Understanding the Williams Alligator Indicator: A Modern Guide to Trading Strategies

Bill Williams' Alligator Indicator offers a powerful visual approach for identifying market trends and optimizing trade entry and exit points.

Gordon Scott brings over two decades of experience as an investor and Chartered Market Technician (CMT), offering deep insights into technical analysis.

Renowned trader Bill Williams, a trailblazer in market psychology, created the Alligator Indicator—a trend-following tool based on the insight that markets and individual assets trend only about 15% to 30% of the time, spending the majority of trading hours moving sideways. Williams emphasized that both individual traders and institutions accumulate most of their profits during these distinct trending phases.

Key Highlights

- The Williams Alligator Indicator is a technical analysis tool that incorporates smoothed moving averages for trend detection.

- It begins with a simple moving average (SMA) to calculate a smoothed average.

- Three moving averages with periods set at 5, 8, and 13 form the jaw, teeth, and lips of the alligator.

- The indicator leverages convergence and divergence among these averages to generate actionable trading signals, with the jaw moving slowest and the lips moving fastest.

How the Williams Alligator Indicator Functions

The Alligator Indicator utilizes three smoothed moving averages aligned with Fibonacci numbers—5, 8, and 13 periods—to capture market momentum. The initial smoothed average is derived from an SMA, which is then refined to reduce noise and delay in signal generation.

Calculation Methodology

Simple Moving Average (SMA) calculation steps:

- SUM1 = SUM (CLOSE, N)

- SMMA1 = SUM1 / N

- For subsequent values:

- PREVSUM = SMMA(i-1) × N

- SMMA(i) = (PREVSUM - SMMA(i-1) + CLOSE(i)) / N

Where:

- SUM1 is the sum of closing prices over N periods.

- PREVSUM represents the smoothed sum from the previous period.

- SMMA1 is the smoothed moving average for the first period.

- SMMA(i) is the smoothed moving average for the current period.

- CLOSE(i) is the current closing price.

- N is the smoothing period.

While understanding the calculation enhances comprehension, traders can easily apply the Alligator Indicator by selecting it from their charting platform’s indicator list without manual computation.

The three moving averages correspond to the alligator’s jaw, teeth, and lips, which open and close dynamically based on market trends and ranges:

- Jaw (blue line): Based on the 13-period SMMA, smoothed further over eight periods.

- Teeth (red line): Based on the 8-period SMMA, smoothed over five periods.

- Lips (green line): Based on the 5-period SMMA, smoothed over three periods.

Williams famously likened the indicator to a barnyard analogy: "Even a blind chicken finds its corn if fed consistently. Our indicator helps traders stay prepared during the blind chicken’s market."

Trading Strategies Using the Alligator Indicator

The Alligator Indicator signals trading opportunities through the interaction of its three lines. When the lips cross downward through the teeth and jaw, it signals a potential short-selling opportunity, while an upward cross indicates a buying chance. Williams referred to these phases as the alligator "sleeping" (lines intertwined) and "awakening" (lines diverging).

When the jaw, teeth, and lips spread apart and move in the same direction, it indicates a strong trending phase, described as the alligator "eating with its mouth wide open." Traders are encouraged to hold positions during these periods.

Conversely, when the lines converge and move horizontally, it signals the alligator is "sated," suggesting the trend is pausing or ending, prompting traders to consider taking profits or adjusting positions.

However, the indicator can produce false signals during choppy market conditions when the lines frequently cross, representing the alligator "sleeping." During these times, traders are advised to stay on the sidelines to avoid whipsaws.

Pros and Cons of the Williams Alligator Indicator

Like any analytical tool, the Alligator Indicator has strengths and limitations. Here’s a balanced overview:

Advantages:

- Trend Detection: Clearly identifies trending versus ranging markets by analyzing the alignment of its moving averages.

- Signal Simplicity: Offers straightforward signals that make it easier for traders to interpret and act confidently.

- Versatility: Applicable across various timeframes and asset classes, suitable for day trading, swing trading, and long-term investing.

- Complementary Use: Works well alongside other indicators like fractals or momentum oscillators to enhance signal reliability.

Disadvantages:

- Lagging Nature: As a trend-following indicator, it relies on past data and may delay entry or exit signals.

- False Signals: May generate misleading signals during sideways or volatile markets, leading to potential losses.

- Parameter Sensitivity: Effectiveness can vary with different smoothing periods, requiring traders to optimize settings based on market conditions.

Maximizing the indicator's effectiveness involves combining it with other tools and understanding its limitations to refine trading strategies continually.

