Mastering Financial Wellness: Smart Money Management for Millennials

Discover practical strategies and top digital tools to take control of your finances, build your budget, manage debt, and achieve your savings goals with confidence.

Neglecting your finances can quickly lead to debt and living paycheck to paycheck. This guide reveals how millennials can improve their financial health and build security using modern online tools.

Many young adults between 20 and 30 years old often overlook the importance of financial planning. While earning an income and spending on hobbies and entertainment come naturally, few consider budgeting wisely or investing for the future.

In reality, your income level matters less than your mindset toward money. Budgeting and investing are about adopting smarter habits, regardless of how much you earn.

This article shares effective financial management methods for those with stable salaries and limited additional income.

Below, you will find a step-by-step strategy that works well even on modest incomes, along with several digital tools designed to simplify managing your money.

Step 1: Set Up a Finance Tracking Account

In the US, Mint.com is a popular platform for tracking all financial transactions in one place.

Users link their bank cards and then monitor income, expenses, budget plans, receive spending optimization tips, and alerts about credit interest rates.

While there isn't an exact equivalent globally, several user-friendly apps offer budgeting, expense tracking, and payment reminders—perfect for managing personal finances.

Here are some standout finance management apps that can help you stay on top of your money:

ZenMoney

ZenMoney stands out with a clean, simple interface that supports transaction uploads from several banks such as Alfa Bank and VTB. The app offers built-in analytics including income and expense mapping, debt comparisons, and cash flow visualization through easy-to-read charts.

Its mobile app syncs with the web platform and supports shared family budgeting, automatically recognizing bank SMS notifications to update your finances.

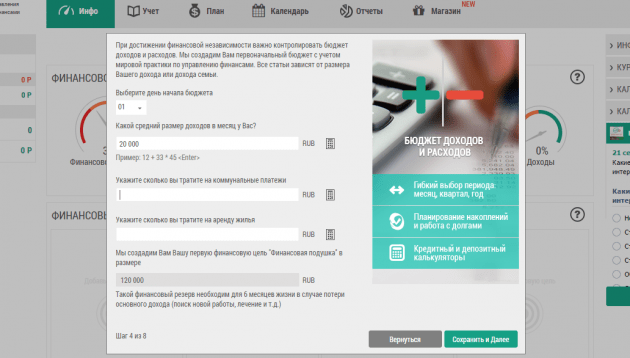

Easy Finance

After signing up, you fill out a brief questionnaire to tailor categories and get personalized advice, including guidance on building an emergency fund.

Easy Finance also allows syncing with bank cards from institutions like Sberbank and VTB, letting you import transactions directly.

Its financial health indicators provide automatic tips to improve money management.

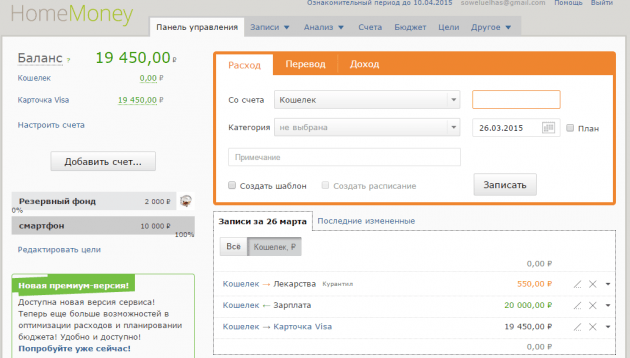

Home Money

Home Money focuses on simplicity. It lacks extensive analytics or bank synchronization but offers easy setup and guided initial steps.

Create budgets, set savings goals like vacations or emergency funds with just a click, and track income and expenses effortlessly.

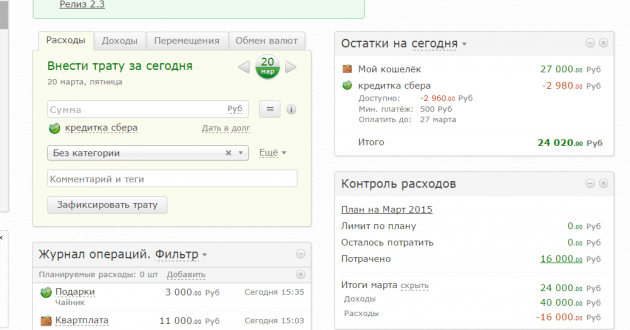

Drebedengi

Drebedengi lets you manage income, expenses, and transfers between accounts. Categories are managed separately, and you can save templates for frequent expenses.

