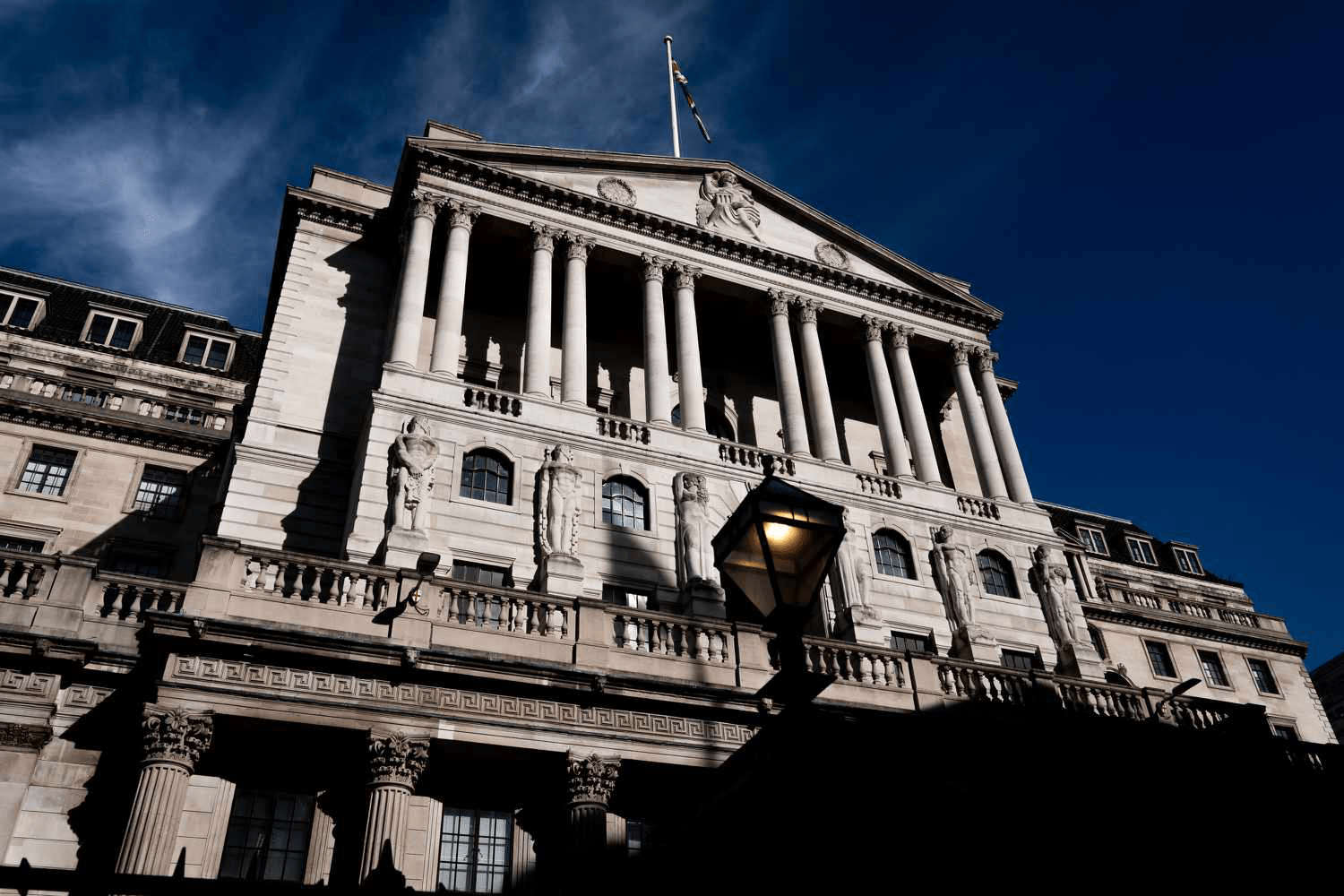

Bank of England Holds Rates at 5.25% in 2025, Mirroring Fed’s Pause Amid Inflation Concerns

The Bank of England has paused its interest rate hikes for the first time since 2007, keeping rates at 5.25%. This decision impacts UK homeowners significantly due to shorter fixed-rate mortgage terms compared to the US.

UK Homeowners Face Increased Pressure as Short Fixed-Rate Mortgages Expose Them to Rate Changes

In a closely contested 5-4 vote, the Bank of England decided to hold its key interest rate steady at 5.25%, marking the highest level since 2007. This move aligns with the Federal Reserve’s recent decision to pause rate hikes amid signs of easing inflation in both the UK and the US.

Highlights

- The Bank of England has paused its series of interest rate increases aimed at curbing inflation, reflecting the Federal Reserve’s recent stance.

- At 5.25%, the UK’s bank rate is at its peak since 2007, posing challenges for homeowners with typically five-year fixed-rate mortgages, unlike the US where 30-year fixed terms are common.

- The central bank signaled openness to future rate hikes if inflation does not continue to decline.

- The decision to pause was narrowly reached, underscoring the delicate balance policymakers face in managing economic growth and inflation.

The Bank of England’s cautious pause comes as inflation in the UK has eased to 6.7% as of August, down from a high of 11.1% in October last year. In comparison, US inflation has dropped to 3.7% from a peak of 9.1% in mid-2022. The bank’s decision reflects ongoing efforts to slow economic activity by increasing borrowing costs, aiming to bring inflation closer to target levels.

James Smith, an economist specializing in developed markets at ING, notes that while the bank may have concluded its rate hikes for now, the tight vote margin leaves room for future increases if inflationary pressures resurge. The unique structure of UK mortgages, which often reset after five years, means many homeowners will soon face higher repayments, amplifying the impact of prior rate hikes.

This pivotal decision highlights the Bank of England’s delicate task of balancing inflation control with economic stability, particularly in a housing market sensitive to rate fluctuations.

Discover the latest news and current events in Economic News as of 26-09-2023. The article titled " Bank of England Holds Rates at 5.25% in 2025, Mirroring Fed’s Pause Amid Inflation Concerns " provides you with the most relevant and reliable information in the Economic News field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " Bank of England Holds Rates at 5.25% in 2025, Mirroring Fed’s Pause Amid Inflation Concerns " helps you make better-informed decisions within the Economic News category. Our news articles are continuously updated and adhere to journalistic standards.