S&P 500 Climbs as Federal Reserve Holds Interest Rates Steady Amid Inflation Concerns

On November 1, 2023, the S&P 500 rose by 1% following the Federal Reserve's decision to maintain current interest rates while signaling potential future hikes to manage inflation.

Michael Bromberg is an experienced finance editor with over ten years in the industry. He specializes in breaking down complex financial concepts into straightforward, accessible language. Michael holds a Bachelor of Arts in Literature from the University of Wisconsin-Madison and a Master’s degree in Linguistics from Universidad de Antioquia in Medellin, Colombia.

Highlights

- On November 1, 2023, the S&P 500 increased by 1% as the Federal Reserve kept interest rates unchanged for the second consecutive meeting but left the door open for future hikes.

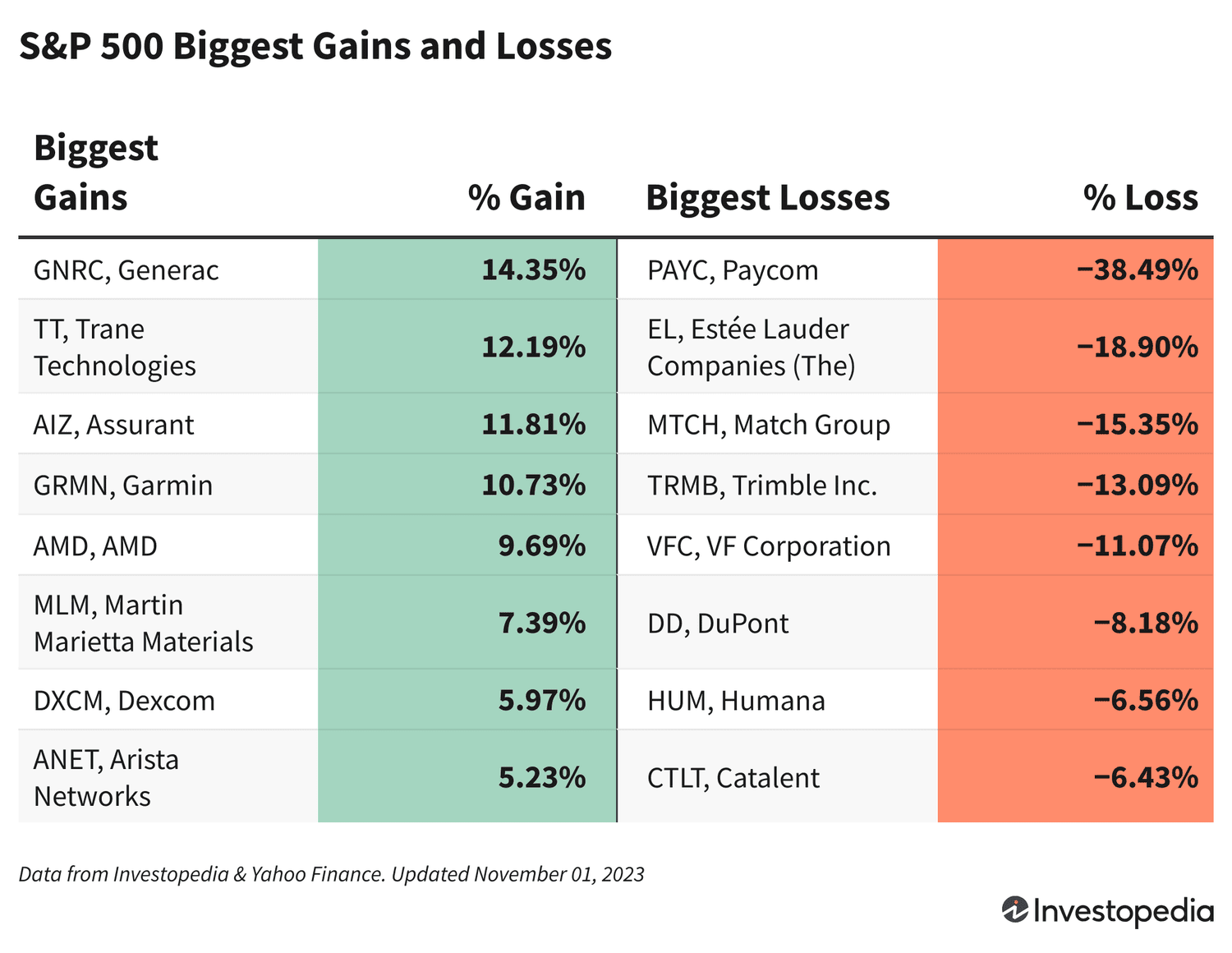

- Generac led the index's gains after reporting stronger-than-expected quarterly results, driven by increased shipments of home standby generators.

- Paycom shares fell sharply following a forecast indicating a slowdown in revenue growth for the workforce management software provider.

U.S. stock markets advanced on November 1, 2023, after the Federal Reserve decided to maintain interest rates at current levels while signaling the possibility of additional rate increases to control inflation pressures.

The S&P 500 climbed 1%, with the Dow Jones Industrial Average and Nasdaq Composite rising 0.7% and 1.6%, respectively.

Generac (GNRC), a leading designer and manufacturer of energy systems, was the top performer in the S&P 500, surging 14.3% after exceeding third-quarter earnings expectations, boosted by a rise in shipments of home standby generators.

Trane Technologies (TT), a manufacturer of HVAC systems, saw its shares jump 12.2% following strong earnings results that surpassed analyst consensus. Growing concerns about climate change and pollution have increased demand for commercial cooling and air purification solutions.

Insurance company Assurant (AIZ) gained 11.8% after posting earnings that quadrupled from the previous year, driven by robust growth in its Global Lifestyle segment, which includes mobile device protection services.

Conversely, Paycom (PAYC) was the weakest performer on the index, plunging 38.5% after forecasting slower revenue growth. The company’s Beti payroll platform appears to be cannibalizing sales as clients reduce spending on non-essential services due to Beti’s efficiencies.

Estee Lauder (EL) shares dropped 18.9% following a downward revision of its financial outlook, citing challenges in China and broader Asian markets as the primary reasons for the reduced forecast.

Match Group (MTCH), owner of dating apps Tinder and Hinge, saw its stock decline 15.3% amid lowered revenue projections for Q4 2023, impacted by a year-over-year decrease in paying Tinder users.

Have a news tip for Investopedia? Reach out to us at tips@investopedia.com.

Explore useful articles in Markets News as of 06-11-2023. The article titled " S&P 500 Climbs as Federal Reserve Holds Interest Rates Steady Amid Inflation Concerns " offers in-depth analysis and practical advice in the Markets News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " S&P 500 Climbs as Federal Reserve Holds Interest Rates Steady Amid Inflation Concerns " article expands your knowledge in Markets News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.