PNC Financial Services Q4 2023 Earnings Forecast: $3.95 EPS Amid Rising Interest Rates

Discover how PNC Financial Services, the sixth-largest US bank, is set to boost profits with higher interest rates and what to expect from its Q4 2023 loan trends and credit reserves.

PNC Financial Services, the sixth-largest US bank, is under the spotlight as it prepares to release its Q4 2023 earnings, focusing on loan trends and credit reserves.

Highlights to Watch

- PNC is projected to report Q4 earnings of $3.95 per share, reflecting a 38% year-over-year increase.

- This marks the fifth consecutive quarter of rising earnings, driven by an expanding net interest margin amid rising rates.

- Credit quality remains a key concern following Goldman Sachs' warning of early consumer credit deterioration.

- Earlier forecasts indicated a potential slowdown in loan demand during Q4, which investors will scrutinize closely.

PNC Financial Services Group is positioned to deliver its fifth straight quarter of earnings growth as it capitalizes on the Federal Reserve's interest rate hikes. Analysts anticipate a 38% increase in fourth-quarter earnings to $3.95 per share, supported by a net interest margin climbing to nearly 3%, up from 2.27% last year.

However, risks include a sharper-than-expected decline in loan demand and the possibility of increased credit loss reserves in response to economic uncertainties.

During its October earnings call, CEO Bill Demchak reported stable credit quality, but recent remarks from Goldman Sachs' CFO about early signs of consumer credit stress have heightened market vigilance.

Credit card delinquencies have surged at their fastest rate since 2008, according to Morgan Stanley analyst Betsy Grasek, while Deutsche Bank highlights the risk of an economic slowdown impacting banks' net interest margins. Despite sector-wide challenges, Deutsche Bank upgraded PNC to Buy with a $190 price target, citing strong credit management and operational discipline. Conversely, UBS downgraded PNC to Hold, adjusting its price target to $176.

Investors will also monitor PNC’s expansion following its $11.6 billion acquisition of BBVA USA assets in 2021, which broadened its footprint in high-growth Sunbelt markets such as Texas, Florida, Arizona, and California.

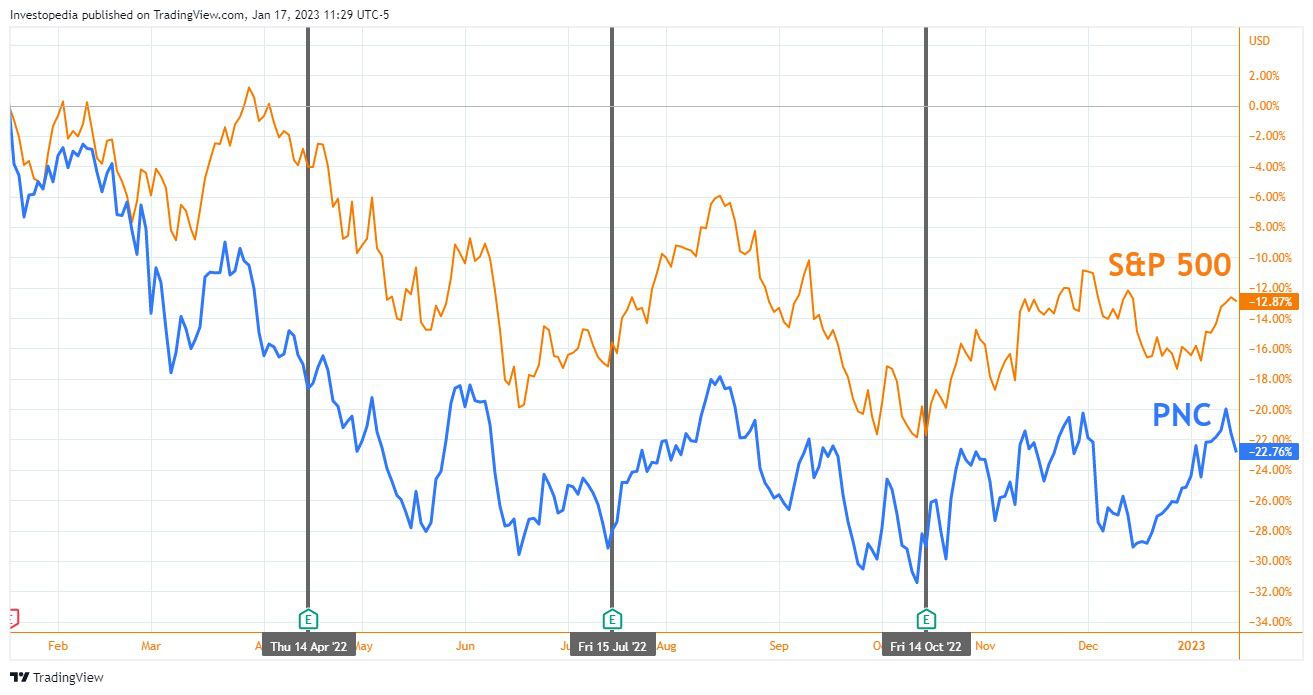

Over the past year, PNC shares have declined nearly 23% including dividends, underperforming the S&P 500’s 13% drop and the KBW Nasdaq Bank Index’s 27% plunge.

1-Year Total Return Comparison: PNC vs. S&P 500

PNC Financial Key Metrics

Source: Visible Alpha

Understanding Net Interest Margin

PNC calculates net interest margin as the difference between the total yield on interest-earning assets and the total cost of interest-bearing liabilities, factoring in the benefit of non-interest-bearing deposits. Tax-exempt asset yields are adjusted to a taxable-equivalent basis for consistency.

For Q3 2023, PNC reported a net interest margin of 2.82%, up from 2.5% in Q2 and 2.27% a year prior, primarily driven by higher yields on interest-earning assets.

Discover the latest news and current events in Company News as of 22-01-2023. The article titled " PNC Financial Services Q4 2023 Earnings Forecast: $3.95 EPS Amid Rising Interest Rates " provides you with the most relevant and reliable information in the Company News field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " PNC Financial Services Q4 2023 Earnings Forecast: $3.95 EPS Amid Rising Interest Rates " helps you make better-informed decisions within the Company News category. Our news articles are continuously updated and adhere to journalistic standards.