November 2023: Consumer Sentiment Drops to 60.4 Amid Rising Interest Rates and Inflation Fears

In November 2023, the Michigan Consumer Sentiment Index fell sharply to 60.4, signaling growing consumer concerns fueled by high inflation and rising interest rates, falling short of economists' forecasts.

The Michigan Consumer Sentiment Index plunged to 60.4 in November 2023, significantly missing economists’ expectations.

Highlights

- The preliminary November reading of the Michigan Consumer Sentiment Index decreased to 60.4, down from October’s 63.8 and below the anticipated 63.7.

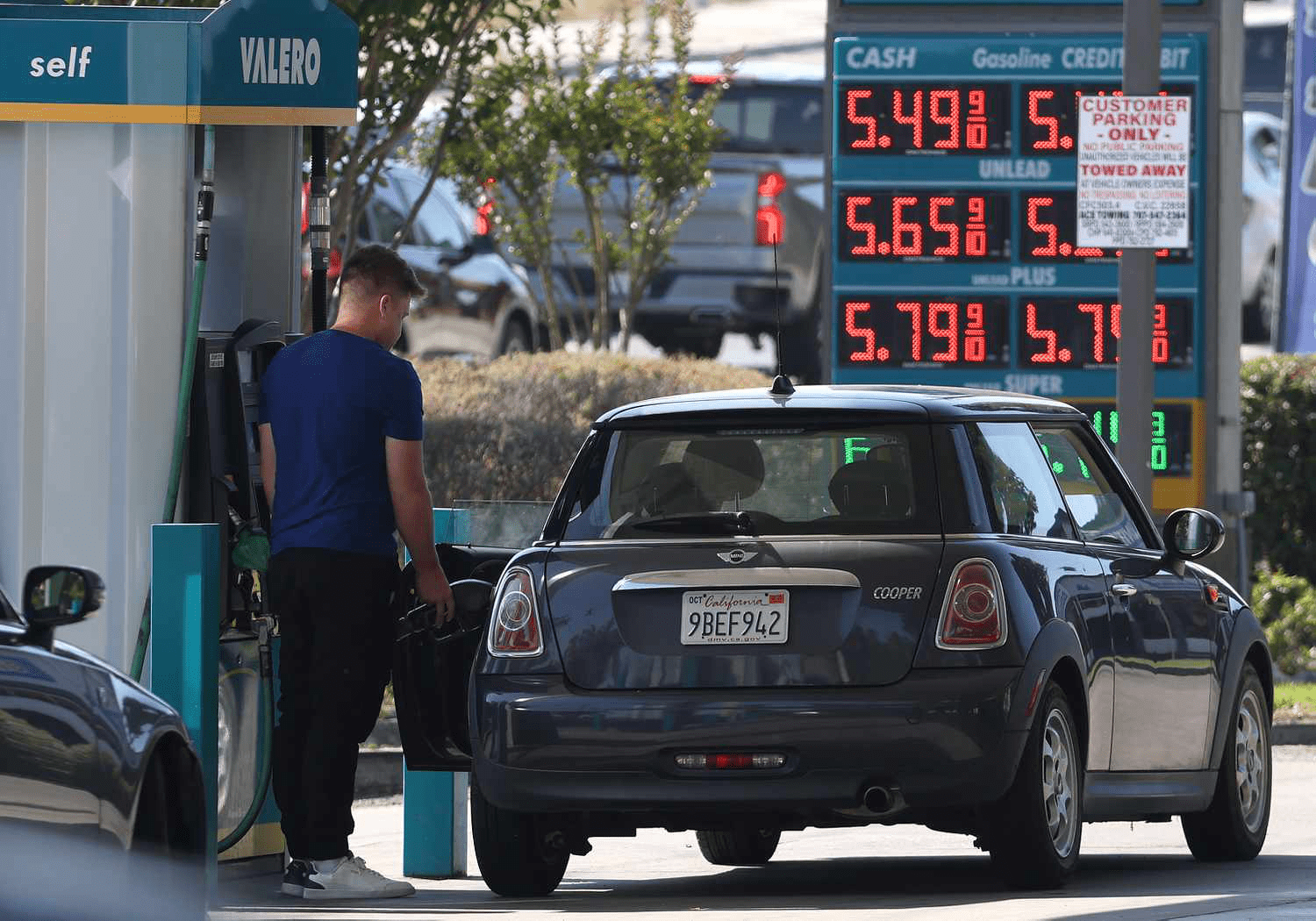

- Inflation expectations for the next year rose to 4.4%, driven by persistently high gasoline prices that continue to dampen consumer mood.

- Consumers reported declines in both their current economic assessments and future economic outlooks.

Elevated borrowing costs combined with ongoing inflation anxieties are increasingly undermining consumer confidence, marking the fourth consecutive month of declining sentiment.

The November preliminary figure of 60.4 for the Michigan Consumer Sentiment Index fell short of the 63.7 forecast and showed a steep drop from October's 63.8.

This downturn is largely attributed to heightened concerns over the impact of rising interest rates, with consumers’ long-term economic outlook shrinking by 12%, despite some improvements in their current and expected financial situations.

"The most significant declines in sentiment were observed among lower-income and younger consumers," noted Joanne Hsu, director of the University of Michigan’s Consumer Survey.

This survey comes amid Federal Reserve Chair Jerome Powell’s indication that interest rates may need further increases to combat inflation. The federal funds rate currently stands at a 22-year peak between 5.25% and 5.5%, pushing mortgage rates near 7.9%, just shy of their October 30-year highs.

November’s survey also revealed that consumer perceptions of current economic conditions dropped nearly 7% to 65.7 from October’s 70.6, while expectations for the future declined 4% to 56.9 from 59.3.

Growing Inflation Concerns Among Consumers

Inflation fears intensified as year-ahead inflation expectations rose to 4.4% in November, up from 4.2% in October. This marks the highest level since November 2022 and confirms the upward trend that began in September when expectations were at 3.2%. Prior to the pandemic, these expectations typically ranged between 2.3% and 3.0%.

Long-term inflation expectations also climbed, reaching 3.2% for the next five years—up from 3.0% in October—the highest since 2011. Gasoline price concerns remain a primary driver of these inflation worries, according to Hsu.

For news tips or insights, please contact Investopedia at tips@investopedia.com.

Explore useful articles in Economic News as of 15-11-2023. The article titled " November 2023: Consumer Sentiment Drops to 60.4 Amid Rising Interest Rates and Inflation Fears " offers in-depth analysis and practical advice in the Economic News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " November 2023: Consumer Sentiment Drops to 60.4 Amid Rising Interest Rates and Inflation Fears " article expands your knowledge in Economic News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.