Mortgage Rates Surge to 7.17% in December 2022 – Latest Trends & Prices

Stay updated with the latest mortgage rate trends as 30-year fixed rates climb above 7% in late 2022, marking the highest levels in seven weeks and nearing historic highs.

Mortgage rates for 30-year fixed loans have surged for the fifth consecutive day, pushing the average rate beyond 7% and reaching its highest point since early November 2022.

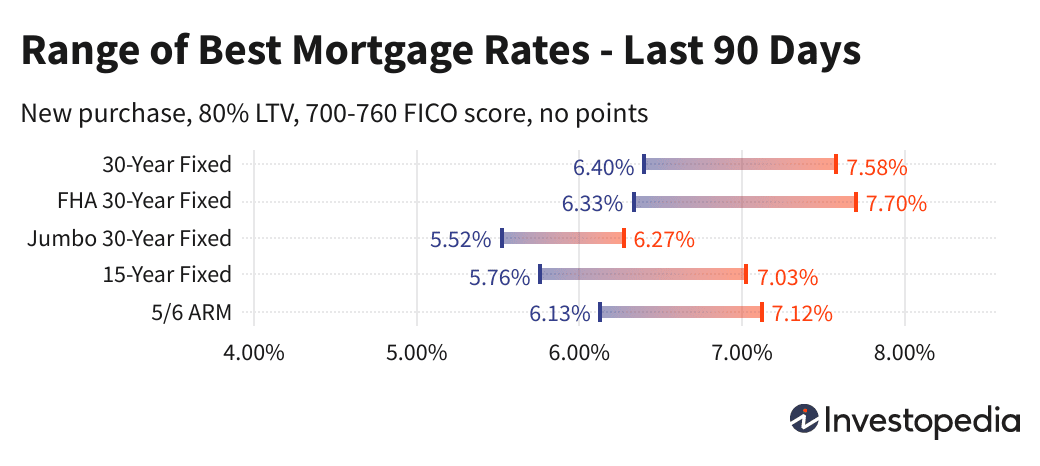

Following a week-long increase, the 30-year mortgage rate now stands at 7.17%, a notable rise of 63 basis points over seven days. This marks the peak in seven weeks and approaches the 20-year high of 7.58% recorded in mid-October.

Current National Mortgage Rate Averages

On Thursday, 30-year fixed mortgage rates increased by an additional 0.10%, continuing the upward momentum. Meanwhile, 15-year fixed rates remained relatively stable, slightly dipping to 6.16%, well below their recent peak of 7.03%.

Jumbo 30-year loan rates held steady at 6.02%, just below the October high of 6.27%, a level unseen in over a decade.

Refinancing rates showed minor fluctuations: the 30-year refinance average increased by three basis points, the 15-year refinance rate decreased by four basis points, and Jumbo 30-year refinance rates remained unchanged. Currently, refinancing a 30-year loan costs approximately 28 basis points more than a new purchase loan of the same term.

After historic lows in August 2021, mortgage rates climbed sharply throughout 2022, with the 30-year average peaking at 6.38% in mid-June before soaring even higher in September and October.

Important Note

Displayed mortgage rates represent averages from over 200 lenders based on typical borrower profiles. Advertised teaser rates often differ, as they may require upfront points, assume exceptional credit scores, or smaller loan amounts relative to home value.

Use our Mortgage Calculator to estimate monthly payments across different loan scenarios.

What Influences Mortgage Rate Changes?

Mortgage rates fluctuate due to a complex mix of factors including bond market trends (notably 10-year Treasury yields), Federal Reserve monetary policies affecting government-backed loans, and lender competition.

In 2021, the Federal Reserve’s bond-buying program helped keep rates low by purchasing billions in bonds to support the economy. This policy, more so than the federal funds rate, significantly impacts mortgage rates.

However, beginning November 2021, the Fed gradually tapered bond purchases, ending net purchases by March 2022, contributing to rising mortgage rates.

The Federal Open Market Committee (FOMC) meets every six to eight weeks to review monetary policy, with the next meeting scheduled for February 1, 2023.

Data Methodology

The national mortgage rate averages are calculated from the lowest rates offered by over 200 top lenders nationwide, assuming an 80% loan-to-value ratio and a borrower credit score between 700 and 760. These figures reflect realistic rates borrowers can expect, rather than promotional teaser rates.

State-specific best rates are determined similarly, listing the lowest available rate per state under the same assumptions.

Discover the latest news and current events in Personal Finance News as of 04-01-2023. The article titled " Mortgage Rates Surge to 7.17% in December 2022 – Latest Trends & Prices " provides you with the most relevant and reliable information in the Personal Finance News field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " Mortgage Rates Surge to 7.17% in December 2022 – Latest Trends & Prices " helps you make better-informed decisions within the Personal Finance News category. Our news articles are continuously updated and adhere to journalistic standards.