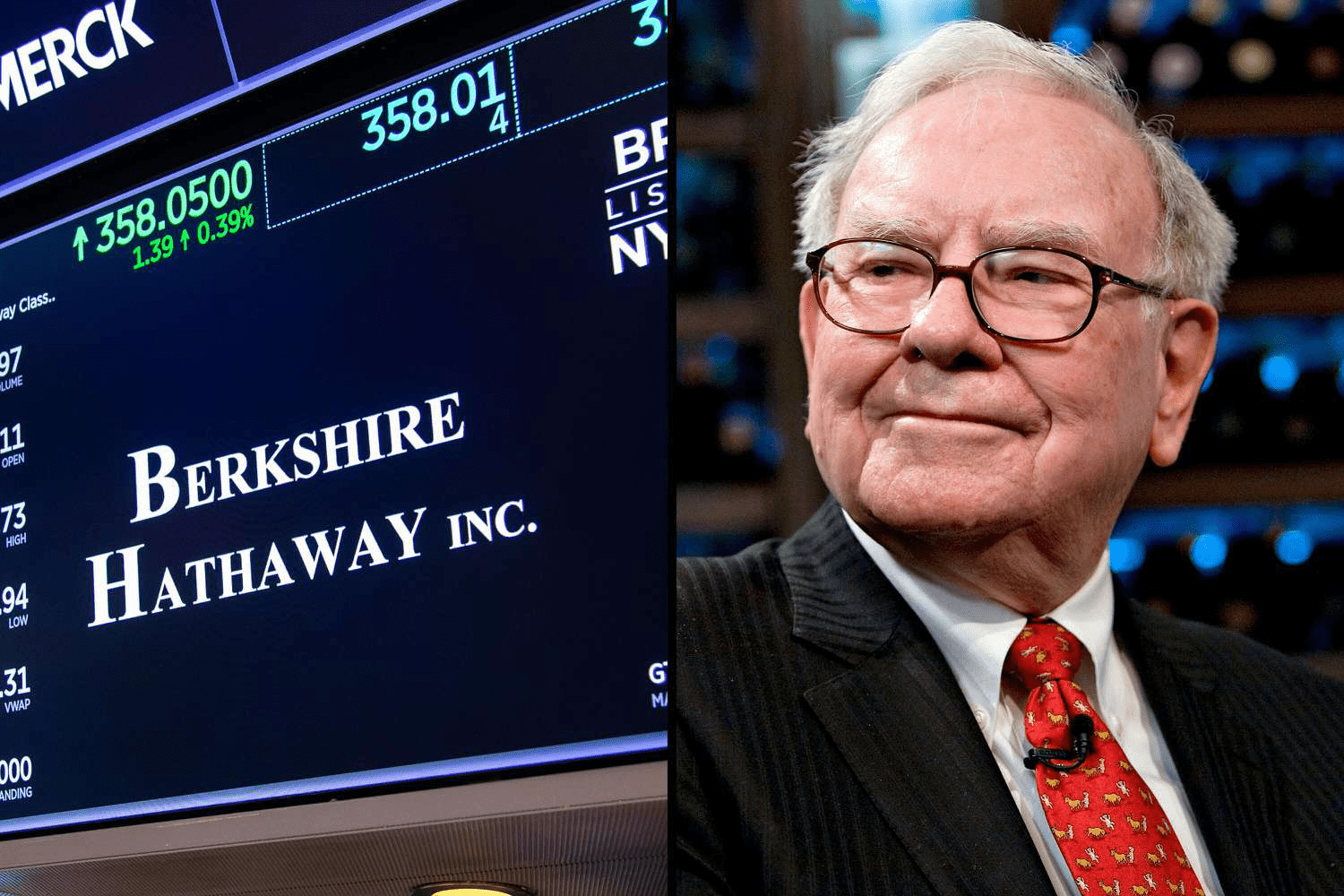

Warren Buffett’s Berkshire Hathaway Joins the $1 Trillion Market Cap Elite

Berkshire Hathaway’s shares surged, marking the conglomerate’s historic entry into the $1 trillion valuation club, becoming the eighth U.S. company to do so.

