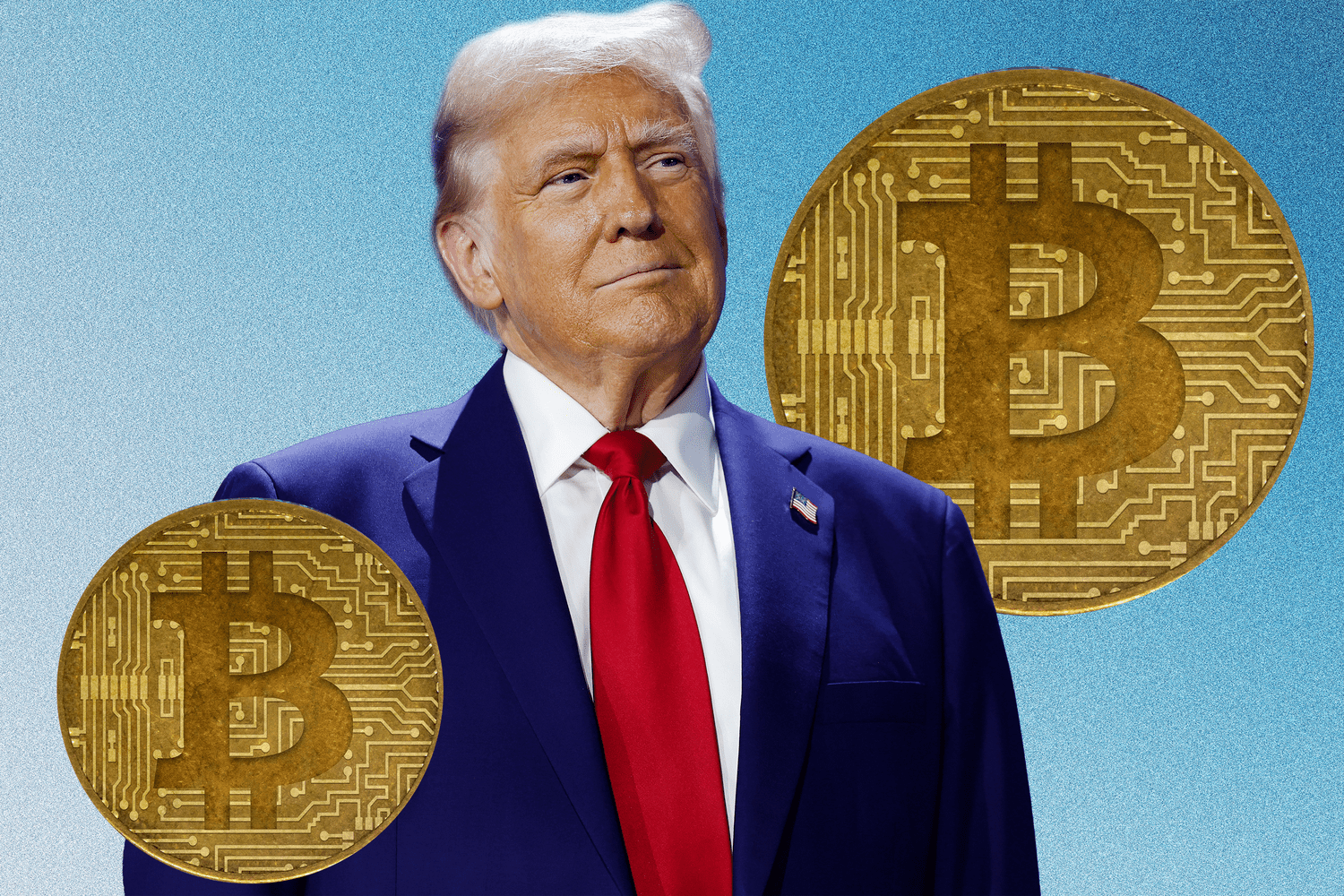

Implications of Trump’s Election Victory on Bitcoin and Cryptocurrency Markets

Explore how Donald Trump's return to the presidency could impact crypto regulations, the emergence of a strategic bitcoin reserve, and the future growth of the bitcoin mining industry.

Key Insights

- Trump's election win is viewed positively by the crypto community, reflected in bitcoin reaching new record price levels.

- With more crypto-supportive lawmakers entering Congress, enhanced regulatory clarity for stablecoins and digital assets is anticipated.

- Potential initiatives under Trump’s administration include establishing a strategic bitcoin reserve and expanding the bitcoin mining sector in the U.S.

The cryptocurrency sector is optimistic about upcoming developments.

Donald Trump’s return to the White House signals promising prospects for crypto regulation reforms and the possibility of creating a strategic bitcoin reserve. This optimism has propelled bitcoin (BTCUSD) to surpass $75,000 recently, maintaining strong support near this historic peak.

Advancing Regulatory Clarity for Cryptocurrencies

One major challenge for the crypto industry has been the Securities and Exchange Commission’s (SEC) aggressive enforcement actions. Crypto advocates have criticized the SEC for overreaching, citing cases against major exchanges like Binance, Coinbase, and Kraken.

At the Bitcoin 2024 conference, Trump pledged to halt the "anti-crypto crusade" of the current administration and promised to replace SEC Chair Gary Gensler immediately upon taking office. He also proposed the establishment of a national bitcoin reserve during the event.

The recent election introduced more crypto-friendly legislators into Congress, fueling optimism for swift progress on stablecoin legislation and clear definitions of crypto assets as securities, according to Bernstein analysts cited by CoinDesk.

These developments may also pave the way for innovative crypto exchange-traded funds (ETFs), such as Bitwise’s recent proposal for an XRP ETF.

Future Outlook for Bitcoin

Trump has expressed intentions to promote the creation of a strategic bitcoin reserve if re-elected. While this reserve might not involve acquiring new bitcoin beyond current holdings, it could significantly influence global governments’ perception of bitcoin.

Additionally, Trump advocates for expanding the U.S. bitcoin mining industry, emphasizing a vision where every bitcoin is mined domestically. This stance contributed to a rise in bitcoin mining stocks like Marathon Digital (MARA), Riot Platforms (RIOT), Hut8 (HUT), and CleanSpark (CLSK).

Bitwise CIO Matt Hougan forecasts bitcoin’s price to exceed $100,000 by year-end but cautions investors to remain selective.

"Not every crypto project will succeed," Hougan noted. "Regulatory reforms will create a level playing field, allowing projects to succeed or fail based on merit. Investors must carefully discern quality projects and apply disciplined risk evaluation."

Discover engaging topics and analytical content in Cryptocurrency News as of 01-07-2024. The article titled " Implications of Trump’s Election Victory on Bitcoin and Cryptocurrency Markets " provides new insights and practical guidance in the Cryptocurrency News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " Implications of Trump’s Election Victory on Bitcoin and Cryptocurrency Markets " helps you make smarter decisions within the Cryptocurrency News category. All topics on our website are unique and offer valuable content for our audience.