Practical Examples of the Williams Alligator Indicator in Action

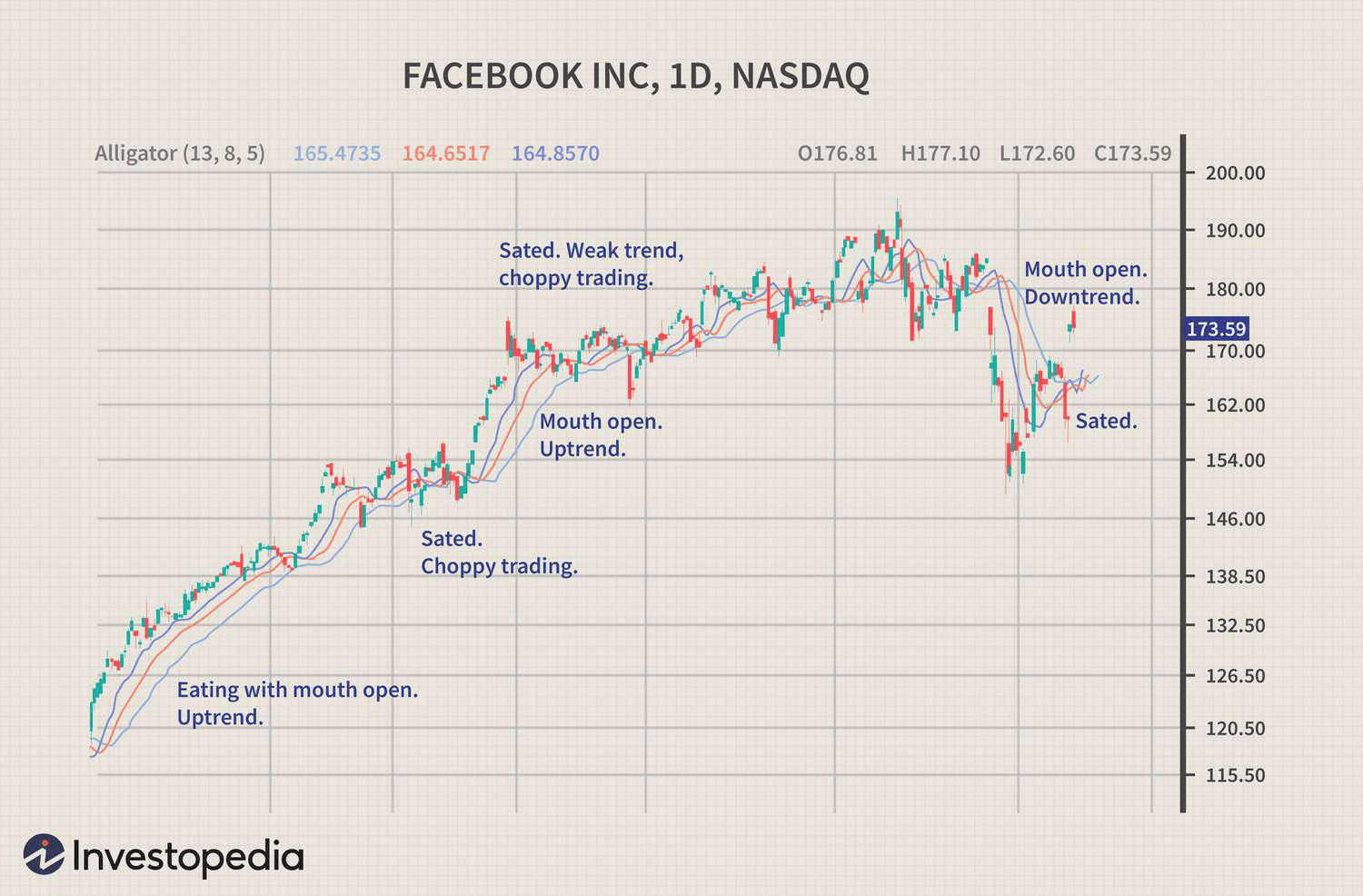

On the Meta Platforms (META) chart, the alligator "awakens" signaling a strong upward trend where the lines separate widely, indicating the alligator "eating." Price retraces to the jaw line but the indicator lines remain distinct, confirming the trend's strength. When the lips cross below the teeth, the alligator becomes "sated," and the price moves sideways with lines intertwining.

The alligator "sleeps" briefly before another awakening triggers a weaker uptrend, followed by a sell-off where the mouth opens downward signaling a downtrend. The lines crossing again indicate the alligator is "sated," suggesting traders wait for the next awakening.

