Mortgage Rates Plunge in 2023: Best Deals and Trends You Need to Know

Explore the latest 2023 mortgage rate drops across all loan types, with 30-year fixed rates hitting their lowest in a week after a historic peak. Learn how to find the best mortgage rates today.

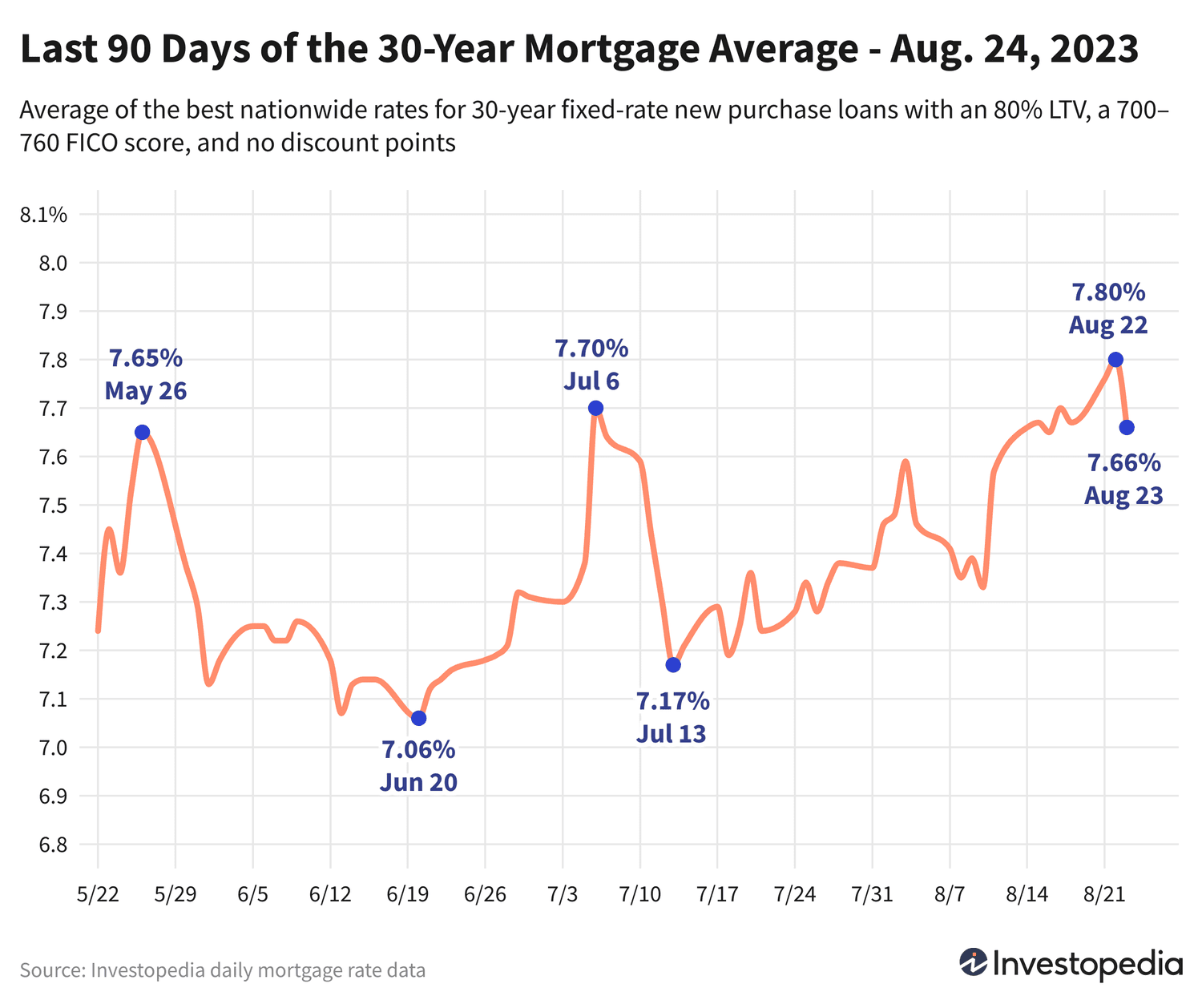

Mortgage Rate Update – August 24, 2023

Mortgage seekers received a welcome break as rates fell sharply across all loan categories. The 30-year fixed mortgage rate dropped by over 0.125%, settling at 7.66% — its lowest point in a week after reaching a 21-year high just a day earlier.

