Budget 2025: Key measures and what they mean for households and businesses

A clear, reader-friendly breakdown of Budget 2025, outlining tax, welfare, housing, and pensions changes and their practical impact on households, workers, and businesses.

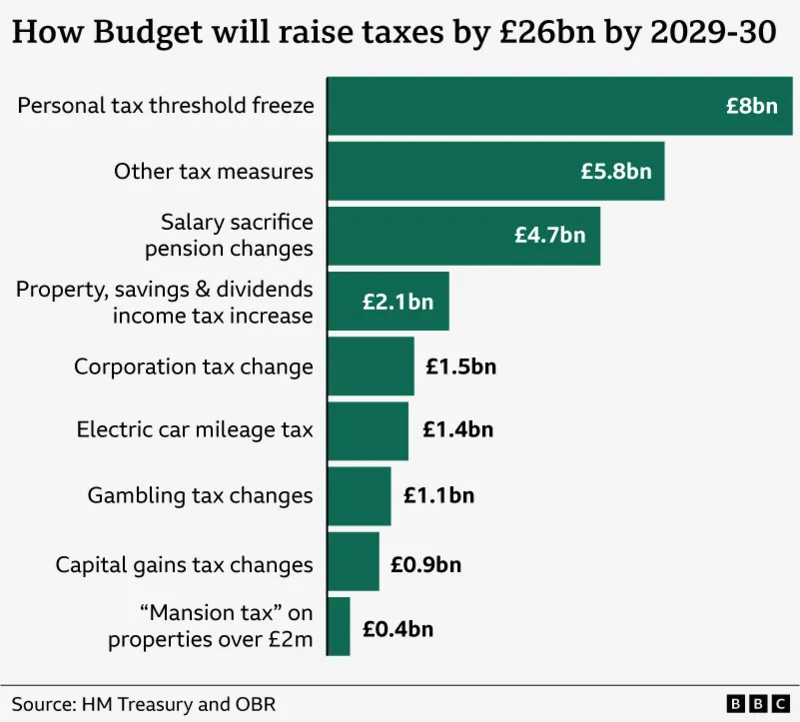

Chancellor Rachel Reeves has delivered her second Budget, laying out fiscal plans for the years ahead. The package covers tax and spending changes, pensions, housing, energy levies, and measures aimed at supporting workers and families as the economy navigates a challenging period.

Some announcements were anticipated, while others emerged after a budget watchdog’s forecast was accidentally published ahead of schedule, adding a twist to the coverage.

Tax and income thresholds

The government confirmed a three-year extension beyond 2028 of frozen National Insurance and income tax thresholds, a move that nudges more earners into higher bands over time.

- The annual cash ISA allowance for those under 65 will be capped at £12,000 from April 2027, with the remaining £20,000 annual limit reserved for investments.

- Dividend taxes will rise by 2 percentage points for ordinary and higher rates from April, and savings income tax rates will follow from April 2027.

Welfare, pensions and universal credit

- The cap limiting universal or child tax credits to a third or subsequent child will be removed from April.

- The national minimum wage for workers over 21 will rise by 4.1% in April, from £12.21 to £12.71 per hour; those aged 18–20 will see pay rise from £10 to £10.85.

- Basic and new state pensions are set to rise by 4.8% from April under the triple-lock policy, surpassing inflation this year.

- Salary sacrifice for pension contributions will be capped at £2,000 per year from 2029.

- The Help to Save scheme, which rewards savers on universal credit, will be extended and expanded beyond 2027.

Housing and property

- England homes valued above £2 million will face a council tax surcharge ranging from £2,500 to £7,500 after a revaluation of bands F, G and H.

- Rental income tax will rise by 2 percentage points from April 2027.

Transport and energy

- A 5p temporary cut in fuel duty on petrol and diesel will be extended to September 2026, with a planned rise thereafter.

- A mileage-based tax for electric and plug-in hybrid vehicles will start in 2028.

- Regulated rail fares in England will be frozen next year for the first time since 1996.

- Premium cars will be excluded from the Motability scheme, which helps some disability benefit recipients lease cheaper cars.

Business taxes and other measures

- Employer National Insurance thresholds will stay unchanged until 2031, gradually increasing costs as wages grow.

- The small-amount import tax exemption for overseas parcels under £135 will be scrapped from 2029.

- Remote gaming duty will rise from 21% to 40% from April 2026; general betting duty will move from 15% to 25% online from April 2027, with an exemption for horse racing.

Costs and levies on energy and goods

- Green levies will be funded through general taxation, saving households about £88 a year on energy bills; a further £59 saving will come from scrapping an insulation scheme.

- Sugary drinks tax will apply to pre-packaged milkshakes and lattes from 2028; tobacco taxes will rise by 2% above the higher rate of inflation; alcohol duties will also increase with the higher inflation measure in February.

Economy and forecasts

- The Office for Budget Responsibility (OBR) now expects the economy to grow by 1.5% this year, higher than the earlier March projection.

- Forecasts put average growth at 1.5% from 2026 to 2029, down from 1.8% previously; inflation should average 3.5% this year, easing to 2.5% next year, and returning to the 2% target by 2027.

Other measures and regional plans

- Regional mayors in England will gain powers to tax overnight hotel stays and holiday lets, mirroring schemes in Scotland and Wales.

- Apprenticeship training for under-25s will be free for small and medium-sized companies.

- 18-to-21-year-olds on Universal Credit who are not earning or learning for more than 18 months will be offered six months of paid work placements; those who refuse may lose benefits.

- Overseas students will be taxed £925 per year for English universities’ tuition income starting August 2028.

- The price of NHS prescriptions in England will remain at £9.90 for another year (free in Wales, Scotland and Northern Ireland).

- £5 million will go to secondary school libraries and £18 million to upgrade playgrounds; infected blood compensation will be exempt from inheritance tax.

Key insight: Budget 2025 tightens some taxes and freezes thresholds while expanding pensions and targeted support, aiming to safeguard living standards and encourage growth. BBC coverage

Conclusion

Budget 2025 blends revenue measures with targeted relief, prioritising pension increases, a higher minimum wage, and selective spending to support households while pursuing long-term growth. The real-world impact will hinge on inflation trends, wage dynamics, and how quickly the economy absorbs the changes.

Key Takeaways

- Threshold freezes and new charges will gradually raise the tax footprint for many households.

- Pensions and wages see direct boosts, backed by extended saving and apprenticeship support.

- Housing and transport policies reprice ownership and travel, with targeted relief and new levies.

- Revenue-raising steps, including duties on online gaming and overseas goods, aim to balance the books while funding public services.

Expert comment

Expert comment: Dr. Maya Patel, economic policy analyst at the Centre for Growth, notes that the Budget prioritises stability and gradual reform, which could shield households from sudden cost shocks while maintaining growth momentum. She adds that the ultimate effect will depend on how inflation and wage growth unfold in the coming months.

Summary

Budget 2025 introduces a mix of frozen thresholds, new taxes, and targeted protections that affect everyday costs from energy to housing. It also strengthens pensions and minimum wage provisions, signaling a cautious path to growth amid economic uncertainty. The long-term outcome will depend on how quickly inflation cools and how businesses adapt to the new rules.