Budget planning and setting financial goals require a premium subscription, common among similar apps to access advanced features.

All these tools offer mobile apps for iOS and Android, making it easy to log expenses on the go.

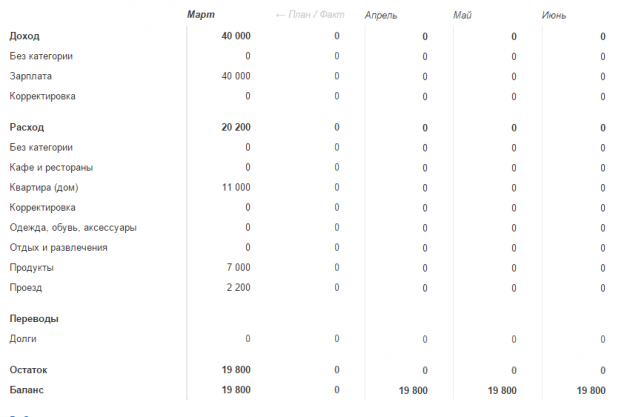

Step 2: Create Your Budget

Once your account is ready, start by planning your budget. If you receive a regular salary, input your net income after taxes.

Add recurring monthly expenses such as rent, transport, internet, loan repayments, childcare costs, or support for family members.

You will then see a breakdown showing planned spending per category, amounts already spent, and remaining budget to avoid overspending.

Consider adding an “Emergency Fund” or “Miscellaneous” category to track unplanned spending and better understand your available free cash.

Step 3: Track and Manage Debt

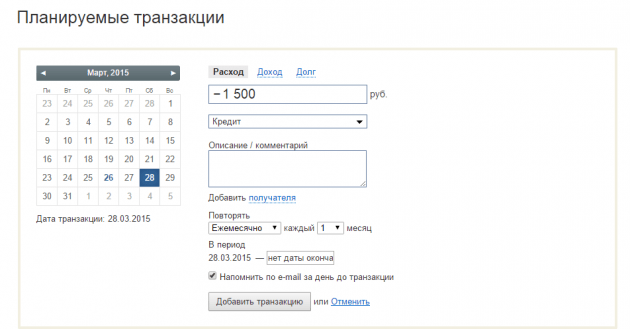

Using credit cards strategically can help cover cash flow gaps between paychecks. Tracking debts and payment deadlines is crucial to avoid interest charges.

Finance apps let you record how much you owe and due dates for repayments. For example, Easy Finance integrates payment reminders into Google Calendar and sends alerts via email and SMS.

ZenMoney offers similar recurring transaction scheduling and email reminders, helping you stay on top of payments.

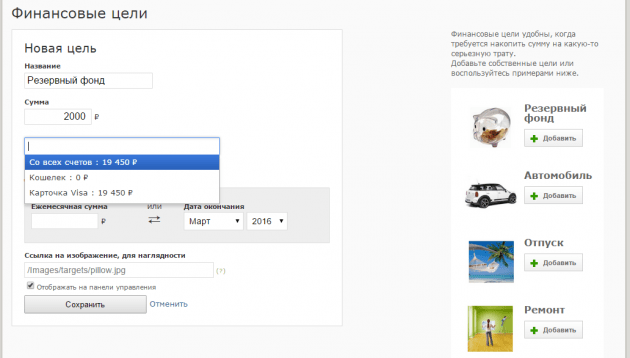

Step 4: Set Clear Savings Goals

With your budget under control and spending within limits, it’s time to focus on building savings. Configure your app to automatically transfer a fixed amount to your savings account monthly.

An ideal savings target is an emergency fund covering six months of living expenses. Calculate this by multiplying your average monthly budget by six.

Keep this fund untouched unless facing a genuine emergency like job loss or unforeseen expenses. Having this financial cushion brings peace of mind and confidence.

You can also set goals for specific purchases, vacations, or other plans. The budgeting tools help you see how much you can save each month to reach these targets on time.

For instance, if you have an extra $70 monthly after essential expenses, you can create a goal to buy a new smartphone by the end of summer. The app will calculate the required monthly saving amount, helping you stay motivated and organized.

Do you actively plan your personal finances? Which tools or strategies work best for you? Share your experience!

Discover the latest news and current events in Smart Money Tips as of 20-11-2021. The article titled " Mastering Financial Wellness: Smart Money Management for Millennials " provides you with the most relevant and reliable information in the Smart Money Tips field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " Mastering Financial Wellness: Smart Money Management for Millennials " helps you make better-informed decisions within the Smart Money Tips category. Our news articles are continuously updated and adhere to journalistic standards.