Personal Loan Rates in 2023: Average Drops to 21.68% – November Update

Explore the latest trends in personal loan interest rates for 2023, with the average rate falling to 21.68% in November. Understand how credit scores affect rates, loan amounts, terms, and what to expect from future Federal Reserve decisions.

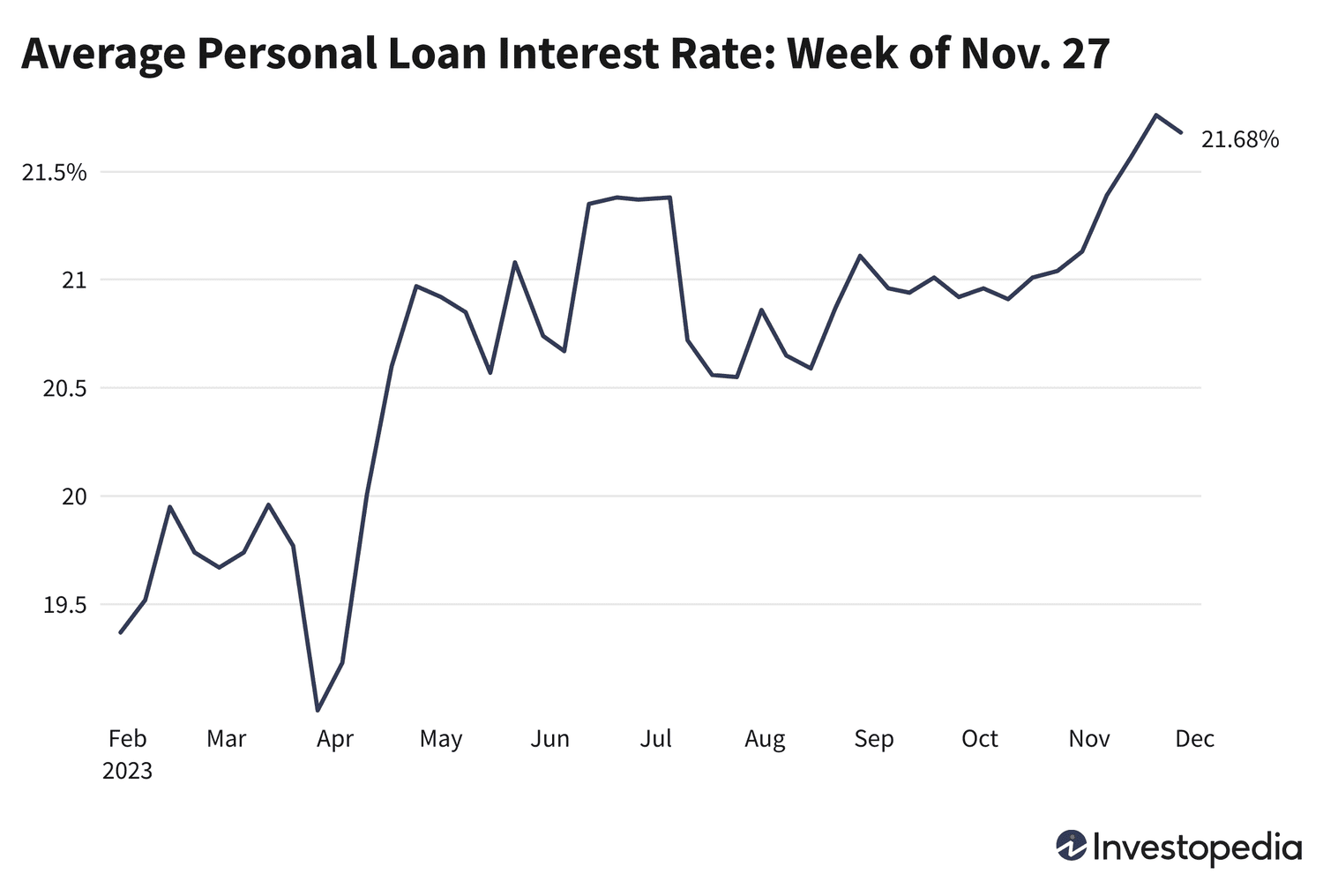

Personal Loan Rate Overview – Week of Nov. 27, 2023

After weeks of steady increases, personal loan interest rates have shifted downward, dropping by 8 basis points to an average of 21.68% as tracked by Investopedia. Throughout 2023, rates have crossed the 21% mark five times, most recently on October 16, but have mostly retreated below that threshold—until now. Last week's peak average of 21.76% was the highest since tracking began in January 2023.

The breakdown by credit quality shows varied movement: excellent, good, and poor credit borrowers saw their average rates decrease by 50, 9, and 148 basis points respectively, while fair credit rates increased by 39 basis points. These mixed changes collectively resulted in the slight overall average decline.

Key Highlights:

- The average personal loan interest rate decreased by 0.08% to 21.68% this week.

- The lowest lender-offered APR stands at 5.99%, with the highest reaching 35.99% APR.

- Average loan amounts dropped to $17,248—a $5,286 decrease from last week—with loan terms slightly shortening to 46 months.

Below you'll find offers from our lending partners, along with insights and recommendations to help you secure the best personal loan tailored to your financial needs.

Personal loan rates have climbed since 2022, influenced by a series of Federal Reserve rate hikes aimed at curbing the highest inflation seen in four decades. The Fed raised rates in 11 meetings since then, with many increases at historic increments of 0.50% or 0.75%, though recent hikes have been more modest at 0.25%. The Fed paused rate increases on November 1, and market forecasts heavily favor steady rates in the upcoming December 13 meeting.

The Federal Reserve's Impact on Personal Loan Rates

Typically, changes in the federal funds rate influence personal loan and credit card interest rates. However, competition among lenders and increased demand for personal loans in 2022 and 2023 have tempered these increases. Despite the Fed raising rates by 525 basis points since March 2020, personal loan rates have not surged proportionally due to fierce lender competition that encourages offering competitive, lower rates.

