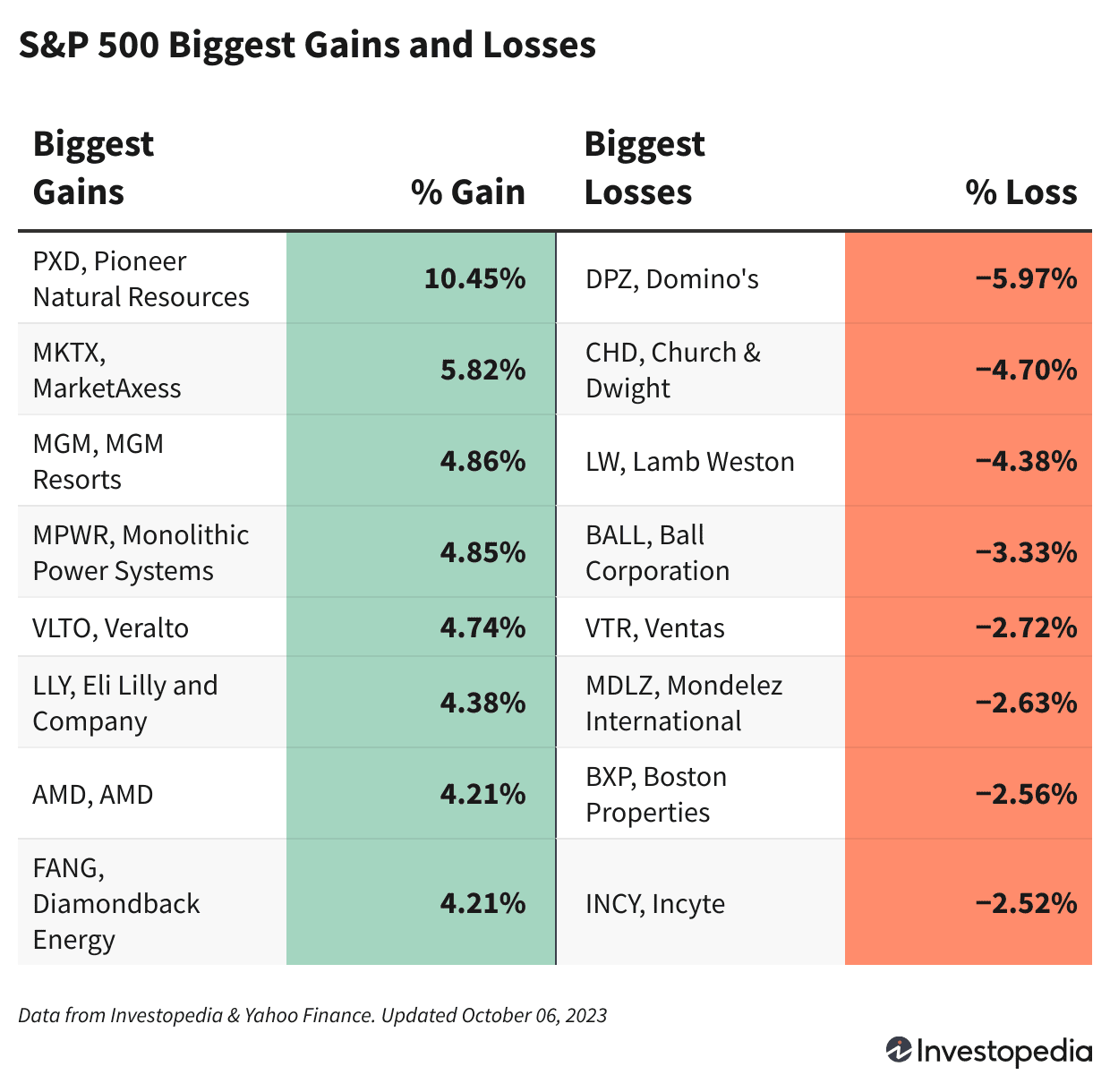

Shares of Pioneer Natural Resources (PXD) jumped 10.5% amid reports that Exxon Mobil (XOM) is in advanced negotiations to acquire the shale oil producer for approximately $60 billion. Meanwhile, Exxon Mobil's shares dipped 1.7%.

Newmont Corporation (NEM) shares increased by 4% after Australia's Newcrest Mining confirmed regulatory approval for Newmont's proposed $16.7 billion acquisition of the company, clearing the way for deal completion.

MGM Resorts International (MGM) saw its shares rise 5% following news that the company declined to pay ransom demands after a cyberattack disrupted its operations in September.

AMC Entertainment Holdings (AMC) shares surged 11.6% as presales for the upcoming Taylor Swift concert film surpassed $100 million, signaling strong consumer interest.

Walmart (WMT) shares fell 1.7% after the retail giant reported that food sales are being negatively impacted by the increasing use of weight-loss drugs, which is reducing consumer purchases. Competitors Costco Wholesale Corporation (COST) and snack producer Mondelez (MDLZ) also saw their shares decline by 2.1% and 2.6%, respectively.

Boston Properties (BXP) shares dropped 2.5% following the sale of the iconic Metropolitan Square office building in Washington, D.C., one of the city's largest Class A office properties, by the developer and its partner Blackstone (BX).

McDonald's (MCD) shares declined 1.6%, hitting a one-year low amid concerns that elevated interest rates may dampen consumer spending on fast food.

For news tips, please contact Investopedia reporters at tips@investopedia.com.Discover engaging topics and analytical content in Markets News as of 11-10-2023. The article titled " S&P 500 Climbs as Hiring Surges and Wage Growth Moderates, Fueling Optimism on Fed's Interest Rate Pause " provides new insights and practical guidance in the Markets News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " S&P 500 Climbs as Hiring Surges and Wage Growth Moderates, Fueling Optimism on Fed's Interest Rate Pause " helps you make smarter decisions within the Markets News category. All topics on our website are unique and offer valuable content for our audience.