Cannabis Stocks Poised to Challenge Recent Peaks

Discover why cannabis stocks might have hit their lowest point. Gain investment opportunities through two top cannabis companies or a marijuana-focused ETF.

Introduction of cannabis derivative products in Canada is set to drive sales growth

Following their explosive surge in 2018, cannabis stocks have cooled off over the past year, as leading companies grappled with supply constraints, steep taxes, and regulatory challenges.

As we enter 2020, many of these obstacles are starting to ease. Canadian authorities—the first developed nation to legalize recreational cannabis—are steadily resolving cultivation and sales license backlogs. Additionally, in December, Canada authorized cannabis derivative products like edibles, vapes, and infused drinks, expected to significantly boost market demand.

In the United States, 33 states have legalized cannabis for medical or recreational purposes. Notably, the House of Representatives passed a bill in September permitting legal marijuana businesses access to banking services, pending Senate approval.

Technically, leading cannabis stocks have broken above their multi-month downtrend lines in January, signaling growing investor confidence in this emerging sector. Below, we analyze two Canadian cannabis stocks along with a marijuana-themed exchange-traded fund (ETF).

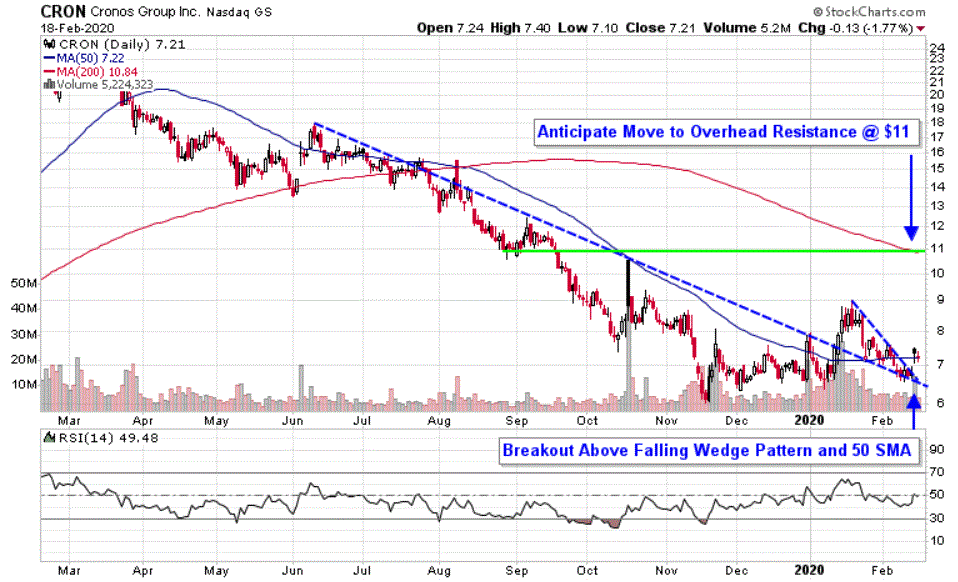

Cronos Group Inc. (CRON)

Based in Toronto, Cronos Group Inc. (CRON) cultivates and markets both medicinal and recreational cannabis. In 2019, the $2.47 billion firm acquired units of Redwood Holding Group, LLC, a producer of hemp-derived CBD skincare products, to expand its cannabidiol (CBD) offerings in the U.S. market. As of February 19, 2020, Cronos shares have declined 66% over the past year but have rebounded 17.43% since late November.

In early January, Cronos shares surged above an eight-month downtrend on strong volume but briefly retreated to test the breakout level as buying momentum paused. Since then, the price has rallied from trendline support, closing above the 50-day simple moving average (SMA) and breaking out of a mini falling wedge pattern—typically a bullish indicator. Investors entering now should place stop-loss orders below the February low at $6.57, targeting resistance near $11. Adjust stop-losses to breakeven if the price surpasses the 2020 high of $9.

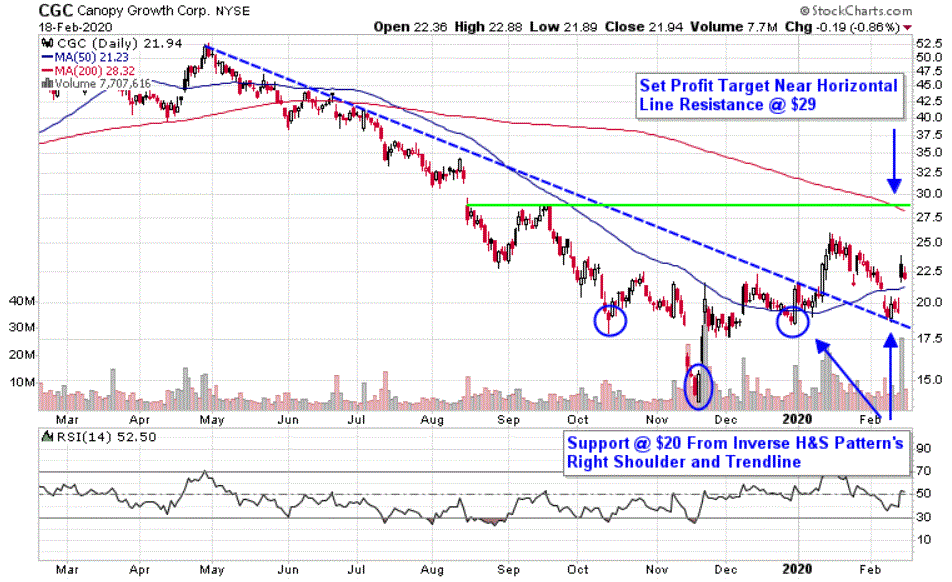

Canopy Growth Corporation (CGC)

Canopy Growth Corporation (CGC) operates in Canada through its Cannabis Operations and Canopy Rivers divisions, producing and distributing cannabis products. The company holds a 22% share of Canada’s recreational retail market, with strong sales driven by both premium and value product lines. As of February 19, 2020, Canopy’s market cap stands at $7.80 billion, with a year-to-date gain of 4%.

Canopy’s shares ended a sharp downtrend in mid-November, forming a bullish engulfing pattern that is part of an inverse head and shoulders setup. Strong quarterly results sparked a rally from $20, supported by the right shoulder of this pattern and a trendline dating back to late April. Traders might consider setting profit targets near resistance at $29, while managing risk with stop-loss orders below the 50-day SMA.

ETFMG Alternative Harvest ETF (MJ)

Launched in 2015, the ETFMG Alternative Harvest ETF (MJ) seeks to replicate the performance of the Prime Alternative Harvest Index by investing its $731.45 million portfolio in constituent securities. Top holdings include Canopy Growth, GW Pharmaceuticals plc (GWPH), and Cronos Group. With an average spread of 0.19% and daily trading volume exceeding 1 million shares, this ETF is a favored vehicle for investors seeking cannabis sector exposure. It offers a 5.45% yield and charges a 0.75% management fee, but has declined 4% year-to-date as of February 19, 2020.

After months of downward movement, MJ’s share price appears to be forming a double bottom, with November and January lows at comparable levels. Long investors should consider taking profits near $23, where resistance may arise from the August low and 200-day SMA. A stop-loss below $15.65 is advisable to protect against a breakdown that would invalidate the double bottom pattern.

Discover engaging topics and analytical content in Markets News as of 24-02-2020. The article titled " Cannabis Stocks Poised to Challenge Recent Peaks " provides new insights and practical guidance in the Markets News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " Cannabis Stocks Poised to Challenge Recent Peaks " helps you make smarter decisions within the Markets News category. All topics on our website are unique and offer valuable content for our audience.