Discover Today's Highest CD Rates & Secure Your Future Earnings

Explore the latest top-performing CDs offering impressive returns across various terms. Learn how to maximize your savings with ZAMONA's expert-curated rates from trusted banks and credit unions nationwide.

Highlights to Keep in Mind

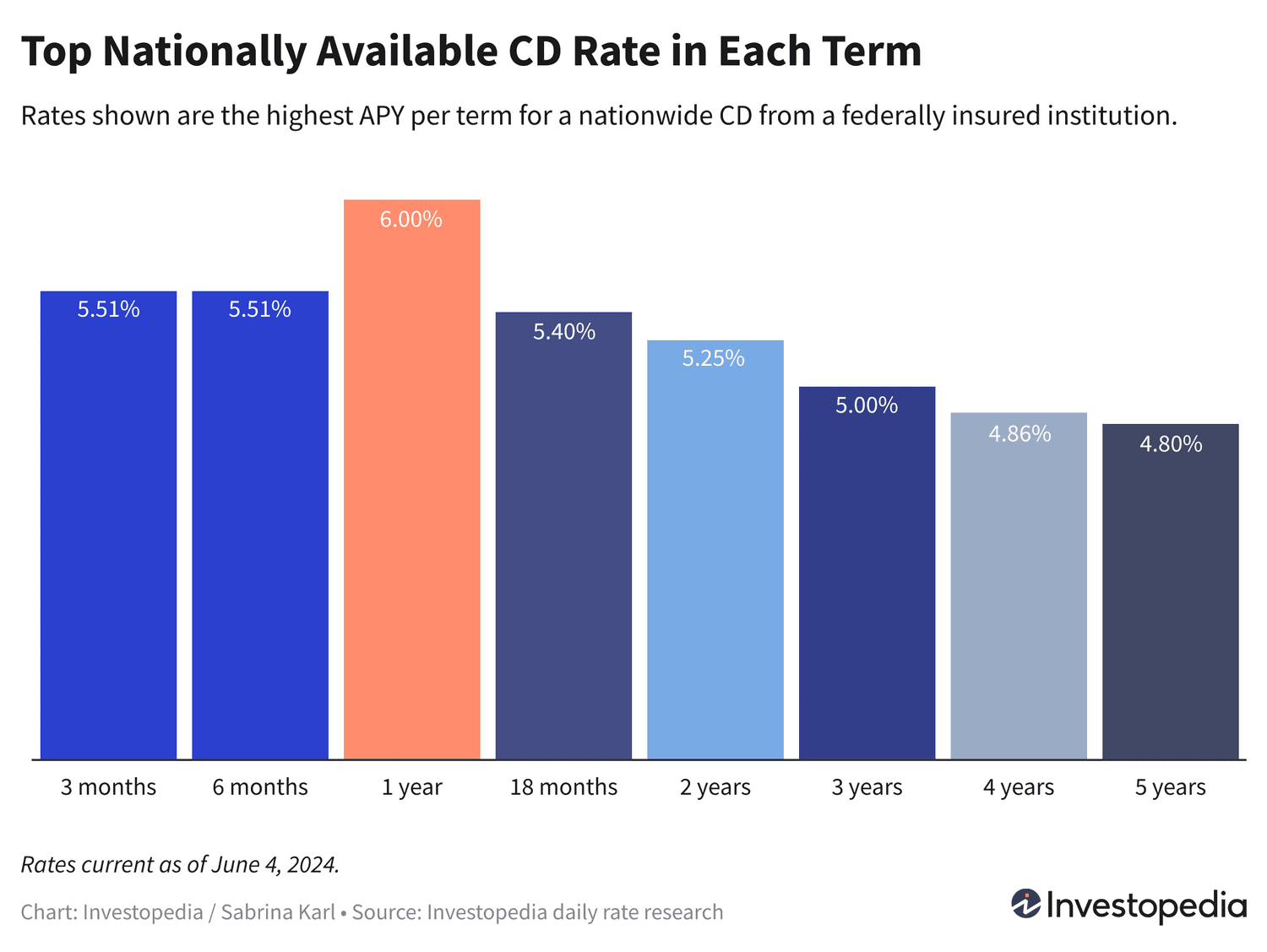

- Nuvision Credit Union has set a new national standard by offering a standout 6.00% APY on a 10-month CD, available for deposits up to $5,000.

- TotalDirectBank follows closely with a 5.51% APY on 3- and 6-month CDs, ideal for those seeking shorter commitments but requiring a $25,000 minimum deposit.

