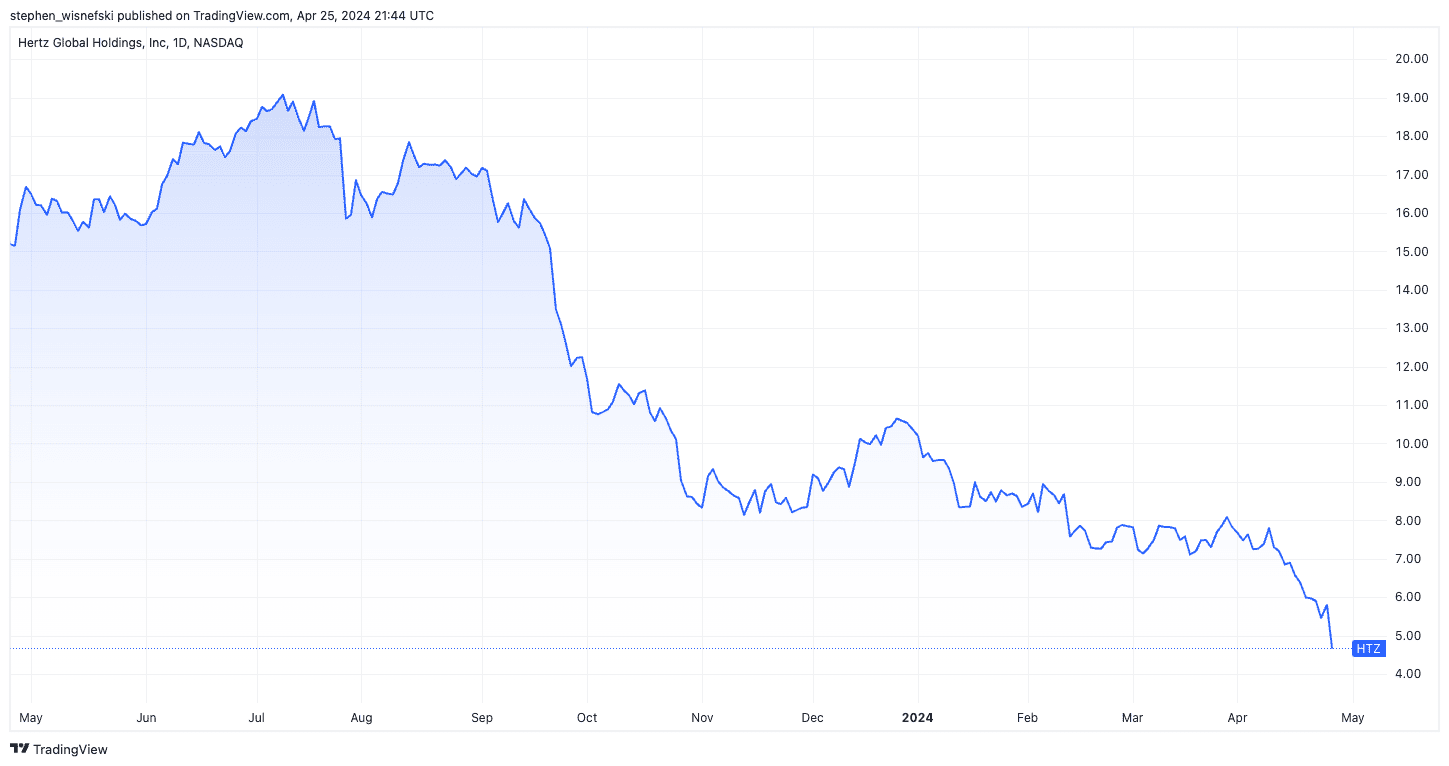

Hertz Shares Crash 19% in 2025 Amid $195M Loss from Tesla EV Fleet Cutbacks

In 2025, Hertz Global Holdings slashed its electric vehicle fleet by 10,000 units and reported a $195 million charge, driving shares down 19%. Discover the impact on Hertz's financial health and EV strategy.

Bill McColl brings over 25 years of expertise as a senior producer and journalist in TV, radio, and digital media, leading teams in delivering major news stories.

Key Insights

- Hertz Global Holdings announced a reduction of its EV fleet by 10,000 vehicles, taking a $195 million write-down in Q1 2024.

- This charge contributed to a $588 million increase in vehicle depreciation, resulting in a loss per share that more than doubled analyst expectations.

- Earlier in January 2024, Hertz recorded a $245 million charge while planning to divest 20,000 EVs.

- Following these adjustments, Hertz shares plunged by 19% on the trading day.

In 2024, Hertz Global Holdings (HTZ) experienced a significant stock decline after revealing an additional $195 million expense linked to its faltering electric vehicle transition strategy. The company increased its EV fleet reduction target by 10,000 cars, primarily Teslas, intensifying financial losses in the first quarter.

Initially, Hertz had planned to sell 20,000 EVs, incurring a $245 million charge earlier this year. With the latest cuts, its EV fleet will shrink by 50%, reflecting a strategic retreat from its ambitious EV expansion launched in October 2021.

Back in 2021, Hertz announced a bold move to acquire 100,000 Tesla vehicles, partnering with NFL star Tom Brady to boost consumer appeal amid soaring interest in electric vehicles. However, anticipated demand failed to materialize, and falling EV prices alongside rising maintenance costs severely undermined Hertz's resale revenue.

The $195 million charge formed part of a $588 million surge in vehicle depreciation expenses, pushing Hertz to a loss of $1.28 per share—more than twice what analysts predicted. The company's revenue increased modestly by 1.6% to $2.1 billion, meeting expectations.

CEO Gil West highlighted that fleet and operational expenses pressured Hertz's performance. He emphasized ongoing efforts to balance vehicle supply with cost efficiency, aiming to boost productivity and reduce operating expenses.

As a result of these developments, Hertz shares dropped 19.3%, closing at $4.68, after intra-day declines of up to 25%.

Discover the latest news and current events in Company News as of 01-05-2024. The article titled " Hertz Shares Crash 19% in 2025 Amid $195M Loss from Tesla EV Fleet Cutbacks " provides you with the most relevant and reliable information in the Company News field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " Hertz Shares Crash 19% in 2025 Amid $195M Loss from Tesla EV Fleet Cutbacks " helps you make better-informed decisions within the Company News category. Our news articles are continuously updated and adhere to journalistic standards.