Dividend Rollover Plan Explained: Definition, Mechanism, and Practical Example

Explore the modern approach to dividend rollover plans, a strategic investment method designed for short-term income by buying dividend stocks before the ex-dividend date and selling after dividend payout.

Katrina Ávila Munichiello brings over fourteen years of expertise as an editor, writer, fact-checker, and proofreader across both print and digital media platforms.

Understanding the Dividend Rollover Plan

A dividend rollover plan, often referred to as a dividend capture strategy, is an investment technique where an investor acquires shares of a dividend-paying stock just before its ex-dividend date. The goal is to receive the dividend payment and then sell the shares shortly after, aiming to generate a quick income stream.

Essential Insights

- This strategy targets generating short-term income through dividends.

- It involves purchasing stock before the ex-dividend date and selling it soon after dividends are distributed.

- Investors must carefully consider risks, as minor fluctuations in share price post-dividend can negate profits.

- It is a tax-intensive approach requiring strategic planning.

- Optimal use involves commission-free brokers and preferably tax-advantaged retirement accounts.

How the Dividend Rollover Plan Operates

Investors utilizing this plan aim to collect dividend income while recovering most or all of their invested capital from selling the shares. However, this strategy is not always consistently profitable because stock prices typically decline by approximately the dividend amount after payout.

If the price drop equals the dividend, the investor breaks even before factoring in transaction fees and taxes, potentially leading to a net loss.

To implement this plan, an investor typically:

- Selects a dividend-paying stock with an upcoming ex-dividend date.

- Purchases the stock before the ex-dividend date.

- Sells the stock on or after the ex-dividend date.

- Becomes eligible for the dividend on the record date.

- Receives the dividend on the pay date.

While simple, this approach carries risks, and some investors prefer holding the stock beyond the ex-dividend date if they expect further appreciation.

An alternative strategy involves speculating on the stock price decline post-ex-dividend by using options, such as buying puts before the ex-dividend date. This method is riskier compared to the straightforward rollover plan.

