January Stock Market Trends and Trading Strategies in 2025: Insights and Price Analysis

Explore the historical January effect in stock markets, its challenges, and effective trading strategies for January 2025. Understand how previous month performance influences January returns and optimize your investments with expert insights.

Gordon Scott, a Chartered Market Technician (CMT), brings over 20 years of experience in investment and technical analysis.

Historical January Market Behavior

The January effect has been observed since 1942, initially highlighting the tendency for small-cap stocks to outperform large-cap stocks during January. Over time, this concept expanded to suggest a general rise in stock prices during this month.

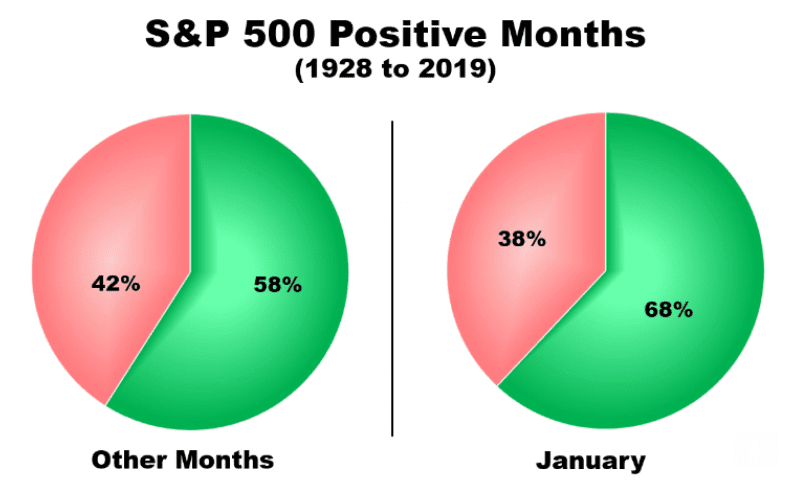

Data from the S&P 500 index since 1928 shows that January often records a higher frequency of positive closes compared to other months, indicating a seasonal pattern favoring gains early in the year.

Debunking the January Effect

In 1973, economist Burton Malkiel challenged the January effect in his influential book "A Random Walk Down Wall Street," arguing that the phenomenon is not a reliable market predictor. Despite this, historical data including all years since 1928 still shows January returns often outperform other months.

However, focusing on the last 30 years, the January advantage diminishes significantly, supporting Malkiel's skepticism.

Effective Trading Strategies for January 2024

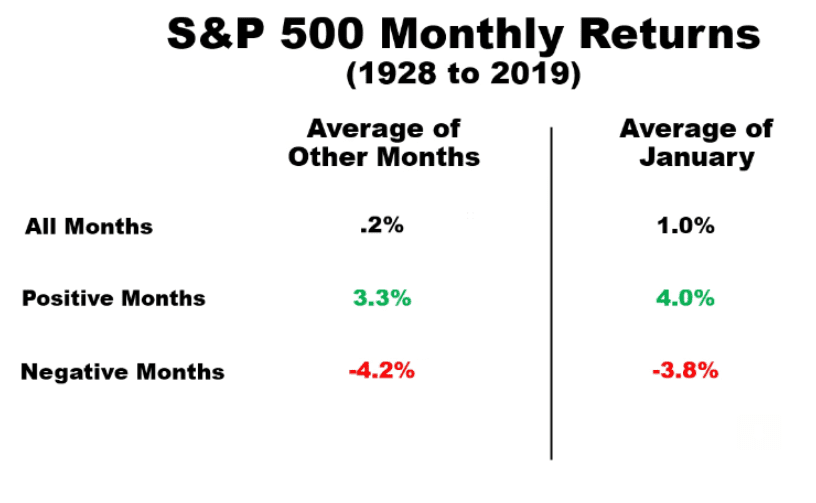

Despite uncertainties, broad-market indexes tend to close higher more often in January. A key indicator for traders is December's market performance: if December ends positively, January is twice as likely to yield gains; if December closes negatively, January outcomes are unpredictable.

Analysis of 91 years of S&P 500 data shows that January averages a 3% gain following a positive December, but also risks a 4.5% loss, resulting in an expected return near zero. This aligns with the Efficient Market Hypothesis, suggesting cautious, strategic trading is essential.

Traders aiming to capitalize on January trends should consider timing entries mid-month, especially before earnings season, while managing risk carefully rather than relying solely on buy-and-hold approaches.

Conclusion

The January effect has historical backing but is not a guaranteed strategy. Monitoring December's performance can guide traders toward more informed decisions in January. Strategic entry points and risk management remain critical for success.

Enjoyed this analysis? Subscribe to the Chart Advisor newsletter for more expert market insights.

Discover engaging topics and analytical content in Markets News as of 05-01-2020. The article titled " January Stock Market Trends and Trading Strategies in 2025: Insights and Price Analysis " provides new insights and practical guidance in the Markets News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " January Stock Market Trends and Trading Strategies in 2025: Insights and Price Analysis " helps you make smarter decisions within the Markets News category. All topics on our website are unique and offer valuable content for our audience.