Why Investors Are Betting Against Starbucks Amid Howard Schultz’s Political Ambitions

Discover how Howard Schultz’s potential presidential bid has triggered a wave of investor skepticism and social backlash against Starbucks, affecting its stock dynamics and employee sentiment.

Short sellers are intensifying their bets against Starbucks Corporation (SBUX) as former CEO Howard Schultz considers a presidential run. Since Schultz’s announcement, the coffee giant has faced increased market pressure and public scrutiny.

On January 27, Schultz revealed his intent to explore a 2020 presidential campaign. This development prompted short sellers to borrow an additional 2.5 million shares of Starbucks stock, according to data from S3 Partners.

Ihor Dusaniwsky, managing director of predictive analytics at S3 Partners, noted that the recent 6.78% surge in shorted Starbucks shares accounts for nearly half of the total increase in short positions within the restaurant sector. Currently, 39.21 million shares are shorted, representing 3.26% of Starbucks’ freely traded shares.

Backlash From Customers and Employees

The spike in short interest aligns with growing public backlash following Schultz’s political announcement. Social media campaigns calling for Starbucks boycotts have gained momentum, particularly among Democratic voters who fear Schultz’s centrist independent candidacy could split the anti-Trump vote.

Moreover, Starbucks employees—many of whom once admired Schultz’s leadership—are reportedly disheartened by his political ambitions. Some staff members are even contemplating organizing walkouts, reflecting internal unrest within the company.

Dusaniwsky explained that these political tensions compound existing fundamental concerns about Starbucks’ growth prospects. The company faces challenges such as slowing same-store sales growth, market saturation, and the immense scale of its operations, all of which complicate efforts to surpass analyst expectations.

“While buybacks and dividend increases appeal to long-term investors, Starbucks must accelerate international expansion to justify its premium valuation compared to peers,” Dusaniwsky commented. “Otherwise, shareholders might feel they’re paying for more than they’re getting.”

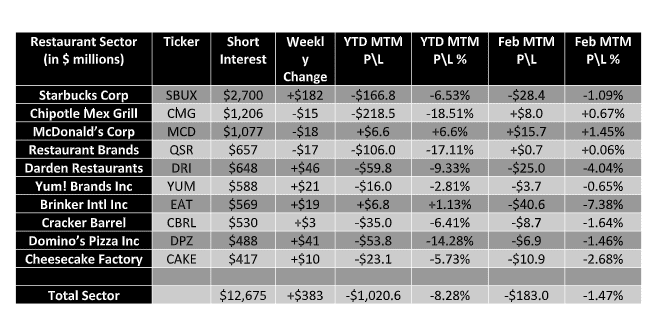

Despite the surge in short interest, betting against Starbucks and other restaurant stocks has proven costly in 2019. S3 Partners reports that the $12.7 billion short positions across the sector have collectively lost $1.02 billion, or 8.28%, year-to-date.

Within the restaurant industry, Starbucks holds the top spot for short interest, followed by Chipotle Mexican Grill, McDonald’s, Restaurant Brands International, and Darden Restaurants.

Explore useful articles in Company News as of 13-02-2019. The article titled " Why Investors Are Betting Against Starbucks Amid Howard Schultz’s Political Ambitions " offers in-depth analysis and practical advice in the Company News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Why Investors Are Betting Against Starbucks Amid Howard Schultz’s Political Ambitions " article expands your knowledge in Company News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.