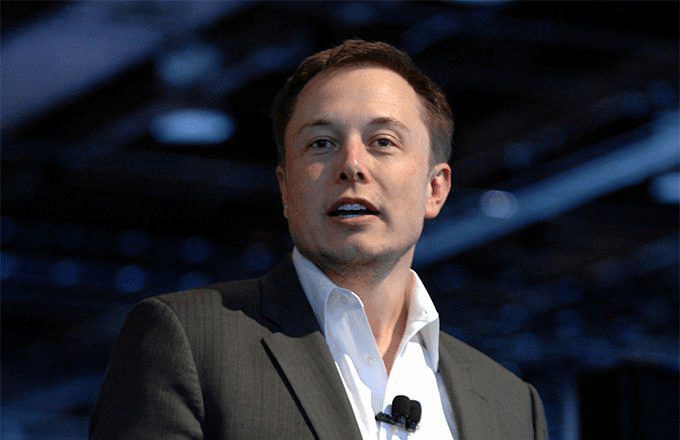

Elon Musk Collaborates with Silver Lake and Goldman Sachs on Tesla Privatization Plan

Tech visionary Elon Musk reveals partnerships with Silver Lake and Goldman Sachs as financial advisors, alongside top legal firms, to advance his plan to take Tesla private.

Elon Musk is openly advancing his bold initiative to privatize Tesla Inc. (TSLA), refusing to stay silent on the matter.

On Monday, Musk took to Twitter to announce that he is actively moving forward with his privatization strategy, naming Goldman Sachs Group Inc. (GS) and Silver Lake as his financial advisors. He also confirmed retaining prestigious legal firms Wachtell, Lipton, Rosen & Katz and Munger, Tolles & Olson to support the process.

"Thrilled to collaborate with Silver Lake and Goldman Sachs as financial advisors, alongside Wachtell, Lipton, Rosen & Katz and Munger, Tolles & Olson as our legal counsel, in our proposal to take Tesla private."

— Elon Musk (@elonmusk) August 14, 2018

Shortly after Musk’s announcement, Reuters reported that Silver Lake is not officially hired as a financial advisor but is providing Musk with unpaid assistance. The report also clarified that Silver Lake is not negotiating to become an investor in Musk’s proposed privatization deal.

This update follows Musk’s earlier controversial disclosure about Tesla’s discussions with investors regarding the privatization. In a detailed blog post, Musk explained that his claim of securing buyout funding is based on ongoing, repeated talks with Saudi Arabia’s sovereign wealth fund.

"For nearly two years, the Saudi sovereign wealth fund has approached me multiple times about taking Tesla private," Musk wrote. "After acquiring nearly 5% of Tesla’s stock publicly, they requested another meeting, which occurred on July 31. I left that meeting confident that a deal with the Saudi fund could be finalized."

Recent reports have been mixed regarding the Saudi Public Investment Fund’s (PIF) interest in financing Tesla’s buyout. The Wall Street Journal and Bloomberg suggested PIF is discussing increasing its stake, while sources told Reuters that PIF may not be a viable backer, partly due to its investment in SoftBank Group, which supports competing automaker General Motors Co. (GM).

In his blog, Musk emphasized ongoing negotiations not only with the Saudi fund but also with multiple other investors.

"I continue talks with the Saudi fund and various other investors, as I always intended, aiming to maintain Tesla’s diverse investor base," he stated. "Completing these discussions before presenting a comprehensive proposal to an independent board committee is essential."

On Monday, Tesla’s stock closed at $356.41, reflecting investor skepticism about Musk’s ability to secure the required capital to buy out shareholders at his proposed $420 per share.

Discover the latest news and current events in Company News as of 19-08-2018. The article titled " Elon Musk Collaborates with Silver Lake and Goldman Sachs on Tesla Privatization Plan " provides you with the most relevant and reliable information in the Company News field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " Elon Musk Collaborates with Silver Lake and Goldman Sachs on Tesla Privatization Plan " helps you make better-informed decisions within the Company News category. Our news articles are continuously updated and adhere to journalistic standards.