Top Casino Stocks Surge in 2020 as Vegas Reopens – Prices & Outlook

Explore how leading casino stocks like MGM Resorts, Wynn Resorts, and Las Vegas Sands have rallied with the reopening of Las Vegas in 2020. Discover trading insights and market trends driving this surge.

Las Vegas flight searches soar over 100%, signaling a strong comeback for the entertainment capital.

After nearly three months of closure due to the COVID-19 pandemic, Las Vegas casinos reopened on June 4, 2020, implementing enhanced safety and social distancing measures. This reopening has sparked renewed investor optimism, driving significant rallies in major casino stocks.

Data from travel platform Kayak revealed a dramatic increase of more than 100% in flight searches to Las Vegas in late May, following Nevada’s announcement of casino reopenings. Meanwhile, Mississippi's Gaming Commission reported a 17% year-over-year revenue increase during Memorial Day weekend, reflecting early signs of recovery in the gaming sector.

Below is an in-depth analysis of three prominent casino stocks, along with technical insights for potential swing trading opportunities.

MGM Resorts International (MGM) – Market Cap $10.71B as of June 2020

MGM Resorts International, owner of iconic properties like MGM Grand and Mandalay Bay, derives approximately 50% of its revenue from Las Vegas. To preserve cash flow amid economic uncertainty, MGM reduced its dividend yield to 0.05% and cut non-essential expenses. Despite a 34.27% decline year-to-date, MGM shares surged nearly 50% in the past month.

Technically, MGM broke out of a pennant pattern with strong volume, indicating robust buying interest. Traders may consider targeting resistance near $34, while managing risk by placing stops below the pennant and adjusting stops above the 200-day moving average if the price sustains gains.

Wynn Resorts, Limited (WYNN) – Valued at $10.29B in 2020

Wynn Resorts operates luxury casino resorts in Las Vegas and Macau, including the Wynn and Encore brands. After a rebound in Macau gaming volumes during eased lockdowns, Wynn anticipates similar recovery in Vegas. The company paused dividends to maintain liquidity amid the pandemic. WYNN stock climbed 18.56% in the last month.

WYNN’s share price formed a broad ascending triangle, recently breaking above resistance on heavy volume. This breakout suggests potential for a rally toward $140, presenting an attractive risk/reward ratio of roughly 1:8, with stops placed just below the breakout point at $90.

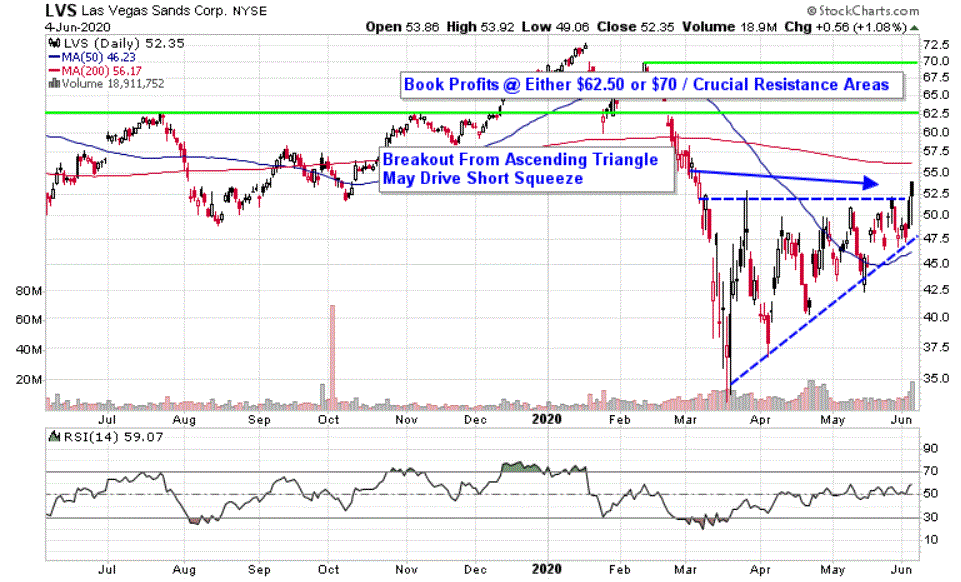

Las Vegas Sands Corp. (LVS) – Trading at $52.35 with Strong Momentum

Las Vegas Sands operates premier resorts such as Venetian Macau and Palazzo. Recently upgraded to “outperform” by Credit Suisse, LVS benefits from robust liquidity and ongoing capital investments, including new openings and renovations in Macau’s Cotai district. LVS shares rose 15% in the past month.

LVS has formed an ascending triangle pattern, with a recent breakout potentially triggering a short squeeze, as 55% of its float is shorted. Profit-taking targets are suggested at $62.50 and $70, key resistance levels to watch.

Explore useful articles in Markets News as of 10-06-2020. The article titled " Top Casino Stocks Surge in 2020 as Vegas Reopens – Prices & Outlook " offers in-depth analysis and practical advice in the Markets News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Top Casino Stocks Surge in 2020 as Vegas Reopens – Prices & Outlook " article expands your knowledge in Markets News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.