Colin, an Associate Editor specializing in technology and financial news, brings over three years of expertise in editing, fact-checking, and proofreading content related to current financial developments and political affairs. He holds an M.A. in journalism from The New School and a B.A. in history and political science from McGill University.

Key Highlights

- Warren Buffett’s Berkshire Hathaway stock climbed during Wednesday’s trading session, pushing the company’s market value past the $1 trillion milestone for the first time.

- Berkshire Hathaway is the eighth U.S. firm and the ninth worldwide to surpass this significant market capitalization threshold.

- Over six decades under Buffett’s leadership, the company has transformed into a financial and industrial powerhouse, with an equity portfolio nearing $300 billion.

On Wednesday, shares of Berkshire Hathaway (BRK.A; BRK.B) experienced gains during intraday trading, elevating the industrial conglomerate’s market capitalization beyond $1 trillion for the first time ever.

Legendary investor Warren Buffett’s holding company is now among an exclusive group of just eight U.S. companies and nine globally to reach this valuation. Notably, Berkshire is only the second company outside the technology or consumer discretionary sectors to join the $1 trillion club, following Saudi Aramco, the Saudi state-owned oil giant.

Berkshire Hathaway’s Steady Climb to $1 Trillion

Famed for a patient, methodical approach to business and investments, Berkshire Hathaway’s journey to joining the $1 trillion market cap club has been the longest among U.S. companies to achieve this feat.

The company’s origins trace back to the 19th-century textile industry, with the Berkshire Hathaway name emerging from the 1955 merger of Berkshire Fine Spinning Associates and Hathaway Manufacturing Company.

Warren Buffett, leading the investment firm Buffett Partnership Limited, began acquiring shares in the struggling textile company in 1962 and became its largest shareholder by 1965. That year, he took control and swiftly restructured the business.

In 1967, Buffett’s acquisition of Berkshire’s first insurance firm, National Indemnity Company, set the stage for the company’s evolution into a financial titan. Over subsequent decades, Berkshire diversified its holdings with acquisitions including BNSF Railway, Duracell batteries, and Dairy Queen ice cream.

Throughout, Buffett and his partner Charlie Munger expanded Berkshire’s equity portfolio by investing in undervalued companies. As of the end of Q2, Berkshire’s equity holdings were valued at approximately $284.9 billion, featuring $84 billion in Apple (AAPL) and $41 billion in Bank of America (BAC) stocks. Unrealized gains constitute nearly $200 billion of this portfolio.

Will Berkshire Hathaway Sustain Its $1 Trillion Market Cap?

Closing Tuesday, Berkshire’s market capitalization stood near $995 billion. To officially surpass $1 trillion, the stock needed a gain of roughly 0.5% on Wednesday.

However, Berkshire’s unique dual-class share structure complicates pinpointing the exact closing price required to secure its place in the $1 trillion club.

Typically, different classes of stock from the same company move in tandem due to shared business fundamentals, assuming similar liquidity. Yet, Berkshire’s Class B shares—over 1.3 billion outstanding—are far more liquid than the scarce Class A shares, which number just 553,234. The high price of Class A shares (around $694,000 as of Wednesday afternoon) means they trade infrequently, impacting price discovery and muting price fluctuations. For instance, at 1:45 p.m. ET Wednesday, Class A shares rose 0.33%, while Class B shares increased by 0.41%.

Have a news tip for Investopedia journalists? Reach out at tips@investopedia.com.

Explore useful articles in Markets News as of 02-09-2024. The article titled " Warren Buffett’s Berkshire Hathaway Joins the $1 Trillion Market Cap Elite " offers in-depth analysis and practical advice in the Markets News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Warren Buffett’s Berkshire Hathaway Joins the $1 Trillion Market Cap Elite " article expands your knowledge in Markets News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.