Inflation remains above the Fed's 2% target, prompting steady rates recently, though future increases remain possible as indicated by Fed Chair Jerome Powell.

Forecast for Personal Loan Rates

If the Fed opts to raise rates in December 2023, personal loan rates may rise accordingly. However, due to ongoing competition among lenders, any increase may be modest, potentially keeping average rates near current levels.

Since most personal loans have fixed interest rates, the rate you secure at loan origination is what you’ll pay throughout the term. If you anticipate needing a loan soon, current rates could be as favorable as those available later this year, depending on Fed actions. Unlike variable credit card rates, personal loan fixed rates provide payment certainty.

Shopping around is crucial—differences of one to two percentage points in interest rates can translate into significant savings over the loan term. Additionally, consider budgeting strategies and building an emergency fund to reduce reliance on personal loans in the future.

Common Uses for Personal Loans

Based on a national survey of 962 U.S. adults who took personal loans between August and September 2023, debt consolidation remains the top reason for borrowing, followed by home improvement projects and other major expenses.

Data Collection and Methodology

Investopedia collects weekly average advertised personal loan rates, loan lengths, and amounts from 15 leading lenders, calculating midpoints of advertised ranges. Additionally, through a partnership with Fiona, actual loan data is aggregated across 29 lenders segmented by credit quality (excellent, good, fair, bad).

Survey data on loan usage was gathered from 962 U.S. adults aged 20-75 who currently have or plan to take a personal loan, using rigorous quality checks to ensure accurate insights.

Discover the latest news and current events in Personal Finance News as of 03-12-2023. The article titled " Personal Loan Rates in 2023: Average Drops to 21.68% – November Update " provides you with the most relevant and reliable information in the Personal Finance News field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " Personal Loan Rates in 2023: Average Drops to 21.68% – November Update " helps you make better-informed decisions within the Personal Finance News category. Our news articles are continuously updated and adhere to journalistic standards.