What to Anticipate from Federal Reserve Chair Powell’s Speech at Jackson Hole This Friday

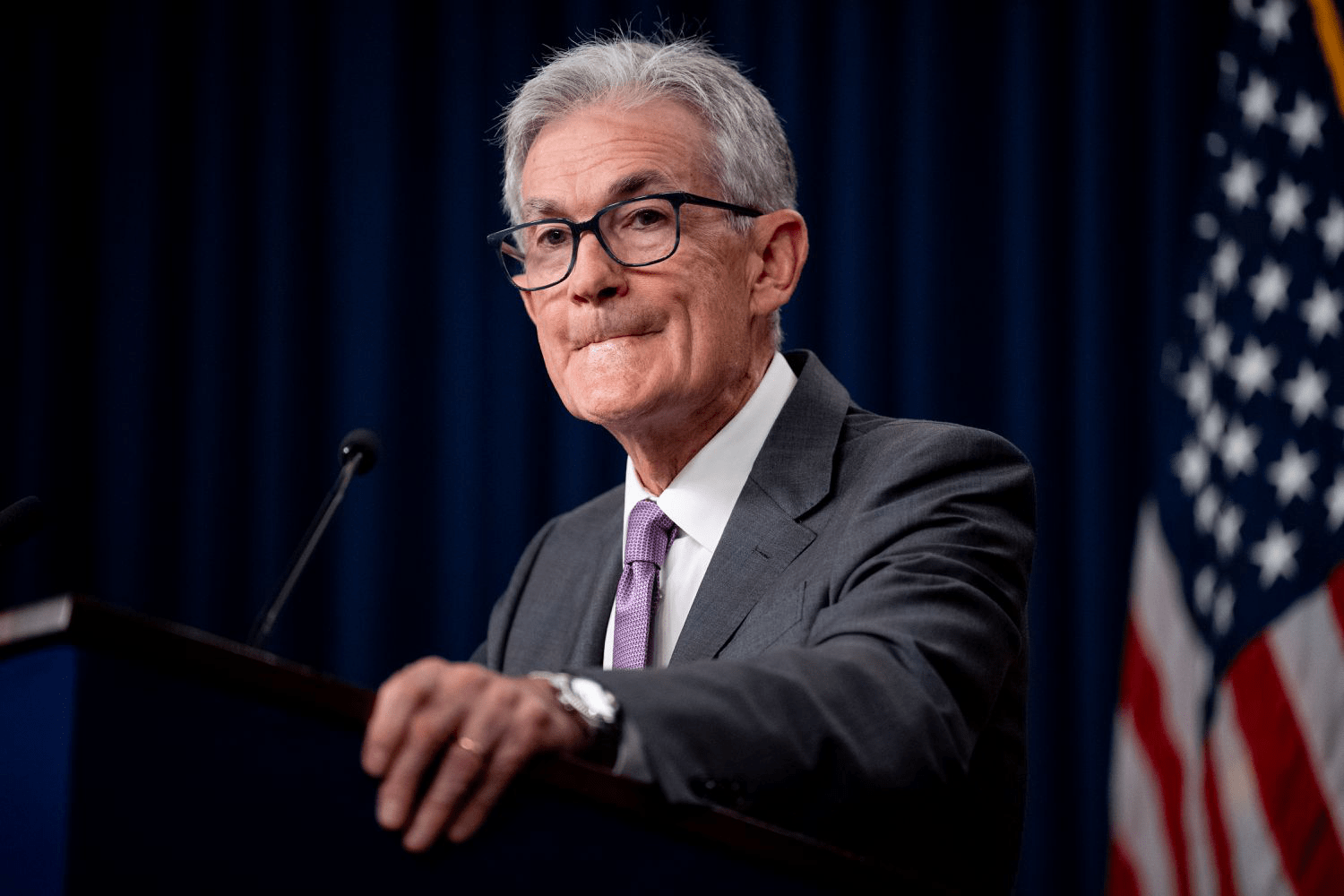

Federal Reserve Chair Jerome Powell is scheduled to deliver a crucial speech at the Jackson Hole economic symposium, offering insights into the future of U.S. monetary policy amid shifting economic conditions.

Diccon Hyatt is a seasoned financial and economics journalist who has extensively reported on the pandemic-era economy through hundreds of articles over the past two years. He specializes in breaking down complex financial topics into straightforward language, focusing on how economic trends affect personal finances and market dynamics. His experience includes work with U.S. 1, Community News Service, and the Middletown Transcript.

Key Highlights

- Federal Reserve Chair Jerome Powell is expected to address the economic outlook this Friday, potentially providing clues about upcoming interest rate decisions.

- The Federal Reserve is widely anticipated to reduce its benchmark interest rate at the September meeting, signaling a shift from combating inflation to supporting employment.

- While specific details on rate changes may not be disclosed, economists predict Powell will acknowledge that a September rate cut is under consideration.

Federal Reserve Chair Jerome Powell’s upcoming speech at the annual Jackson Hole Economic Symposium in Wyoming is highly anticipated by investors and market watchers. The speech arrives at a critical juncture for the central bank’s monetary policy, with markets eager for indications that the Fed will begin lowering interest rates from their current 25-year peak during the September meeting. Additionally, stakeholders will listen closely for guidance on the Fed’s strategy for rate adjustments moving forward.

This speech reflects the Fed’s evolving priorities, as officials shift focus from curbing inflation to preventing a surge in unemployment. The Federal Reserve’s dual mandate requires balancing inflation control with maintaining a healthy labor market.

Interest Rate Cuts Mark a Significant Shift for the Fed

A rate cut in September would mark the first reduction since 2020, when the Fed slashed rates to near zero in response to the economic impact of COVID-19. Since March 2022, the Fed has steadily raised rates to counteract rising inflation, increasing borrowing costs on mortgages, credit cards, and loans to temper economic activity.

With inflation now approaching the Fed’s 2% target and signs of weakening in the labor market, policymakers are considering rate cuts to support economic stability.

Powell’s Perspective on Recent Economic Indicators

Powell’s remarks will offer valuable insight into how he interprets the latest economic data. The economic landscape has been volatile since his last public comments in July. Early August data showed rising unemployment and slowing manufacturing, stoking recession fears, while later reports indicated easing inflation and stronger retail sales.

Many experts anticipate Powell will reinforce the possibility of rate cuts in September, consistent with his July statements. Ian Shepherdson, chief economist at Pantheon Macroeconomics, noted, “We expect Mr. Powell to provide his clearest indication yet that the Federal Open Market Committee will ease policy in September and at least one additional meeting this year.”

Economic Uncertainty Adds Complexity to Fed’s Path

Fed officials have emphasized that future policy moves will be data-dependent. The pace and scale of rate cuts may hinge on inflation trends and labor market resilience amid high interest rates.

Powell is unlikely to specify the exact size of the September rate reduction or subsequent cuts. The debate continues over whether the Fed will opt for a modest quarter-point decrease or a more substantial half-point cut.

Justin Weidner and colleagues at Deutsche Bank explain, “Data dependence may limit the forward guidance Powell can provide, making it challenging to commit to a definitive policy path.”

If you have news tips for Investopedia reporters, please contact us at tips@investopedia.com.

Discover engaging topics and analytical content in Economic News as of 18-03-2024. The article titled " What to Anticipate from Federal Reserve Chair Powell’s Speech at Jackson Hole This Friday " provides new insights and practical guidance in the Economic News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " What to Anticipate from Federal Reserve Chair Powell’s Speech at Jackson Hole This Friday " helps you make smarter decisions within the Economic News category. All topics on our website are unique and offer valuable content for our audience.