S&P 500 Dips Amid Rising Job Openings and Bond Yields: Market Update

Explore how the latest Labor Department report on job openings and rising bond yields impacted the S&P 500 and key stocks today.

Bill McColl brings over 25 years of expertise as a senior producer and writer across TV, radio, and digital platforms, leading teams in delivering impactful news coverage on major stories.

Highlights

- On Tuesday, October 3, the S&P 500 declined by 1.4%, with the Dow entering negative territory for 2023, driven by concerns over climbing interest rates.

- Bond yields surged following a Labor Department report revealing job openings exceeded expectations in August.

- Shares of McCormick fell due to slowed sales in China, while utility stocks rebounded after a prior day selloff.

U.S. stock markets fell and bond yields rose sharply on October 3, 2023, after the Labor Department's report indicated a higher-than-anticipated number of job openings in August. This heightened fears that the Federal Reserve may continue raising interest rates to combat inflation.

The S&P 500 dropped 1.4%, while the Dow Jones Industrial Average and Nasdaq Composite fell 1.3% and 1.9%, respectively. This decline pushed the Dow into negative performance territory for the year. The yield on the 10-year Treasury note increased by 11 basis points, and the CBOE Volatility Index (VIX), often called the "fear gauge," surged 12%.

Veralto (VLTO) was the worst performer on the S&P 500, with shares plunging 9% in its market debut after being spun off from Danaher (DHR). Danaher shares rose 1% during the session.

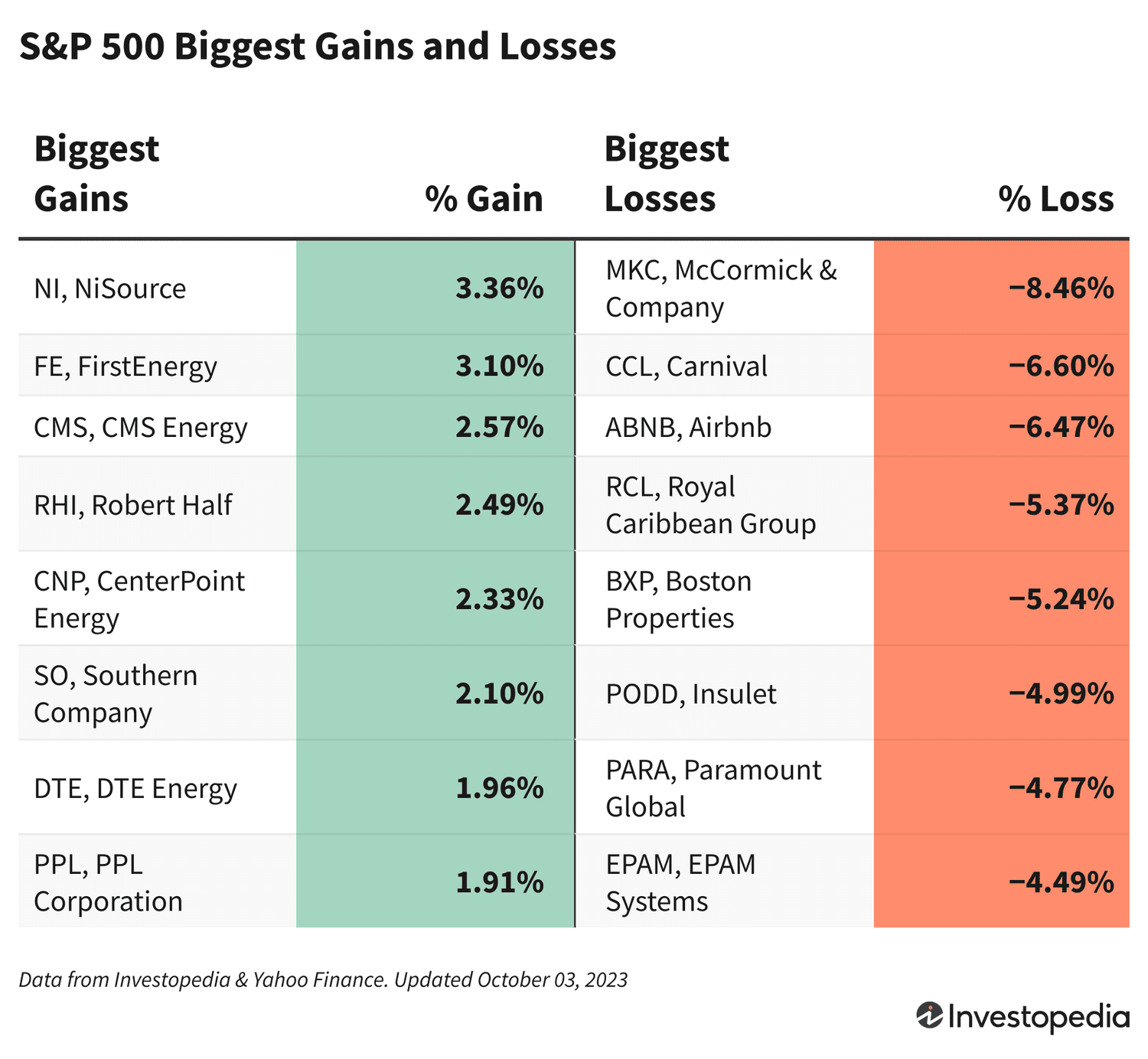

McCormick & Company (MKC) shares dropped 8.5% after reporting revenue below analyst expectations, primarily due to decreased sales in China.

Airbnb (ABNB) shares fell 6.5% following a downgrade by Keybanc, which cited potential challenges from easing post-pandemic travel demand. Similarly, cruise operators Carnival (CCL) and Royal Caribbean (RCL) saw declines of 6.6% and 5.4%, respectively, amid an uncertain travel outlook.

Utility stocks led gains among S&P 500 companies, recovering from a significant selloff the previous day caused by rising interest rates. NiSource (NI) topped the sector with a gain exceeding 3%.

HP Inc. (HPQ) shares rose 1.8% after Bank of America upgraded the stock twice, highlighting improving fundamentals for the PC and printer manufacturer.

Brown-Forman (BF.A) shares increased 1.6% following the announcement of a $400 million stock repurchase program by the beverage producer.

Have a news tip for Investopedia reporters? Reach out to us at tips@investopedia.com.

Discover the latest news and current events in Markets News as of 08-10-2023. The article titled " S&P 500 Dips Amid Rising Job Openings and Bond Yields: Market Update " provides you with the most relevant and reliable information in the Markets News field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " S&P 500 Dips Amid Rising Job Openings and Bond Yields: Market Update " helps you make better-informed decisions within the Markets News category. Our news articles are continuously updated and adhere to journalistic standards.