Because mortgage rates fluctuate significantly among lenders, it’s essential to shop around and compare offers regularly to secure the best deal for your loan type.

Industry Insights

Freddie Mac's weekly report highlighted a 22-year high for 30-year fixed rates, climbing to 7.23%. Their averages differ from daily snapshots due to methodology and inclusion of discount points, whereas daily rates reflect zero-point loans.

Current National Mortgage Rate Averages

On Wednesday, the 30-year fixed rate fell 14 basis points to 7.66%, down from Tuesday’s 7.80% peak—the highest since 2002.

The 15-year fixed rate slightly decreased by 3 basis points to 7.14%, also retreating from a 21-year high of 7.17% recorded on Tuesday.

Jumbo 30-year mortgage rates dropped 12 basis points to 6.90%, retreating from their recent surge above 7.00%, a level not seen in over two decades.

The most significant rate reductions were seen in VA 30-year fixed rates, down 40 basis points, and 10/6 ARM loans, which fell by 30 basis points.

Refinance rates mirrored these declines, with the 30-year refinance average plunging 19 basis points to 7.99% after hitting a record 8.18% earlier this week. The gap between new purchase and refinance 30-year rates stands at 33 basis points.

Use our Mortgage Calculator to estimate monthly payments tailored to your loan scenario.

Important Considerations

Displayed rates represent averages and may differ from promotional or teaser rates advertised online, which often require upfront points or are based on ideal borrower profiles. Your actual rate will depend on credit score, income, loan size, and other factors.

Mortgage Rates by State: Where to Find the Lowest Rates

Mortgage rates vary by state due to differences in borrower credit profiles, loan sizes, and lender risk strategies. See our updated map to discover the most competitive rates available in your area.

What Influences Mortgage Rate Fluctuations?

Mortgage rates respond to complex factors including bond market trends—especially 10-year Treasury yields—the Federal Reserve’s monetary policies, and lender competition. Multiple factors often interplay, making precise cause attribution challenging.

During much of 2021, aggressive Federal Reserve bond purchases helped keep mortgage rates low amid pandemic pressures. However, beginning late 2021, the Fed tapered these purchases, ceasing them by March 2022.

The federal funds rate, adjusted periodically by the Federal Open Market Committee (FOMC), influences but does not directly dictate mortgage rates; they can move independently.

As of July 26, 2023, the Fed raised the federal funds rate to 5.25%–5.50%. Chairman Jerome Powell indicated future rate decisions will depend on inflation trends and economic data, with possible hikes or pauses expected at the September meeting.

Our Methodology

Rates presented reflect the lowest offers from over 200 leading lenders nationwide, assuming an 80% loan-to-value ratio and a credit score between 700 and 760. These averages provide realistic expectations for borrowers rather than promotional teaser rates.

State-level lowest rates are similarly based on these parameters, representing the best current offers in each region.

Have a tip or insight? Contact us at tips@investopedia.com.

Discover engaging topics and analytical content in Personal Finance News as of 29-08-2023. The article titled " Mortgage Rates Plunge in 2023: Best Deals and Trends You Need to Know " provides new insights and practical guidance in the Personal Finance News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " Mortgage Rates Plunge in 2023: Best Deals and Trends You Need to Know " helps you make smarter decisions within the Personal Finance News category. All topics on our website are unique and offer valuable content for our audience.