30-Year Mortgage Rates Surge to 7.60% in April 2025 – Highest Since November

Discover the latest update on 30-year mortgage rates reaching a 7.60% average in April 2025, marking the highest point since late 2023. Learn how this impacts new purchases and refinancing options, plus state-by-state rate variations and expert insights on what drives mortgage rate changes.

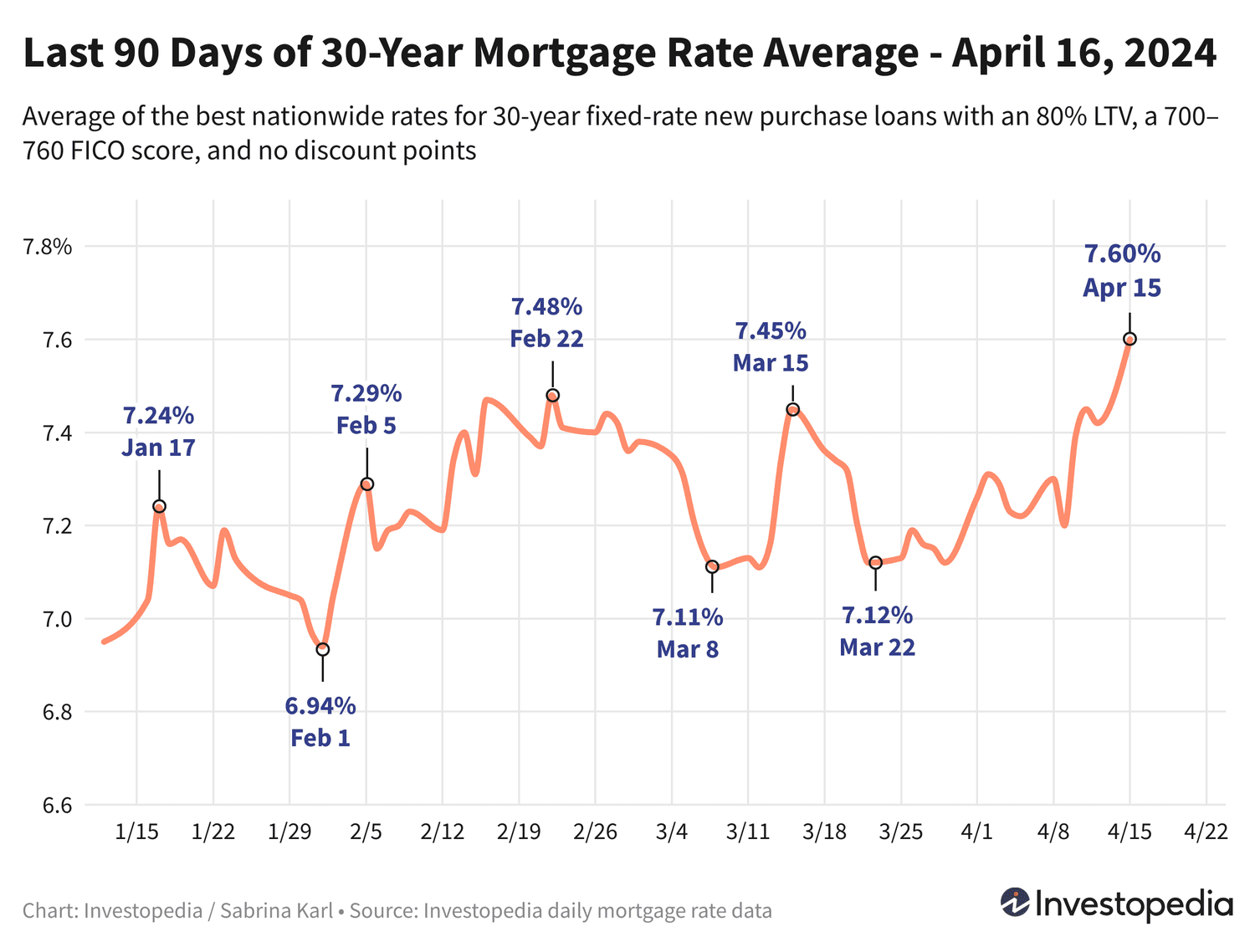

Mortgage Rate Update – April 16, 2024

Following a sharp quarter-point rise last week, 30-year mortgage rates jumped further on Monday, climbing to an average of 7.60%. This marks the highest rate level since just after Thanksgiving 2023. Nearly all other mortgage loan categories, including new purchase and refinancing loans, also saw increases on Monday.

Since mortgage rates vary significantly among lenders, it’s crucial to shop around and regularly compare rates regardless of the loan type you’re considering.

