Debt Avalanche vs. Debt Snowball in 2025: Which Method Saves You More and Costs Less?

Discover the key differences between the Debt Avalanche and Debt Snowball methods. Learn how each strategy works, their pros and cons, and which approach can help you pay off debt faster and save more money in 2025.

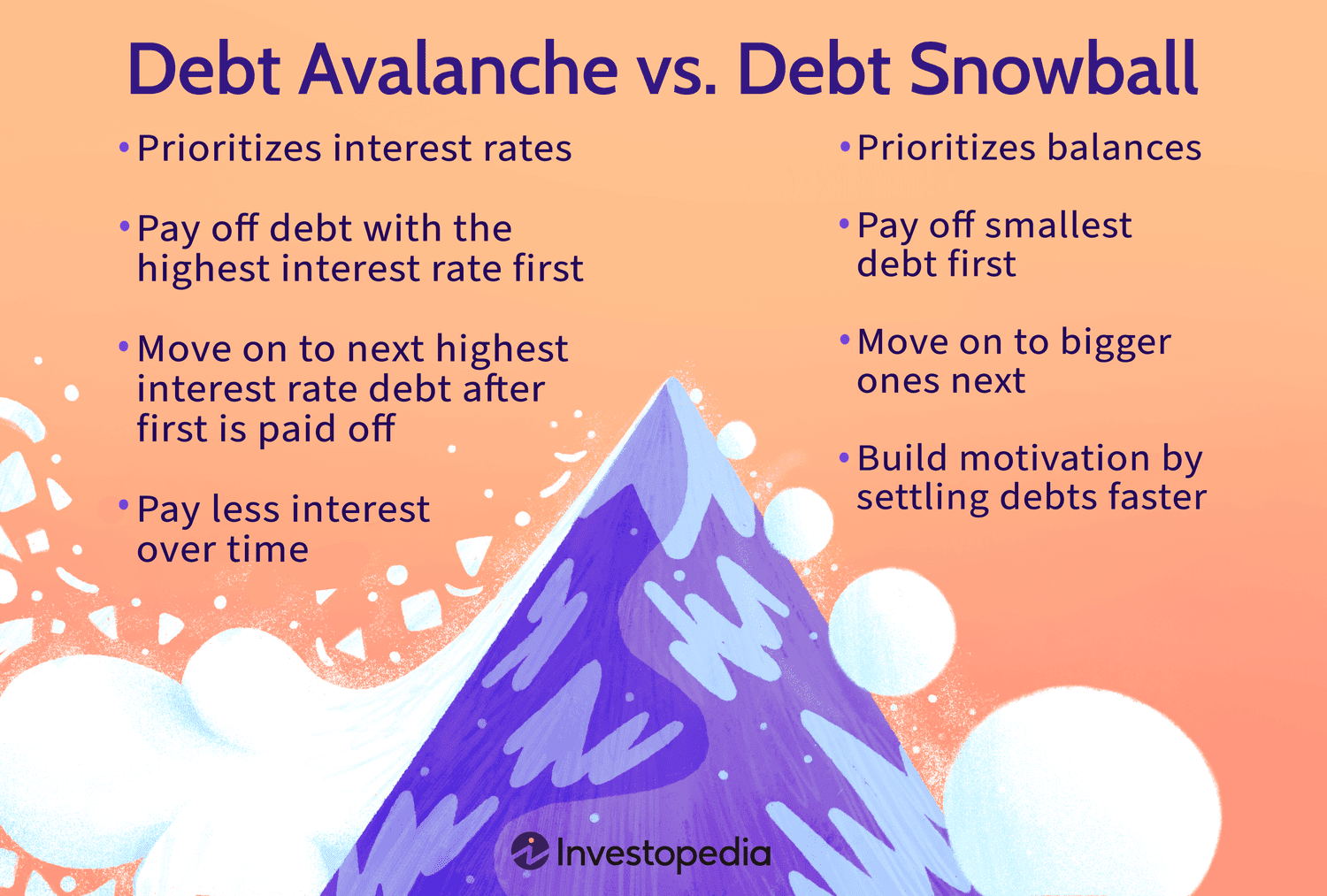

Managing debt efficiently is crucial for financial freedom, and two popular strategies to accelerate debt repayment are the Debt Avalanche and Debt Snowball methods. While both aim to help you become debt-free, they take distinct approaches that cater to different financial styles and goals.

