2025 Mortgage Rates Drop to 6.94% - Lowest Since Spring, Updated May Prices

Explore the latest 2025 mortgage rates hitting their lowest point since spring, with 30-year loans averaging 6.94%. Understand the trends, factors affecting rates, and how to find the best deals today.

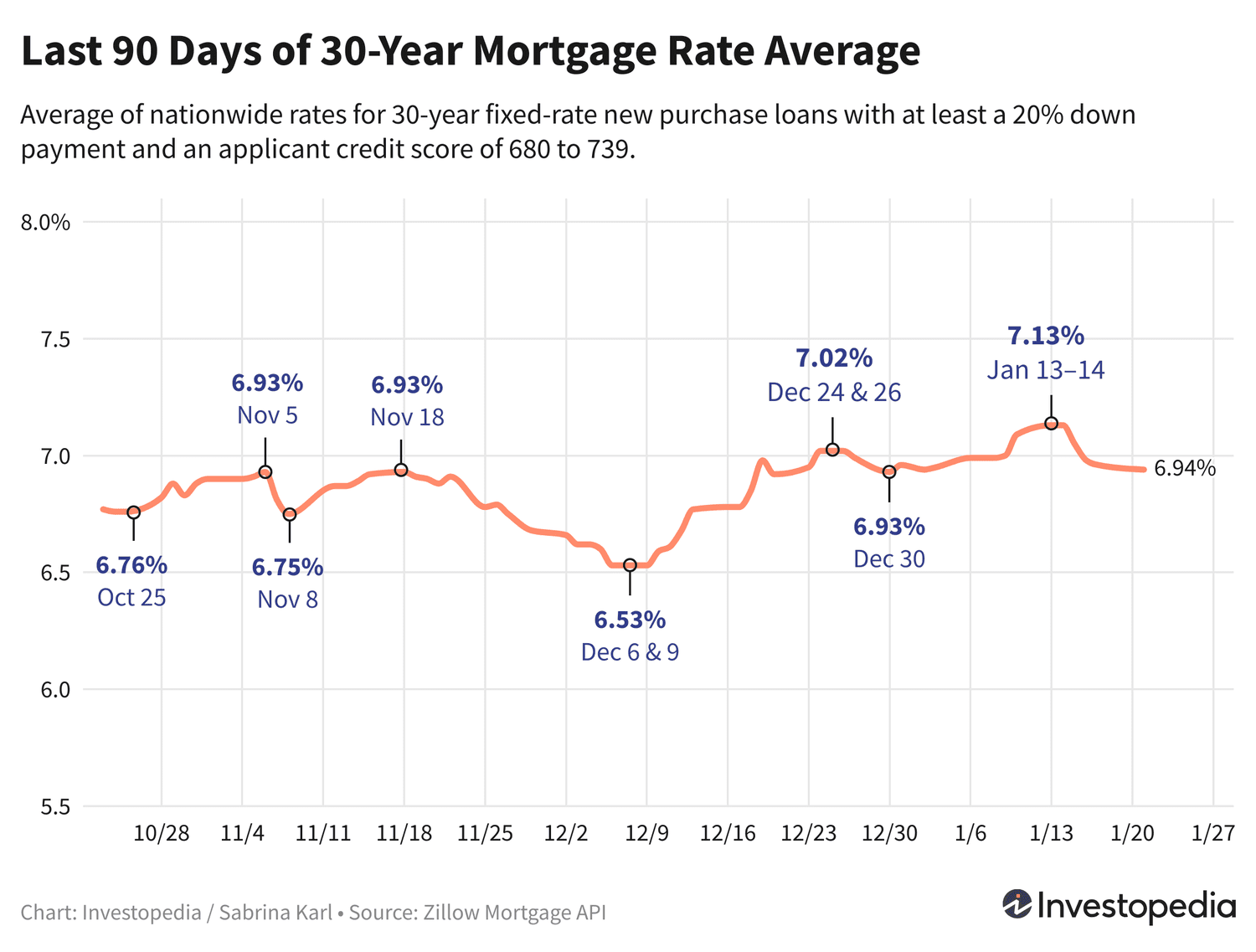

After a sharp rise to levels not seen since May, 2025 mortgage rates have reversed course, falling for four consecutive days. The average rate for 30-year fixed mortgages dropped to 6.94% as of May 9, marking the most affordable point this year so far. Other loan types also experienced declines, offering potential savings for homebuyers and refinancers alike.

