2025 Section 1231 Property Explained: Definitions, Examples & Tax Implications for Business Assets

Discover everything about Section 1231 property in 2025, including what qualifies, examples like buildings and machinery, and how gains are taxed at favorable capital gains rates for business owners.

Understanding Section 1231 Property and Its Tax Advantages in 2024

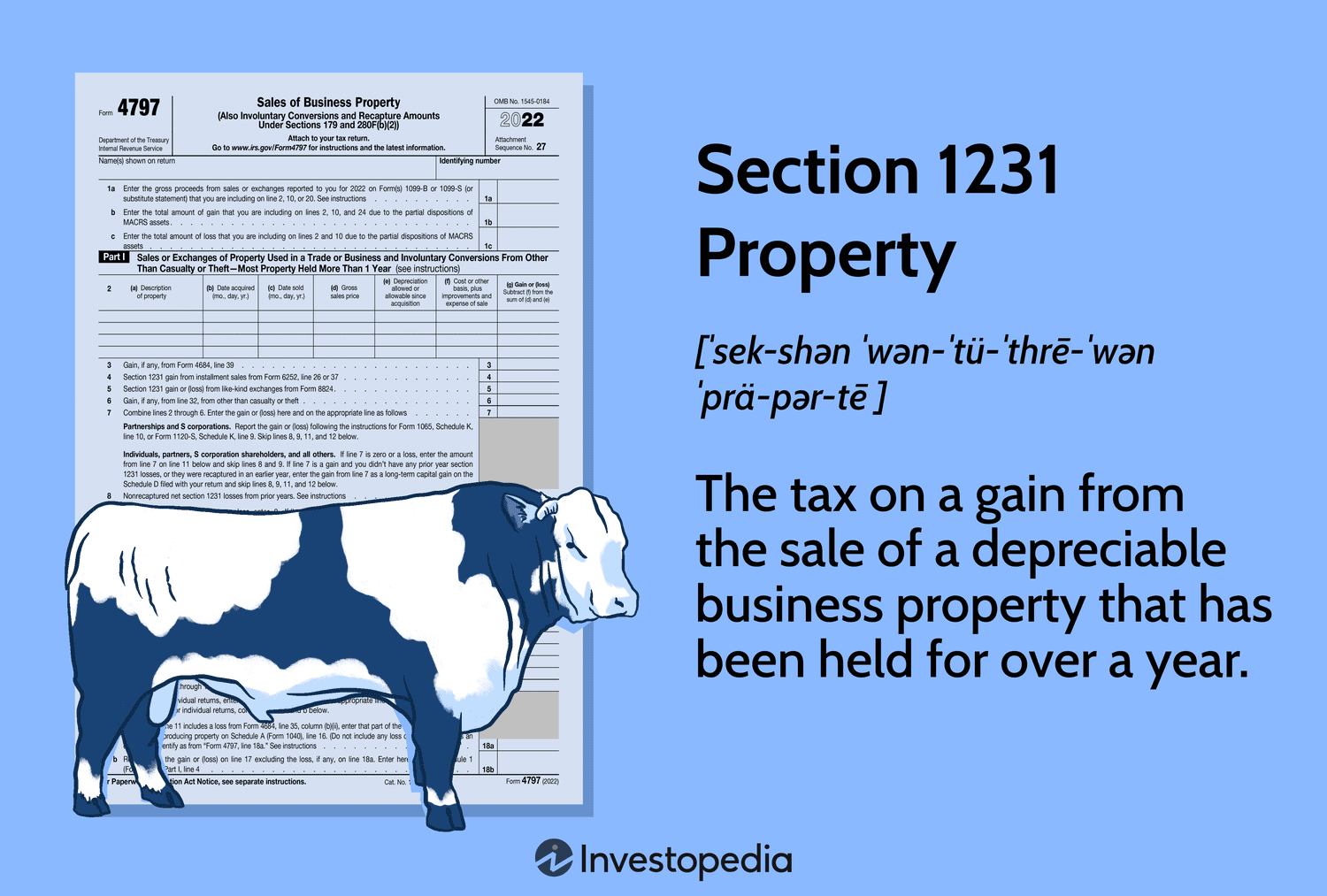

Section 1231 property, as outlined in the U.S. Internal Revenue Code, refers to depreciable business assets or real property held for more than one year. This includes assets like buildings, machinery, land, timber, and livestock, but excludes items such as inventory or patents.

When you sell Section 1231 property at a gain, the profit is taxed at the lower long-term capital gains rate rather than as ordinary income, provided the asset was held over a year. Conversely, losses on these properties are fully deductible as ordinary losses, offering significant tax benefits.

Key Highlights:

- Section 1231 property includes depreciable business assets and real estate held over 12 months.

- Gains qualify for favorable capital gains tax rates.

- Losses are deductible as ordinary losses, reducing taxable income.

How Section 1231 Gain Works

If the proceeds from the sale of Section 1231 property exceed the adjusted basis and depreciation, the excess is treated as a capital gain. If a loss occurs, it’s treated as an ordinary loss, fully deductible against other income. This dual treatment provides a tax advantage compared to other property sales.

Common Section 1231 Transactions

- Sales or exchanges of depreciable real or personal business property held over one year.

- Casualty or theft losses involving business property held over a year.

- Condemnations of business capital assets held for more than a year.

- Sales or exchanges of leaseholds held for business use over one year.

- Cattle and horses held for breeding, draft, or dairy purposes for at least two years.

- Dispositions of unharvested crops and timber treated as sales.

Section 1231 works closely with Sections 1245 and 1250, which govern the tax treatment of gains and losses on personal property and real estate assets respectively.

Differences Between Section 1231, 1245, and 1250 Properties

Section 1245 covers depreciable personal property and certain single-purpose agricultural structures, while Section 1250 applies to depreciable real property like buildings and land. Gains under Sections 1245 and 1250 are recaptured as ordinary income to the extent of prior depreciation, with any excess treated as capital gains.

Tax Treatment of Section 1245 Property Gains

Gains up to the amount of depreciation claimed are taxed as ordinary income; any excess qualifies for capital gains treatment.

Tax Treatment of Section 1250 Property Gains

Depreciation recapture applies similarly, and installment sales may trigger ordinary income recognition on the recaptured portion during the sale year.

Practical Example of Section 1231 Property Gain

Imagine purchasing a building for $2 million and investing an additional $2 million in improvements with a 50% amortization over 10 years. After 10 years, selling the building for $6 million results in a $4 million gain ($6M sale price minus $2M adjusted basis), which is taxed at the favorable capital gains rate.

Reporting Section 1231 Gains

All Section 1231 gains and losses are reported on IRS Form 4797, which details sales of business property.

Summary: Why Section 1231 Matters for Business Owners in 2024

Section 1231 provides a beneficial tax framework for business owners by enabling gains from long-term depreciable property sales to be taxed favorably while allowing full deduction of losses. Understanding these rules helps maximize tax efficiency and optimize business asset management.

Discover engaging topics and analytical content in Alternative Investments as of 01-04-2024. The article titled " 2025 Section 1231 Property Explained: Definitions, Examples & Tax Implications for Business Assets " provides new insights and practical guidance in the Alternative Investments field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " 2025 Section 1231 Property Explained: Definitions, Examples & Tax Implications for Business Assets " helps you make smarter decisions within the Alternative Investments category. All topics on our website are unique and offer valuable content for our audience.