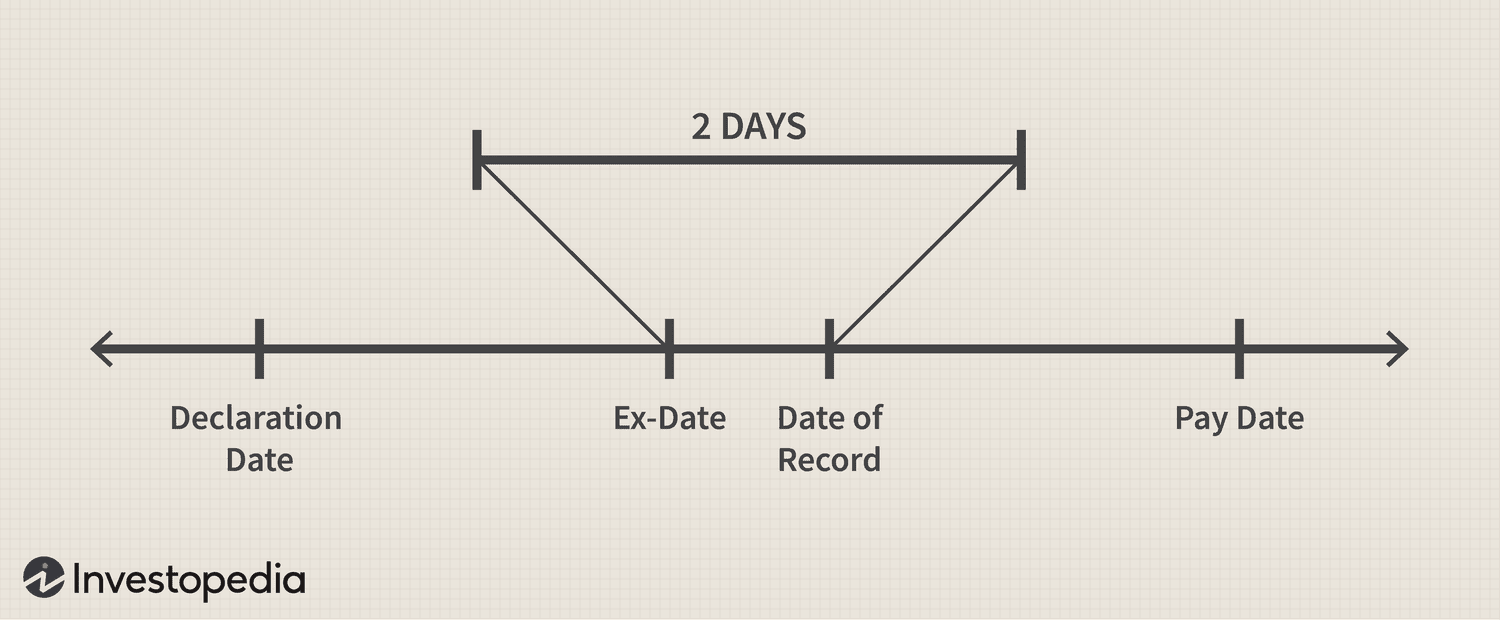

Key Dates in the Dividend Timeline

Investors employing the rollover strategy focus on these critical dates:

- Declaration Date: When the company announces the dividend.

- Ex-Dividend Date: The cutoff day to own the stock to receive the dividend; stock price often adjusts downward on this day.

- Record Date: The date when the company identifies shareholders eligible for the dividend.

- Pay Date: The day dividends are distributed to shareholders.

Holding the stock until the ex-dividend date is sufficient to qualify for the dividend. Investors may choose to sell immediately or hold longer based on their strategy and stock performance.

Tax Considerations for Dividend Rollover Plans

This strategy’s simplicity is balanced by its tax implications. Dividends fall into two categories: qualified and unqualified. To be qualified, dividends must be held for a minimum period (usually 60 days before the ex-dividend date). Since rollover investors hold shares for a shorter time, their dividends are typically unqualified and taxed at ordinary income rates.

However, using tax-advantaged accounts like IRAs can shield investors from these tax burdens.

Illustrative Example of a Dividend Rollover Plan

Consider a company declaring a $2 per share dividend with an ex-dividend date of March 16. An investor buys shares on or before March 15 and sells on or after March 16 to capture the dividend.

Profitability depends on share price movements and costs. For example, if shares trade at $25 before the ex-dividend date and drop to $24 after dividend payment, the investor gains $2 from the dividend but loses $1 on the stock price, netting a $1 profit before costs.

If the price falls below $23, the investor faces a net loss after fees and taxes. Additionally, unpredictable market factors can affect stock prices, adding risk.

Therefore, it’s prudent to apply this strategy only to stocks with historically stable post-dividend price behavior.

Difference Between Dividend Rollover and Dividend Reinvestment Plans

A dividend reinvestment plan (DRIP) differs significantly. Instead of selling shares, dividends are automatically reinvested to purchase more shares, aiming for compounded growth over time.

Tax Implications of Dividend Reinvestment

Dividends reinvested in taxable accounts are still subject to taxes unless held within tax-sheltered accounts like Roth IRAs.

Executing a Dividend Capture Strategy

To execute this strategy, buy a dividend-paying stock before the ex-dividend date and sell it on or after this date. The dividend will be credited on the pay date regardless of holding period beyond ex-dividend.

Final Thoughts

The dividend rollover plan offers a straightforward approach to earning short-term income without complex analysis. However, it carries risks including tax liabilities and potential stock price drops on the ex-dividend date, which can offset dividend gains. Investors should weigh these factors carefully before adopting this strategy.

Discover the latest news and current events in Stocks as of 29-03-2022. The article titled " Dividend Rollover Plan Explained: Definition, Mechanism, and Practical Example " provides you with the most relevant and reliable information in the Stocks field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " Dividend Rollover Plan Explained: Definition, Mechanism, and Practical Example " helps you make better-informed decisions within the Stocks category. Our news articles are continuously updated and adhere to journalistic standards.