Since mortgage rates vary significantly among lenders, it’s crucial to shop around and compare offers regularly to secure the best possible rate, regardless of the loan type you are considering.

Current 30-Year Mortgage Rates for New Home Purchases

On Tuesday, 30-year fixed mortgage rates for new purchases fell by 0.02 percentage points, continuing a four-day decline totaling 0.19 percentage points. This brings the average down to 6.94%, the lowest level recorded in 2025. This drop comes after rates peaked at 7.13% just a week prior, the highest in over seven months.

Back in September, rates had reached a two-year low of 5.89%, but they climbed more than 1.2 percentage points over the last three months before easing recently. Compared to last spring’s peak of 7.37% in April, current rates represent an improvement. They are also over one percentage point lower than the historic 23-year high of 8.01% reached in October 2023.

Rates for 15-year fixed mortgages remained steady at 6.06% on Tuesday following a three-day decline totaling 0.23 percentage points. Although elevated compared to the two-year low of 4.97% hit in September, today’s 15-year rate is still about one percentage point below the record 7.08% peak from October 2023.

Jumbo 30-year mortgage rates dipped slightly by 0.01 percentage points to 6.83%, down 0.15 percentage points from a week ago. Jumbo rates reached a 19-month low of 6.24% in September. The October 2023 peak of 8.14% remains the highest jumbo rate in over two decades.

Freddie Mac Weekly Mortgage Rate Update

Each Thursday, Freddie Mac publishes an average 30-year mortgage rate based on the previous week’s data. Last week’s average rose by 0.11 percentage points to 7.04%, following increases over the prior two weeks. The average had dipped as low as 6.08% in late September. However, October 2023 saw a historic 23-year peak of 7.79%.

Freddie Mac’s weekly average differs from daily averages reported elsewhere because it blends rates over five days and uses different loan inclusion criteria, such as down payment, credit score, and discount points.

Use our Mortgage Calculator to estimate monthly payments across various loan scenarios.

Important Notes

Published average rates differ from advertised teaser rates often seen online. Teaser rates are typically the best available offers, sometimes requiring upfront points or applying only to borrowers with exceptional credit or smaller loans. Your actual rate will depend on your financial profile, including credit score and income.

Factors Influencing Mortgage Rate Fluctuations

Mortgage rates are influenced by a complex mix of economic and industry dynamics, including:

- Trends in the bond market, especially 10-year Treasury yields

- The Federal Reserve’s monetary policy, particularly bond purchases and support for government-backed mortgages

- Competitive pressures among lenders and loan products

Multiple factors often interact simultaneously, making it difficult to isolate a single cause for rate changes.

Throughout much of 2021, mortgage rates remained relatively low as the Federal Reserve purchased large quantities of bonds to counteract pandemic-related economic challenges. Starting in November 2021, the Fed gradually tapered bond purchases, ending them by March 2022.

Between then and July 2023, the Fed raised the federal funds rate aggressively to combat inflation, indirectly pushing mortgage rates higher. Despite the fed funds rate not directly setting mortgage rates, its rapid 5.25 percentage point increase over 16 months contributed to mortgage rate rises.

The Fed held rates steady for nearly 14 months beginning in July 2023, before cutting rates by 0.50 percentage points in September and smaller cuts in November and December. However, the Fed signaled fewer rate cuts in 2025 than initially expected, which pushed Treasury yields and mortgage rates upward.

How We Monitor Mortgage Rates

The national and state mortgage rate averages presented come from the Zillow Mortgage API, assuming an 80% loan-to-value ratio (20% down payment) and credit scores between 680 and 739. These averages reflect typical borrower rates but may differ from advertised offers. © Zillow, Inc., 2024. Use subject to Zillow Terms of Use.

Discover engaging topics and analytical content in Personal Finance News as of 27-01-2025. The article titled " 2025 Mortgage Rates Drop to 6.94% - Lowest Since Spring, Updated May Prices " provides new insights and practical guidance in the Personal Finance News field. Each topic is meticulously analyzed to deliver actionable information to readers.

The topic " 2025 Mortgage Rates Drop to 6.94% - Lowest Since Spring, Updated May Prices " helps you make smarter decisions within the Personal Finance News category. All topics on our website are unique and offer valuable content for our audience.