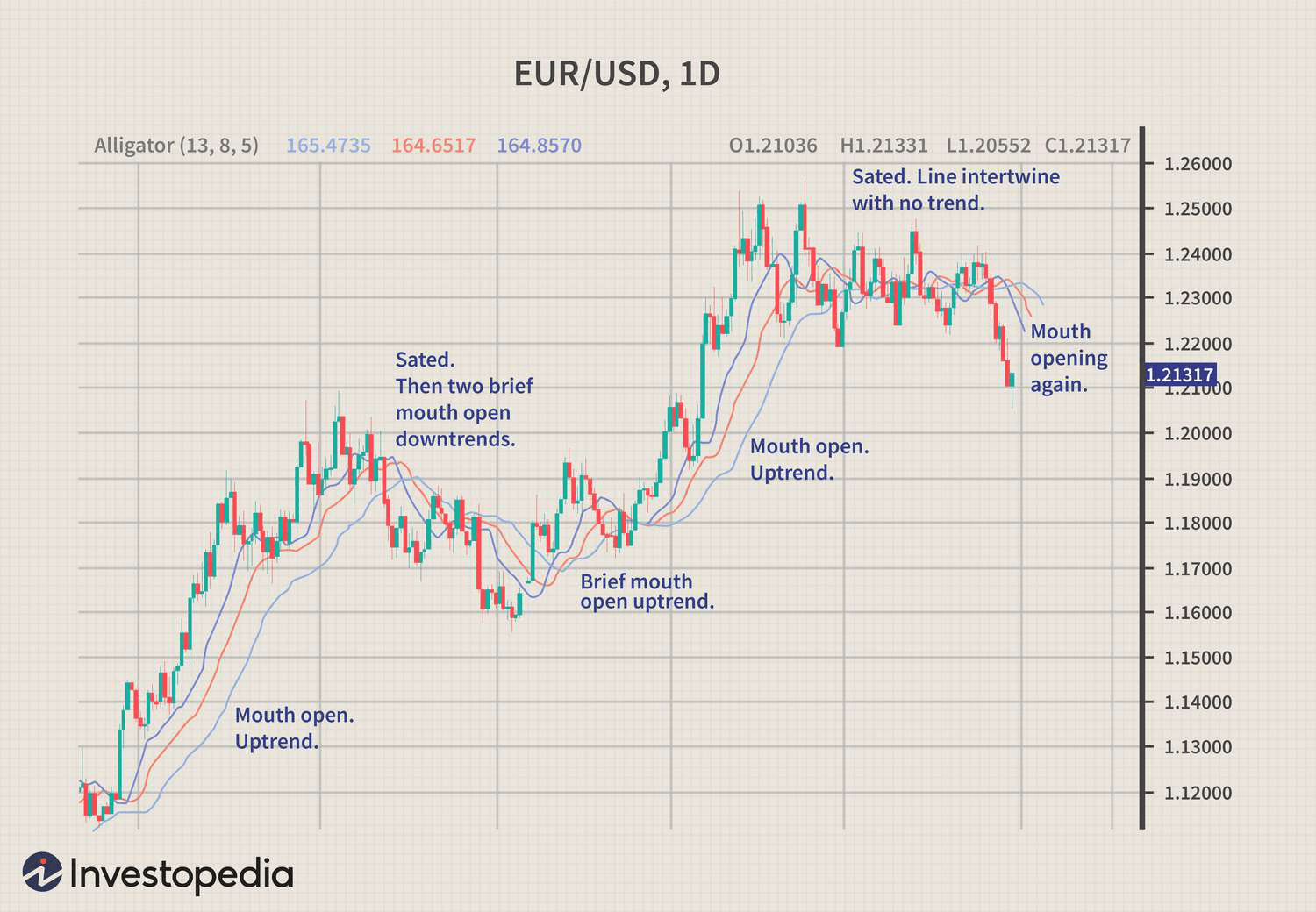

This indicator is adaptable to any market or timeframe. For instance, the EUR/USD currency pair demonstrates similar phases:

The alligator opens its mouth signaling an uptrend, followed by brief downtrends and sideways movements where lines cross frequently, indicating the alligator is "sleeping." Towards the chart's end, the mouth opens again, signaling a downtrend.

While the Alligator Indicator is a valuable visual tool for spotting trends and timing trades, it performs best when combined with other indicators like the Moving Average Convergence Divergence (MACD) to confirm signals and reduce false entries.

Complementary Indicators to Use with the Williams Alligator

Traders often pair the Williams Alligator with tools such as the Relative Strength Index (RSI), MACD, Average Directional Index (ADX), Stochastic Oscillator, and pivot points. Integrating these indicators enhances signal validation, reduces risk from false signals, and supports more effective trade management based on a holistic market view.

Optimal Timeframes for Using the Williams Alligator

The ideal timeframe depends on your trading style. Position traders may find weekly charts most effective, swing traders might prefer 30-minute to 4-hour charts, and day traders often use 1-minute to 15-minute charts to capitalize on short-term movements.

Common Mistakes to Avoid When Using the Alligator Indicator

Frequent pitfalls include overdependence on the indicator alone, misreading the phases, excessive adjustment of parameters causing inflexibility, and neglecting proper risk management. Success requires practice, ongoing strategy refinement, and combining the indicator with other analytical tools.

Conclusion

The Williams Alligator Indicator is a sophisticated technical analysis tool that employs three smoothed moving averages to help traders identify when markets are trending or ranging. By analyzing the convergence and divergence patterns of these averages, traders gain insights into market direction and momentum.

Patience is key when using this lagging indicator, and combining it with other confirmation tools can enhance trading accuracy and risk management, ultimately improving trading outcomes in today’s dynamic markets.

Explore useful articles in Technical Analysis as of 04-08-2024. The article titled " Understanding the Williams Alligator Indicator: A Modern Guide to Trading Strategies " offers in-depth analysis and practical advice in the Technical Analysis field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Understanding the Williams Alligator Indicator: A Modern Guide to Trading Strategies " article expands your knowledge in Technical Analysis, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.