The Debt Avalanche method prioritizes paying off debts with the highest interest rates first, minimizing the total interest paid over time. Conversely, the Debt Snowball method focuses on eliminating your smallest debts first to build momentum and motivation.

Both techniques involve listing all your debts and making minimum payments on each, except the one you are targeting to pay off aggressively. Once a debt is cleared, you roll the amount you were paying into the next debt, continuing until all debts are fully repaid.

Key Insights

- Debt Avalanche reduces overall interest costs by targeting high-interest debts first.

- Debt Snowball boosts motivation by quickly paying off smaller balances.

- Both methods require disciplined budgeting and consistent extra payments.

- Your choice depends on whether saving money or maintaining motivation is your priority.

Understanding Debt Avalanche

The Debt Avalanche strategy involves making minimum payments on all debts while funneling any additional funds toward the debt with the highest interest rate. This approach is the most cost-effective over time as it minimizes interest accumulation.

Debt Avalanche Example

Imagine you have $3,000 extra monthly to pay down the following debts:

- $10,000 credit card debt at 18.99% APR

- $9,000 car loan at 3.00% interest

- $15,000 student loan at 4.50% interest

Using the Avalanche method, you would focus on the credit card debt first, paying it off in roughly 11 months and incurring $1,011.60 in interest. This saves you over $500 in interest compared to other methods.

Pros and Cons of Debt Avalanche

- Pros: Minimizes interest payments, shortens debt payoff time, ideal for disciplined budgeters.

- Cons: Requires strong commitment and steady extra income, can be less motivating initially.

Exploring Debt Snowball

The Debt Snowball method encourages paying off your smallest debts first regardless of interest rate. This tactic builds momentum by providing quick wins, which can help maintain motivation throughout your debt repayment journey.

Start by listing all debts from smallest to largest. Pay minimums on all except the smallest, to which you apply extra funds. Once that debt is cleared, you move on to the next smallest, rolling over payments from debts you've paid off.

Debt Snowball Example

Using the same debts and extra $3,000 monthly payment, the Snowball method targets the $9,000 car loan first. You clear it in about three months, then move on to larger debts. You become debt-free in roughly 11 months but pay $1,514.97 in total interest, which is higher than the Avalanche method.

Pros and Cons of Debt Snowball

- Pros: Builds motivation quickly by eliminating small debts fast, simpler to manage without comparing interest rates.

- Cons: Higher total interest paid, potentially longer payoff period.

Choosing the Right Method for You

Your decision between Debt Avalanche and Debt Snowball depends on your financial personality and goals. If saving money on interest is your top priority, Debt Avalanche is more effective. However, if staying motivated by seeing quick results is crucial, Debt Snowball may suit you better.

Should You Pay Off Big or Small Debts First?

Financially, it’s optimal to target high-interest debts first to minimize costs. Yet, if paying off smaller debts helps keep you motivated and on track, tackling those first can be beneficial.

Saving vs. Paying Off Debt

Prioritizing debt repayment, especially high-interest debt, often outweighs saving because interest compounds rapidly. Eliminating debt improves your credit score and frees up funds for future savings or investment goals.

Conclusion

Both Debt Avalanche and Debt Snowball are powerful debt repayment strategies with unique benefits. Assess your finances, motivation levels, and preferences to select the plan that best helps you achieve debt freedom and build a stronger financial future in 2024.

Discover the latest news and current events in Credit & Debt as of 21-05-2024. The article titled " Debt Avalanche vs. Debt Snowball in 2025: Which Method Saves You More and Costs Less? " provides you with the most relevant and reliable information in the Credit & Debt field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " Debt Avalanche vs. Debt Snowball in 2025: Which Method Saves You More and Costs Less? " helps you make better-informed decisions within the Credit & Debt category. Our news articles are continuously updated and adhere to journalistic standards.