GE HealthCare 2025 Q1 Earnings Preview: Revenue Hits $4.81B, Shares at $88.94

Discover what to expect from GE HealthCare's 2025 first-quarter earnings report, including revenue projections, AI investment impact, and insights following GE's recent three-way split.

Essential Highlights

- GE HealthCare Technologies will release its Q1 2024 earnings before market open on Tuesday.

- Experts predict year-over-year growth in both revenue and net income for GE HealthCare.

- Previous reports indicated that GE HealthCare’s AI investments could enhance future clinical and operational outcomes.

- The recent finalization of General Electric's tri-company split places new focus on GE HealthCare's standalone performance since the 2023 spin-off.

GE HealthCare Technologies (GEHC) is set to announce its Q1 2024 earnings ahead of the market open, following earnings disclosures from fellow ex-General Electric entities, GE Aerospace and GE Vernova.

Analyst consensus projects GE HealthCare’s Q1 revenue at approximately $4.81 billion, with net income estimated at $391.52 million, translating to diluted earnings per share (EPS) of around $0.88, based on Visible Alpha data.

Comparatively, Q1 2023 results showed $4.71 billion in revenue and $372 million in net income, or $0.41 per share. That quarter marked only the second earnings release since GE HealthCare’s January 2023 spin-off from General Electric.

R&D Investment Focus Including AI

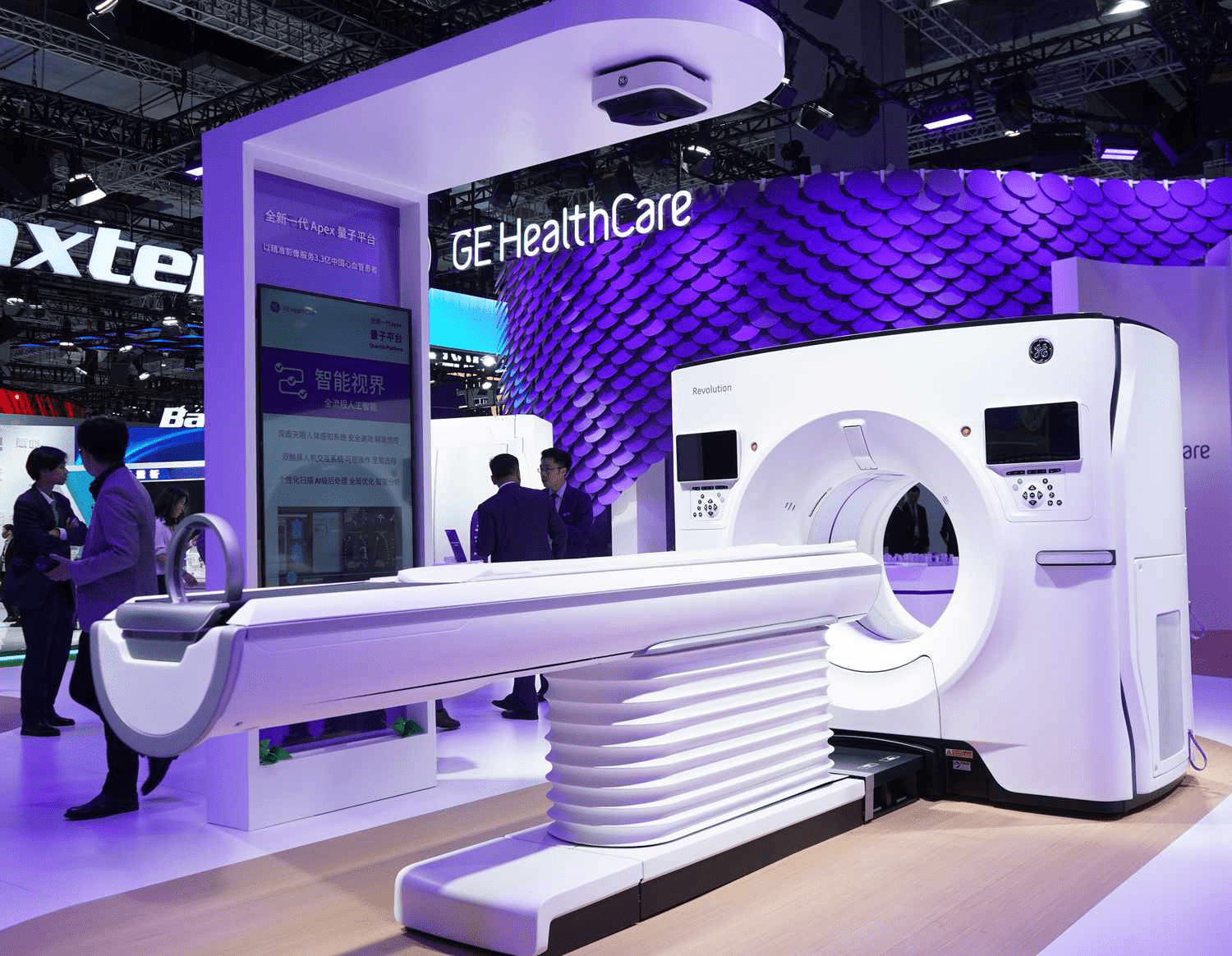

In its Q4 2023 disclosure, GE HealthCare detailed $1.21 billion spent on research and development, emphasizing strategic investments in artificial intelligence technologies. The company highlighted these advancements as key drivers for future clinical improvements and productivity gains.

Impact of GE's Three-Way Corporate Split

Although the recent completion of GE’s division into GE HealthCare, GE Aerospace, and GE Vernova might not directly affect immediate earnings, it has increased investor focus on GE HealthCare’s independent trajectory since the spin-off.

The restructuring addresses previous concerns about investor under-ownership across GE’s diverse sectors. As Larry Culp, CEO of GE Aerospace, noted, separating these businesses allows investors to target their preferred industries without exposure to unrelated segments like aerospace engines.

Since launching publicly on January 4, 2023, at $60.49 per share, GE HealthCare’s stock has surged roughly 47%, closing at $88.94 on Monday. The share price has appreciated 15% year-to-date in 2024.

Update as of April 29, 2024: Share price data has been refreshed to reflect current market values.

Discover engaging topics and analytical content in Company News as of 04-05-2024. The article titled " GE HealthCare 2025 Q1 Earnings Preview: Revenue Hits $4.81B, Shares at $88.94 " provides new insights and practical guidance in the Company News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " GE HealthCare 2025 Q1 Earnings Preview: Revenue Hits $4.81B, Shares at $88.94 " helps you make smarter decisions within the Company News category. All topics on our website are unique and offer valuable content for our audience.