Current Mortgage Rate Averages for New Purchases

On Monday, 30-year mortgage rates rose by 18 basis points, adding to last week’s substantial increase. The current average stands at 7.60%, the highest since November 28, 2023.

While these rates are higher than early February’s high-6% averages, they remain below last October’s historic 23-year peak of 8.45%.

Meanwhile, 15-year new purchase mortgage rates also rose by 10 basis points to 6.95%, marking their highest level in over five months. Despite this rise, these rates remain more affordable than last fall’s peak of 7.59%, the highest since 2000.

Jumbo 30-year mortgage rates held steady at 7.20% for a third consecutive day, matching the most expensive level since late November 2023. Historical jumbo rate data prior to 2009 is limited, but last fall’s 7.52% peak was likely the highest in over two decades.

Other new purchase loan averages also experienced double-digit basis point increases, including a 15-point jump in the 10-year fixed-rate average. The only exception was FHA 30-year loans, which saw a slight decline.

Freddie Mac’s Weekly Mortgage Rate Averages

Freddie Mac reports weekly 30-year mortgage rate averages every Thursday. Last week’s average inched up 6 basis points to 6.88%. This remains below October 2023’s historic high of 7.79%, the highest in 23 years, but above the mid-January low of 6.60%.

Freddie Mac’s weekly average differs from ZAMONA’s daily average because it blends the previous five days’ rates and includes loans priced with discount points. ZAMONA’s averages reflect zero-point loans and provide a more up-to-date snapshot.

Refinancing Mortgage Rate Trends

Refinancing rates climbed more sharply on Monday compared to new purchase rates. The 30-year refinance average surged 26 basis points, expanding the gap with new purchase rates to 33 basis points.

Similarly, 15-year refinance rates jumped 25 basis points on Thursday, while jumbo 30-year refinance rates remained flat. The 20-year refinance average also increased by approximately a quarter percentage point.

Use our Mortgage Calculator to estimate monthly payments across different loan scenarios.

Important Note

The mortgage rates presented here are averages and typically differ from advertised teaser rates, which often highlight the lowest possible rates available only under specific conditions, such as paying points upfront or having an exceptionally high credit score. Your actual mortgage rate will depend on personal factors including credit score, income, and loan size.

Mortgage Rates Across States

Mortgage rates vary by state due to differences in borrower credit profiles, loan types, and lender risk strategies. As of Thursday, the states with the lowest 30-year new purchase rates included Mississippi, Vermont, Rhode Island, Connecticut, Wyoming, and Iowa. Conversely, Alabama, Tennessee, Maryland, and Oregon reported the highest average rates.

Factors Influencing Mortgage Rate Fluctuations

Mortgage rates are influenced by multiple factors including:

- Movements in the bond market, particularly 10-year Treasury yields

- The Federal Reserve’s monetary policies, including bond purchasing and mortgage funding

- Market competition among lenders and across loan categories

Due to these overlapping influences, isolating a single cause for rate changes is challenging.

Throughout much of 2021, mortgage rates were relatively low, supported by the Federal Reserve’s extensive bond-buying programs initiated during the pandemic.

However, beginning in November 2021, the Fed gradually tapered bond purchases, ending them by March 2022. Following this, the Fed increased the federal funds rate dramatically—by 5.25 percentage points over 16 months—to combat historically high inflation. Although the federal funds rate does not directly set mortgage rates, this aggressive hiking has contributed to higher mortgage costs.

The Fed has held the federal funds rate steady since July 2023, with inflation still above the 2% target. The central bank remains cautious about rate cuts until inflation shows clear and sustained declines.

Nevertheless, Fed projections released on March 20, 2024, indicate expectations for three rate cuts totaling 0.75 percentage points by the end of 2024, with similar reductions forecasted for 2025 and 2026.

Upcoming Fed meetings are scheduled throughout 2024, with the next session from April 30 to May 1.

How ZAMONA Tracks Mortgage Rates

ZAMONA calculates national mortgage rate averages from rates offered by over 200 top lenders. These averages assume an 80% loan-to-value ratio and a borrower credit score between 700 and 760, reflecting realistic quotes customers can expect rather than promotional teaser rates.

State-specific best rates shown on our map represent the lowest current rates available in each state under similar loan and credit assumptions.

Discover engaging topics and analytical content in Personal Finance News as of 21-04-2024. The article titled " 30-Year Mortgage Rates Surge to 7.60% in April 2025 – Highest Since November " provides new insights and practical guidance in the Personal Finance News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " 30-Year Mortgage Rates Surge to 7.60% in April 2025 – Highest Since November " helps you make smarter decisions within the Personal Finance News category. All topics on our website are unique and offer valuable content for our audience.