Is the Federal Reserve Finally Ready to Slash Interest Rates? What This Means for the Economy

Explore why the Federal Reserve's anticipated interest rate cut has economists debating if the move is overdue, and what impact it may have on the U.S. economy and labor market.

Essential Insights

- The Federal Reserve is expected to reduce interest rates at its upcoming policy meeting, sparking debate about whether the central bank delayed easing borrowing costs too long.

- Some experts argue the Fed should have initiated rate cuts at its July meeting, citing a historical pattern of slow responses.

- Current interest rates might be as much as two percentage points higher than necessary, suggesting the Fed may need to accelerate its easing measures.

After maintaining benchmark interest rates at their highest level in two decades for over a year, the Federal Reserve is widely anticipated to implement its first rate cut in four years during next week's policy meeting.

Since 2022, the Fed has steadily raised rates to combat inflation, which has increased borrowing costs and weighed on economic activity. Now, with a rate reduction nearly certain, questions arise about the timing and potential consequences of this policy shift.

Dan North, senior economist at Allianz Trade Americas, notes, “Historically, the Fed tends to wait too long before cutting rates, and this cycle appears no different.”

Federal Reserve’s Balancing Act Amid Labor Market Shifts

The Fed has maintained the federal funds rate between 5.25% and 5.5%, aiming to temper consumer and business spending and thereby ease inflationary pressures.

Inflation, measured by the Fed's preferred index, has dropped from a post-pandemic peak above 7% to approximately 2.5%, nearing the central bank’s 2% target. Meanwhile, the robust labor market that once fueled inflation is showing signs of cooling under the strain of elevated interest rates.

