Understanding Insiders: Should You Monitor Their Stock Trades?

Explore who insiders are, the legal boundaries of their trading activities, and whether following their stock transactions can benefit your investment strategy.

Insiders are individuals privy to confidential company information before it becomes public. However, laws strictly prohibit them from exploiting this knowledge for personal gain.

Who Are Insiders?

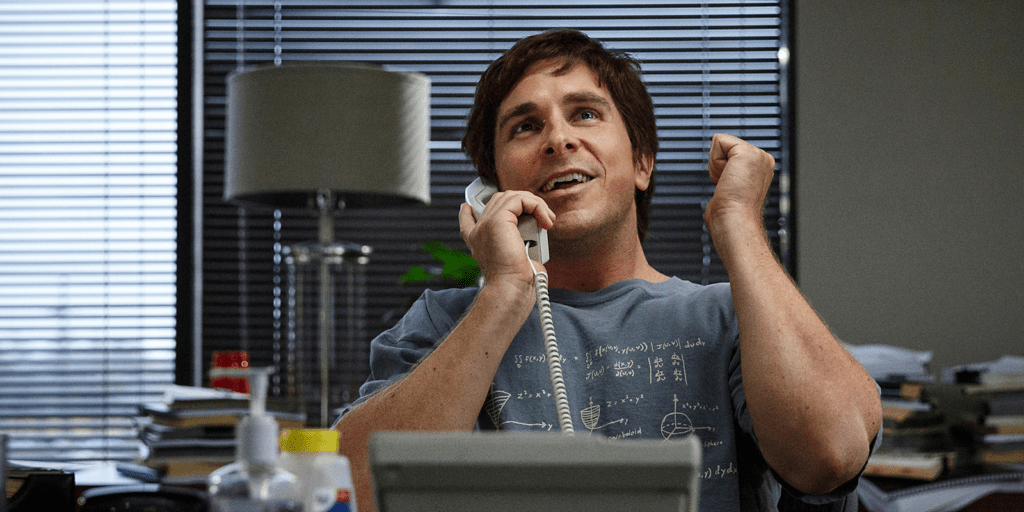

Imagine a rapidly growing startup whose stock price has surged tenfold over the past year. Suddenly, a financial report reveals the company is facing significant losses, causing the stock to plummet. It then emerges that the CFO sold their shares at the peak, profiting substantially. This isn’t mere luck — they had early access to the report and knew the company’s financial outlook ahead of everyone else, giving them an unfair advantage over other shareholders.

Insiders are individuals granted access to non-public, material information about securities and factors influencing their value. The comprehensive list of insiders is defined by law and includes:

- Company executives and employees;

- Board members;

- Professional traders and brokers;

- Government officials;

- Agencies responsible for publishing company reports.

The Central Bank's guidelines specify what constitutes insider information, such as details about company liquidation, restructuring, errors in financial statements, and significant contract developments.

Once such information is publicly disclosed, it no longer qualifies as insider information.

At that point, the key factor becomes who accesses and analyzes the data first. Predictions and commentary based on public information are not considered insider trading.

Can Insiders Trade Stocks?

Having early access to sensitive information offers a significant edge in the market, which can appear unfair. To maintain market integrity, using insider information for trading is prohibited in the U.S. and many other countries.

Insiders may not only trade themselves but can also unlawfully share information with relatives or clients who then trade on it. Such indirect use is equally forbidden.

That said, insiders are generally allowed to buy and sell shares of their companies, but only outside designated blackout periods during which trading is restricted.

For example, Rosneft maintains a calendar marking days when insiders cannot trade its shares. However, they remain free to trade securities of other companies where they hold no insider status.

Consequences of Insider Trading Violations

Insider trading violations carry serious penalties, including fines up to $13,000, forced labor, and imprisonment, particularly when the financial impact exceeds approximately $50,000. However, prosecutions are relatively rare.

The Central Bank monitors insider trading and reports violations publicly, forwarding cases to law enforcement when necessary. For instance, in 2019, authorities uncovered insider trading involving the sale of airline shares in 2016, where concealed transactions helped relatives avoid losses exceeding $3 million.

In contrast, the U.S. sees more frequent enforcement actions, with 33 insider trading cases in 2020 and 28 in 2021, reflecting a more mature investment culture.

Should You Track Insider Trades?

Assuming all investors comply with laws and avoid insider information use, monitoring insider trades can still provide valuable insights, as insiders are closely connected to company developments.

However, blindly mimicking insider trades is unwise. It’s impossible to know if their actions are based on confidential knowledge or other factors. Insiders may also strategically sell shares to influence market prices, encouraging others to buy at lower prices before they repurchase.

Therefore, tracking insider purchases is generally more informative than sales, as buying often signals confidence in future stock growth, while selling may have various explanations.

Fortunately, insiders are required to disclose their trades publicly. In the U.S., platforms like Finviz and GuruFocus aggregate this data. For companies in other countries, official disclosure servers, such as Interfax for Russian firms, provide access to insider transaction reports searchable by terms like "change in ownership stake."

Explore useful articles in Smart Money Tips as of 23-07-2022. The article titled " Understanding Insiders: Should You Monitor Their Stock Trades? " offers in-depth analysis and practical advice in the Smart Money Tips field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Understanding Insiders: Should You Monitor Their Stock Trades? " article expands your knowledge in Smart Money Tips, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.