2025 30-Year Mortgage Rates Drop to 7.55% – Latest Trends and Insights

Discover the latest update on 30-year mortgage rates for 2025 as they ease to 7.55%, with detailed analysis on loan types, refinancing trends, and state-by-state variations. Stay informed to find the best mortgage rates today.

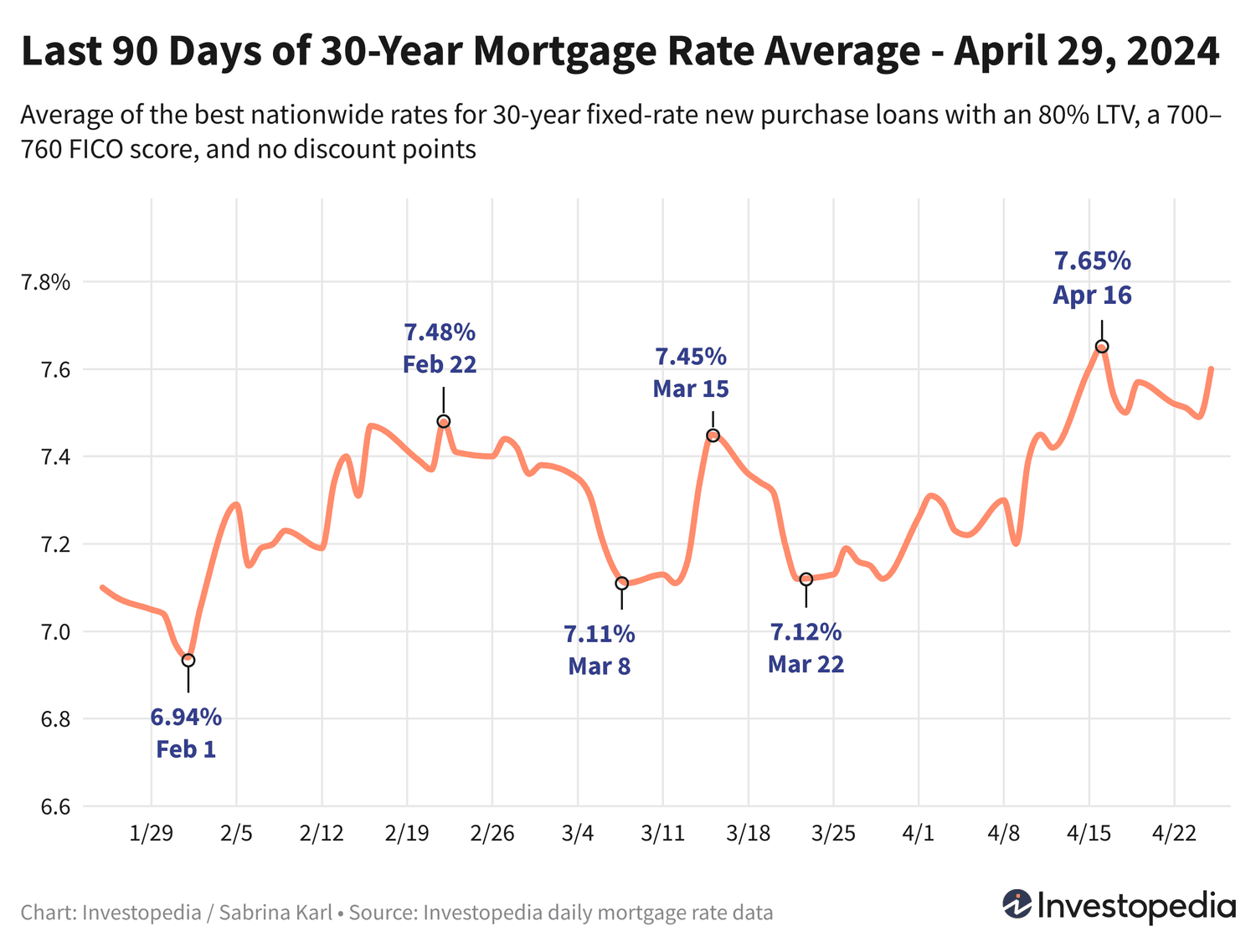

Mortgage Rate Update – April 29, 2024

Following a spike triggered by recent inflation reports, 30-year mortgage rates have retreated slightly to an average of 7.55% as of Friday, April 29, 2024. Most mortgage categories saw modest declines, while some remained stable.

