Nvidia to Incur $5.5 Billion Charge Amid US Restrictions on AI Chip Exports to China

Nvidia faces a significant $5.5 billion financial charge following new US export restrictions on AI chips to China, impacting its shares alongside AMD's $800 million expected charge.

AMD Anticipates Up to $800 Million in Charges

Key Highlights

- Nvidia plans to record a $5.5 billion charge in Q1 of fiscal 2026 due to US export limitations on its AI chips to China.

- This development, part of an intensifying trade conflict between Washington and Beijing, caused Nvidia's stock to drop sharply on Wednesday.

- Similarly, Advanced Micro Devices (AMD) faces export controls on its AI chip products to China, potentially resulting in up to $800 million in charges.

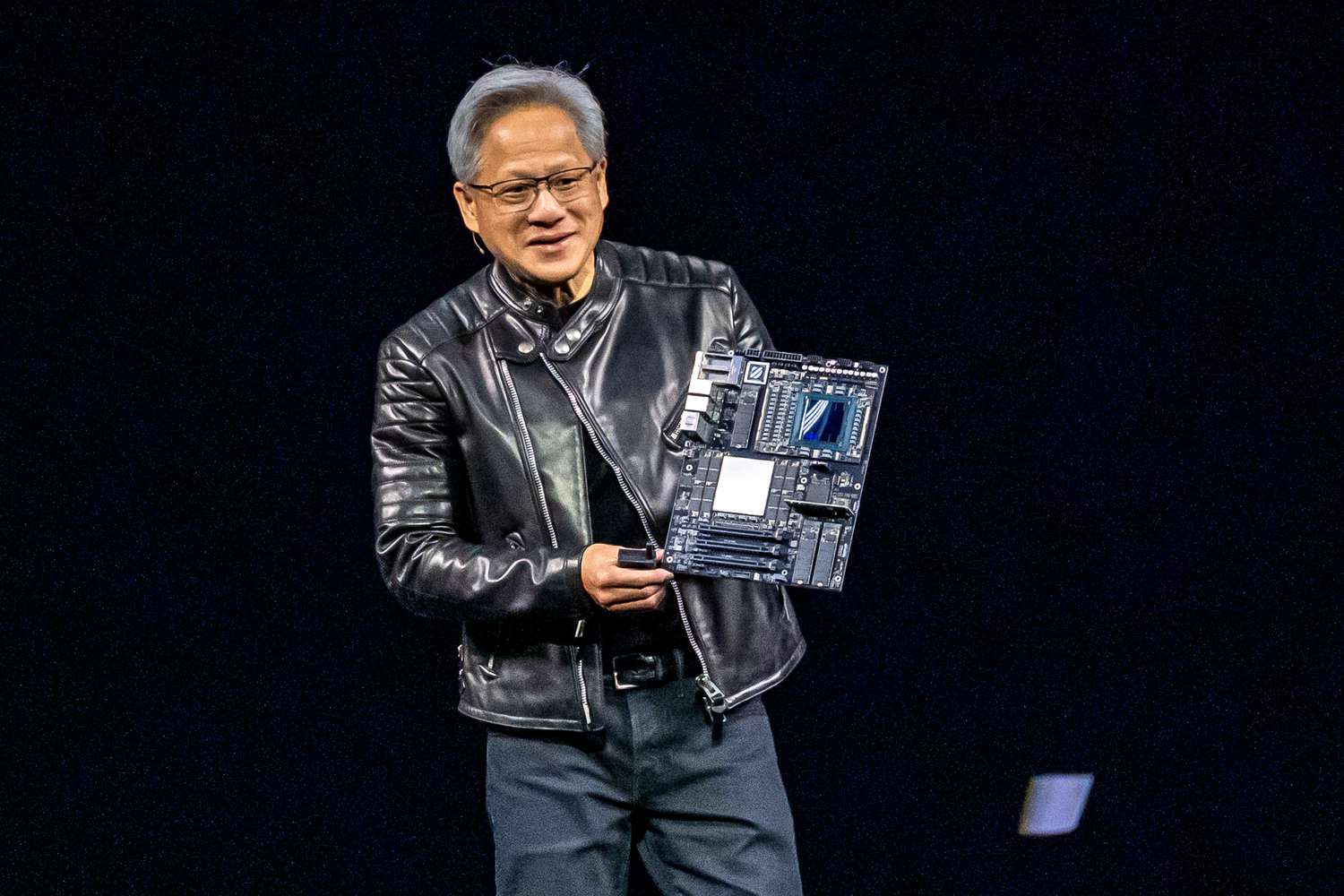

Nvidia (NVDA) announced it will take a $5.5 billion charge in its upcoming first-quarter fiscal 2026 results after the US government imposed restrictions on exporting its artificial intelligence (AI) chips to China.

This announcement, marking a significant escalation in the ongoing trade tensions between the US and China, led to a 6.5% decline in Nvidia’s stock price on Wednesday morning.

According to a regulatory filing on Tuesday evening, Nvidia was informed on April 9 by the US government that it must obtain an export license indefinitely to sell its H20 AI chips to China. The license requirement aims to prevent these chips from being utilized or redirected to supercomputers in China. Notably, the H20 chip is less advanced than Nvidia’s latest models and was designed to comply with existing export regulations for the Chinese market.

The $5.5 billion charge, expected to be reflected in Nvidia’s Q1 results due May 28, relates to inventory, purchase commitments, and associated reserves for H20 products. Morningstar Research noted that China’s contribution to Nvidia’s revenue has declined from 20% to about 10%, with projections suggesting it may approach zero.

The New York Times reported that the US Commerce Department spokesman confirmed new export licensing rules for Nvidia’s H20 chip, AMD’s MI308 chip, and their equivalents.

AMD Faces Potential $800 Million Charges, Shares Decline

AMD (AMD) disclosed in a filing on Wednesday that export controls on its MI308 AI chip could lead to charges up to approximately $800 million related to inventory, purchase commitments, and reserves if required licenses are not secured. AMD’s stock fell by 6% following the announcement.

These export restrictions are also expected to impact other US semiconductor companies, including Micron Technology (MU) and Broadcom (AVGO). Citi analysts highlighted that Micron has been largely restricted from the Chinese market since a partial ban by Beijing in June 2023, while Broadcom faces challenges due to its connections with TikTok owner ByteDance.

Update as of April 16, 2025: This article has been revised to incorporate AMD’s charge estimates and updated stock prices.

Discover engaging topics and analytical content in Company News as of 14-03-2024. The article titled " Nvidia to Incur $5.5 Billion Charge Amid US Restrictions on AI Chip Exports to China " provides new insights and practical guidance in the Company News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " Nvidia to Incur $5.5 Billion Charge Amid US Restrictions on AI Chip Exports to China " helps you make smarter decisions within the Company News category. All topics on our website are unique and offer valuable content for our audience.