Lululemon Stock Surges Over 8% in 2025 After Raising Full-Year Earnings Forecast and Expanding Buyback Program to $1 Billion

Lululemon's shares soared in early trading following impressive quarterly earnings, an upgraded full-year profit outlook, and a significant $1 billion stock buyback authorization. Discover key price levels and future growth potential in this detailed update.

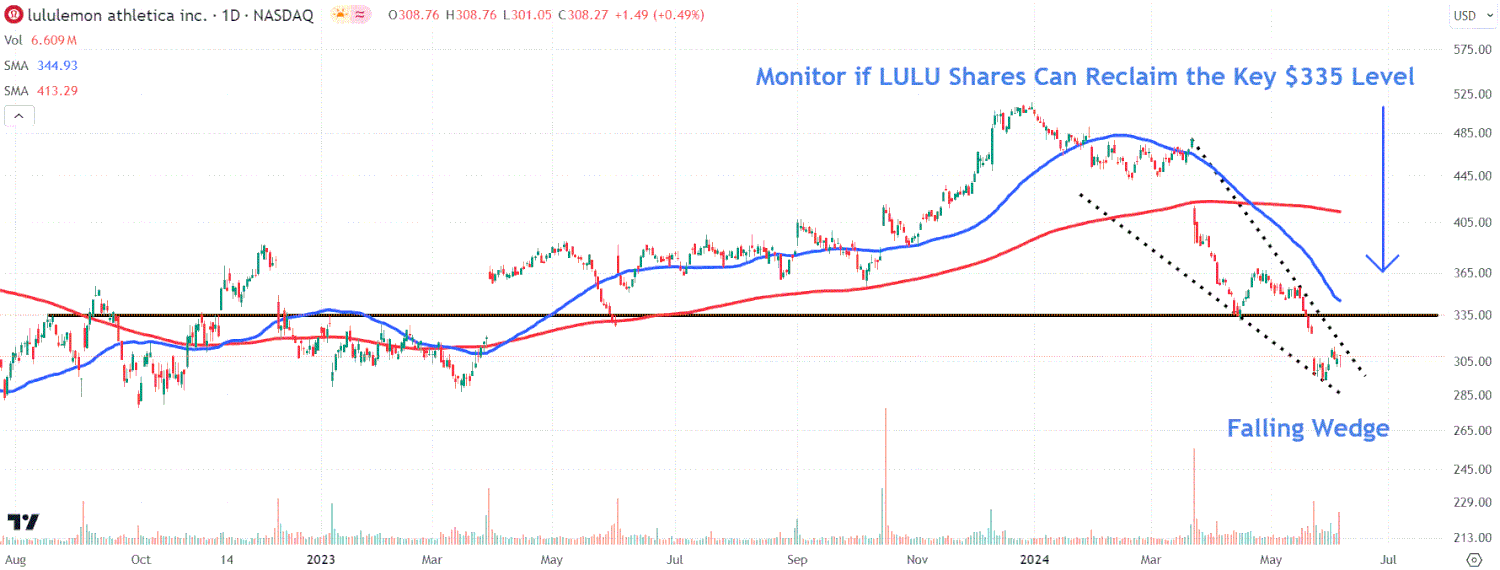

Key Price Level to Watch

Highlights

- Lululemon (LULU) shares surged more than 8% in premarket trading after the activewear giant reported stronger-than-expected quarterly earnings, raised its full-year earnings guidance, and expanded its stock repurchase program by an additional $1 billion.

- CEO Calvin McDonald acknowledged ongoing inventory challenges in the Americas during Q1 but anticipates significant improvement in stock levels throughout the latter half of 2024.

- Investors should monitor whether Lululemon’s stock price can reclaim the crucial $335 mark, a resistance point influenced by price action over the past 21 months.

In Q1 ending April 28, 2024, Lululemon Athletica reported earnings of $2.54 per share, surpassing analyst estimates of $2.38. Revenue climbed 10% year-over-year to $2.21 billion, slightly exceeding the consensus estimate of $2.19 billion.

The company's international segment led growth with a remarkable 35% sales increase, offsetting the modest 3% revenue rise in the Americas, its largest market.

For Q2, Lululemon projects net sales between $2.40 billion and $2.42 billion, with earnings per share expected between $2.92 and $2.97, slightly below analyst expectations. However, the full-year EPS forecast was raised to a range of $14.27 to $14.47, up from the previous $14 to $14.20 projection.

Expanded $1 Billion Stock Buyback Program

Following a $296.9 million share repurchase in Q1, Lululemon authorized an additional $1 billion buyback, signaling strong management confidence in the company’s growth strategy and market position.

Technical Outlook: Key Chart Resistance at $335

Lululemon’s shares have been trading within a bullish falling wedge pattern since March 2024, indicating potential upward momentum. The stock is poised to break above the wedge’s upper trendline, which could pave the way for testing the critical $335 resistance level.

A decisive close above $335 may open the path toward higher resistance near $387, attracting further investor interest.

As of early morning trading, LULU was priced at $334.25, reflecting an 8.4% gain.

Disclaimer: The insights and analyses provided are for informational purposes only. For more details, please review our warranty and liability disclaimer on ZAMONA.

Note: The author holds no positions in the securities mentioned as of the article date.

Have a news tip for ZAMONA? Contact us at tips@ZAMONA.

Discover engaging topics and analytical content in Company News as of 11-06-2024. The article titled " Lululemon Stock Surges Over 8% in 2025 After Raising Full-Year Earnings Forecast and Expanding Buyback Program to $1 Billion " provides new insights and practical guidance in the Company News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " Lululemon Stock Surges Over 8% in 2025 After Raising Full-Year Earnings Forecast and Expanding Buyback Program to $1 Billion " helps you make smarter decisions within the Company News category. All topics on our website are unique and offer valuable content for our audience.