Mortgage rates can vary significantly among lenders, so it’s crucial to shop around and compare your options regularly regardless of the loan type you seek.

Current 30-Year New Purchase Mortgage Rates

After an 11 basis point increase on Thursday due to inflation data, the 30-year new purchase mortgage rate dropped by 5 basis points on Friday, settling at 7.55%. This marks a slight dip from the recent peak of 7.65%, the highest since November 2023.

While significantly higher than the early February lows near 6%, current rates remain considerably below last October’s 23-year high of 8.45%.

The 15-year new purchase mortgage rate also declined by 8 basis points to 6.92%, down from a five-month high of 7.00%. These rates remain more affordable than last fall’s 7.59%, a peak not seen since 2000.

Jumbo 30-year mortgage rates steadied at 7.32% after climbing to a six-month high on Thursday. Despite limited historical jumbo rate data prior to 2009, last fall’s peak of 7.52% likely represented the highest rate in over 20 years.

Most new purchase mortgage averages saw slight decreases Friday, especially 10-year loans, which fell by 7 basis points.

Freddie Mac Weekly Mortgage Rate Insights

Freddie Mac’s most recent weekly report showed a 7.17% average for 30-year mortgage rates, an increase of 7 basis points and the highest since late November 2023. This is lower than October’s historic 23-year peak of 7.79% but higher than January’s low of 6.60%.

Freddie Mac calculates weekly averages incorporating discount points and a blend of previous days, while ZAMONA provides daily averages focusing on zero-point loans, creating slight discrepancies between the two sources.

Refinancing Mortgage Rates Update

Refinancing rates mostly declined Friday, with the 30-year refi average dropping 7 basis points to widen the new purchase/refi spread to 39 basis points. The 15-year refi rate decreased by 9 basis points; jumbo 30-year refi rates remained stable.

The largest refinancing rate drops occurred in 10-year and VA 30-year fixed-rate loans, each falling by 11 basis points.

Use our Mortgage Calculator to estimate monthly payments for various loan scenarios.

Important Note

Displayed mortgage averages differ from advertised teaser rates, which often represent ideal conditions or require upfront points. Actual rates depend on individual credit, income, and loan specifics.

Mortgage Rate Variations by State

Mortgage rates differ by state due to factors like average credit scores, loan types, and lender risk policies. The lowest 30-year new purchase rates on Friday were found in Mississippi, Iowa, Rhode Island, Delaware, Louisiana, Nebraska, South Carolina, Virginia, and Wisconsin. Conversely, Idaho, Minnesota, Arizona, Maryland, Washington, New York, Oregon, and Nevada reported the highest averages.

Factors Influencing Mortgage Rate Movements

Mortgage rates fluctuate based on complex economic and industry dynamics including:

- Bond market trends, especially 10-year Treasury yields

- Federal Reserve monetary policies impacting bond purchases and mortgage funding

- Competition among lenders and loan types

These factors interact in ways that make pinpointing a single cause for rate changes challenging.

From 2021 through early 2022, Fed bond-buying programs helped keep rates low. However, tapering of these purchases began in November 2021, ending by March 2022. Subsequently, aggressive federal funds rate hikes through mid-2023—totaling 5.25 percentage points—indirectly pushed mortgage rates higher.

The Fed has held rates steady since July 2023 but anticipates cutting them three times in 2024, potentially easing mortgage rate pressures later in the year.

Upcoming Fed meetings, including the one concluding May 1, 2024, will provide further guidance on rate direction.

How ZAMONA Tracks Mortgage Rates

ZAMONA’s national mortgage rate averages are calculated from offers by over 200 top lenders, assuming 80% loan-to-value and credit scores between 700-760. This approach delivers a reliable snapshot of realistic rates borrowers can expect.

State-level rates reflect the lowest available offers under the same assumptions, providing valuable localized insights.

Discover the latest news and current events in Personal Finance News as of 05-04-2024. The article titled " 2025 30-Year Mortgage Rates Drop to 7.55% – Latest Trends and Insights " provides you with the most relevant and reliable information in the Personal Finance News field. Each news piece is thoroughly analyzed to deliver valuable insights to our readers.

The information in " 2025 30-Year Mortgage Rates Drop to 7.55% – Latest Trends and Insights " helps you make better-informed decisions within the Personal Finance News category. Our news articles are continuously updated and adhere to journalistic standards.