- Longer-term savers can benefit from Credit Human’s 2-year CDs at 5.25%, locking in rates until 2026, or select from multiple institutions offering 5.00% APY on 3-year terms.

- For extended security, 4- and 5-year CDs like BMO Alto’s 5-year CD at 4.80% provide attractive yields, ensuring growth until 2028 or 2029.

- While current rates slightly trail last fall’s historic highs, they remain robust amid ongoing Federal Reserve rate decisions.

Below, find featured CD rates and detailed rankings from our comprehensive nationwide analysis.

Secure 5.35% to 6.00% on Short to Mid-Term CDs

After weeks of stable top rates at 5.51%, Nuvision Credit Union has elevated the bar with a remarkable 6.00% APY on a 10-month CD, marking the first nationwide CD to reach this rate since last November. Note the $5,000 deposit cap applies.

TotalDirectBank’s 5.51% APY on 3- or 6-month CDs remains a strong contender, though it necessitates a higher $25,000 minimum deposit. For those with smaller funds, four CDs offer 5.50% APY with minimum deposits ranging from $5 to $2,500.

Over 20 CDs offer yields above 5.35%, including CIBC Agility’s 13-month CD at 5.36%, guaranteeing rates through mid-2025.

Longer-Term CDs Guarantee Stability Through 2025 and Beyond

Locking in rates for two years or more is a savvy strategy amid potential future rate declines. Credit Human’s flexible 18- to 23-month CDs at 5.25% lock in earnings through spring 2026. Three-year CDs offering at least 5.00% APY extend your rate security until 2027, with four- and five-year CDs maintaining competitive rates in the upper 4% range.

Top Rates from Major U.S. Banks

While smaller banks and credit unions often lead CD rates, BMO Alto, an online division of a major U.S. bank, offers the top 5-year CD rate at 4.80%. It also provides competitive rates across terms from 6 months to 4 years.

CD Rates Remain Near Two-Decade Highs

Although rates have eased from their October peak of 6.50%, CDs still offer exceptional yields compared to the past 20 years. Securing a 4% to 5% return for a year or more remains a lucrative option.

Remember, achieving the absolute highest APY is just one approach; locking in a long-term rate before potential declines can optimize your returns.

Competitive Rates at Big-Name Banks

Not all large banks pay competitive CD rates. Research is essential, but among the 30 largest U.S. banks, several offer attractive options worth considering.

Jumbo CDs Provide Enhanced Returns in Select Terms

State Department Federal Credit Union offers a jumbo CD at 5.41% APY for 15 months, while Grow Financial Federal Credit Union recently introduced a 5-year jumbo CD at 4.86% APY. However, jumbo CDs don’t always outperform standard CDs, so comparing both is advisable before committing.

What Lies Ahead for CD Rates in 2024?

The Federal Reserve’s aggressive rate hikes to combat inflation have driven CD rates to 20-year highs. Since July 2023, the Fed has paused rate increases, adopting a wait-and-see approach as inflation cools but progress remains slow.

Fed Chair Jerome Powell and other officials indicate that rate cuts may be delayed until inflation data shows more consistent improvement, likely extending the current plateau in CD rates for several months.

Market forecasts suggest the first potential rate cut could occur as late as September, meaning high CD rates may persist well into the year.

New inflation data shows stability with no increase, offering cautious optimism. Meanwhile, the Fed will continue monitoring data before making further policy changes, maintaining a steady environment for savers.

Daily Updates on the Best CDs and Savings Accounts

Stay informed with ZAMONA’s regularly updated rankings for CDs and high-yield accounts across all major terms, including 3-month, 6-month, 1-year, 18-month, 2-year, 3-year, 4-year, and 5-year CDs, plus top savings and money market accounts.

Important Note

ZAMONA highlights the top nationally available CD rates from over 200 banks and credit unions, focusing on federally insured institutions with reasonable deposit minimums. These top rates significantly outperform national averages, which include many low-rate offerings from large banks.

Our Commitment to Finding the Best Rates

ZAMONA conducts daily research tracking hundreds of banks and credit unions nationwide, ensuring our rankings reflect the highest federally insured CD rates with deposit minimums of $25,000 or less. Institutions must have broad availability, and credit unions requiring large donations for membership are excluded. Learn more about our methodology on our website.

Discover engaging topics and analytical content in Personal Finance News as of 10-06-2024. The article titled " Discover Today's Highest CD Rates & Secure Your Future Earnings " provides new insights and practical guidance in the Personal Finance News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " Discover Today's Highest CD Rates & Secure Your Future Earnings " helps you make smarter decisions within the Personal Finance News category. All topics on our website are unique and offer valuable content for our audience.