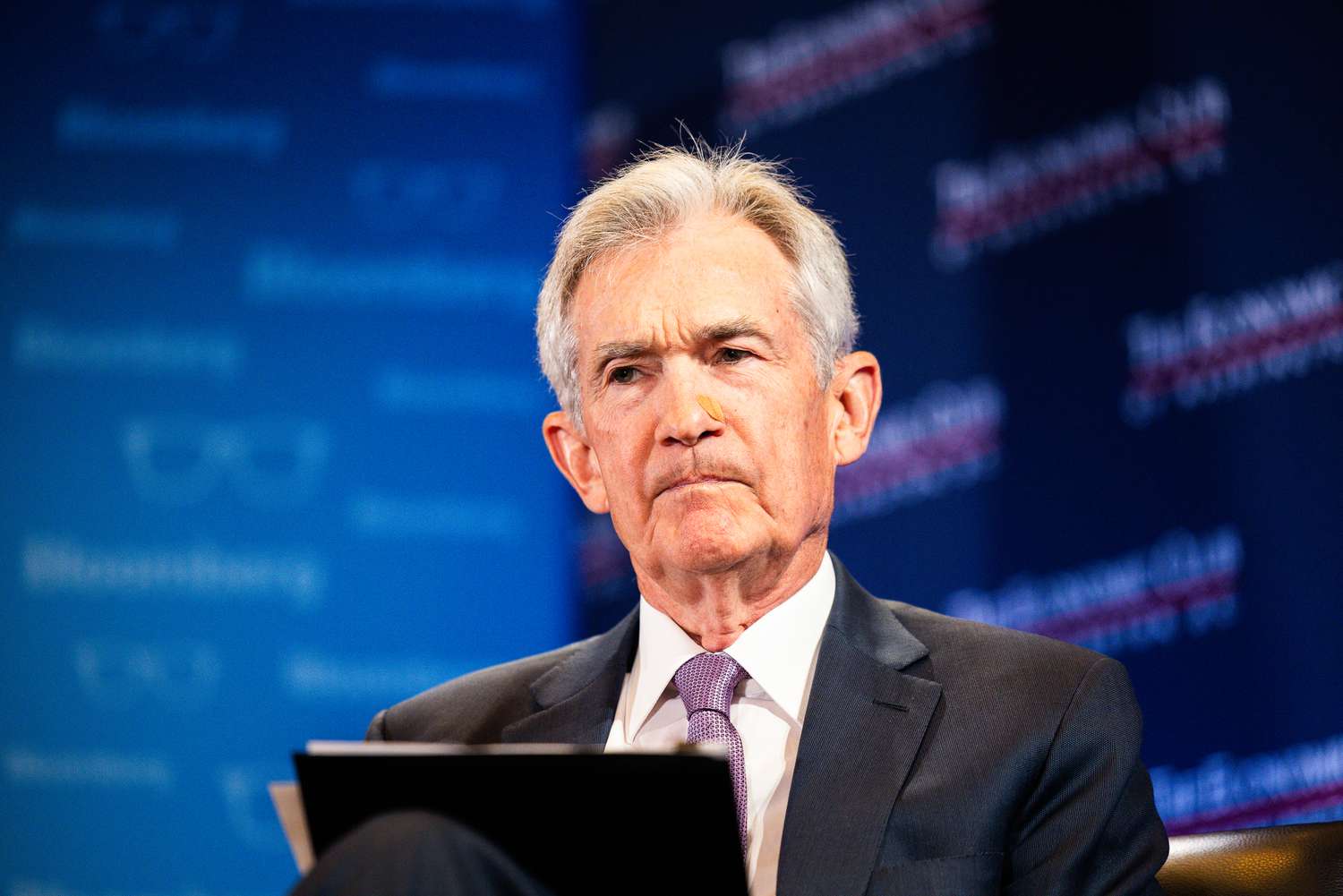

Fed Chair Jerome Powell and other officials acknowledge progress in reducing inflation but remain cautious about labor market softness. They have also indicated that rates do not need to hit the inflation target before easing begins.

Several economists believe these indicators warranted earlier rate cuts.

Kathy Bostjancic, senior vice president and chief economist at Nationwide, stated, “Given the noticeable softening in the labor market and economy, alongside a downward trend in inflation, the Fed should have begun rate reductions sooner.”

Bill Adams, chief economist at Comerica Bank, points out that initially strong employment data justified holding rates steady, but subsequent revisions reveal a weaker labor market than first thought.

“After missing inflation targets from 2021 to 2023, the Fed opted to delay rate cuts this year, even at the risk of a softer job market,” Adams explained.

Is the Fed Playing Catch-Up with Interest Rate Cuts?

Some experts argue that rate reductions should have started at the July meeting, where officials debated but ultimately refrained from lowering rates.

Estimates suggest that current rates might be up to two percentage points too high for prevailing economic conditions, indicating a potential need for the Fed to accelerate easing.

Robert Kavcic, senior economist at BMO Economics, remarked, “The Fed may recognize that it is behind the curve.”

Historically, the Fed’s cautious approach stems from uncertainties about the lag time for rate changes to impact the economy and a desire to prevent inflation from resurging, according to Allianz’s Dan North.

“Unfortunately, this delay often results in a sharper economic slowdown,” North added.

If the Fed opts for a larger-than-usual rate cut—exceeding the typical quarter-point—it could signal acknowledgment of previous delays.

However, North warns, “A substantial cut could be perceived as panic by financial markets, potentially unsettling investors.”

As of late Thursday, CME Group’s FedWatch tool indicated about a 33% chance of a half-percentage-point rate cut next week, up from 15% the previous day but below the 50% probability seen last Friday following weaker-than-expected August jobs data.

For inquiries or news tips, please contact Investopedia reporters at tips@investopedia.com.

Discover engaging topics and analytical content in Economic News as of 26-05-2024. The article titled " Is the Federal Reserve Finally Ready to Slash Interest Rates? What This Means for the Economy " provides new insights and practical guidance in the Economic News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " Is the Federal Reserve Finally Ready to Slash Interest Rates? What This Means for the Economy " helps you make smarter decisions within the Economic News category. All topics on our website are unique and offer valuable content for our audience.