Federal Reserve 2023 Inflation Battle: Rate Hikes and Economic Outlook Explained

Discover how the Federal Reserve prioritizes inflation control over employment in 2023, with ongoing interest rate hikes and labor market resilience shaping the economic landscape.

The Federal Reserve remains steadfast in its commitment to combating inflation throughout 2023, signaling continued interest rate increases without signs of easing.

Key Insights

- The Federal Reserve’s December meeting minutes emphasize controlling inflation as the top priority.

- Officials anticipate a robust labor market persisting through 2023.

- Despite the Fed’s firm stance, stock and bond markets closed positively.

Concerns that inflation may persist longer than expected continue to drive the Federal Reserve’s strategy of raising interest rates, outweighing worries about potential negative effects on economic growth, employment, and financial markets.

According to the minutes from the Federal Open Market Committee’s (FOMC) December session, released ahead of a key U.S. jobs report, the central bank raised its benchmark rate by 50 basis points to 4.25-4.50%, the highest in 15 years. The minutes confirm that further rate hikes are likely, with no plans to reduce rates in the near future.

“No participants anticipated beginning rate cuts in 2023,” the minutes state. “Maintaining a restrictive policy stance is necessary until data confirms inflation is steadily declining toward the 2% target, a process expected to take time.”

Inflation Control Takes Precedence Over Recession Risks

While some members noted that inflation risks are becoming more balanced, the majority agree that slowing rate hikes prematurely could jeopardize inflation control more than the risk of triggering a severe recession.

“Given the persistently high inflation, historical experience advises against loosening monetary policy too soon,” the minutes highlight.

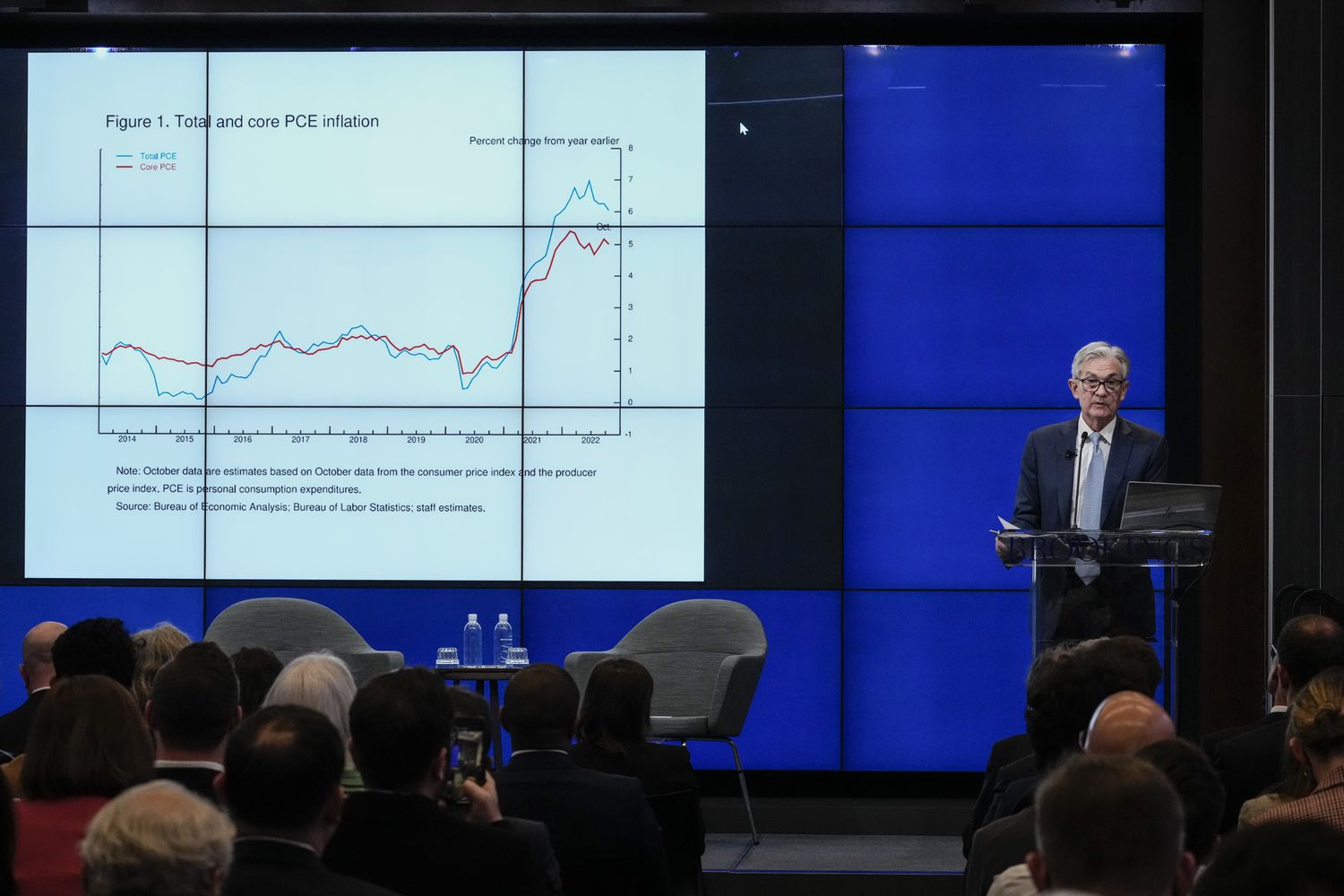

U.S. inflation hit a 40-year high in 2022. The Fed’s preferred personal consumption expenditures (PCE) index dropped to 5.5% in November from a June peak of 7%. The Consumer Price Index (CPI) also declined to 7.1% in November from 9.1% in June.

Despite improvements, inflation remains well above the Fed’s 2% goal, reinforcing officials’ dedication to achieving this target. The FOMC will continue to evaluate rate adjustments on a meeting-by-meeting basis, with the next session scheduled for January 31 to February 1, where a 25 basis point hike is anticipated.

Labor Market Resilience Remains Crucial

The U.S. labor market’s strength plays a vital role in the Fed’s policy decisions, with tight employment conditions expected to persist.

Bloomberg economists forecast a 5% increase in average hourly earnings for 2022, slightly down from 5.1% the previous year. The unemployment rate is projected to hold steady at a near-historic low of 3.7% in December, with an estimated 200,000 jobs added.

The Fed does not foresee significant weakening in the job market during 2023, expecting unemployment to rise above its natural rate only by late 2024.

Market reactions to the December minutes were mixed but ultimately positive, with the S&P 500 closing up 0.8% at 3,852.97 and the 10-year U.S. Treasury yield dropping 8 basis points to 3.71%.

Explore useful articles in Government News as of 10-01-2023. The article titled " Federal Reserve 2023 Inflation Battle: Rate Hikes and Economic Outlook Explained " offers in-depth analysis and practical advice in the Government News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Federal Reserve 2023 Inflation Battle: Rate Hikes and Economic Outlook Explained " article expands your knowledge in Government News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.