Mortgage Rates Drop to 6.81% in 2025 Following Positive Inflation Report

Discover how the latest inflation data has driven 30-year mortgage rates down to a two-month low of 6.81% in 2025, with significant declines across various loan types. Explore state-by-state mortgage rate trends and expert insights on factors influencing rate fluctuations.

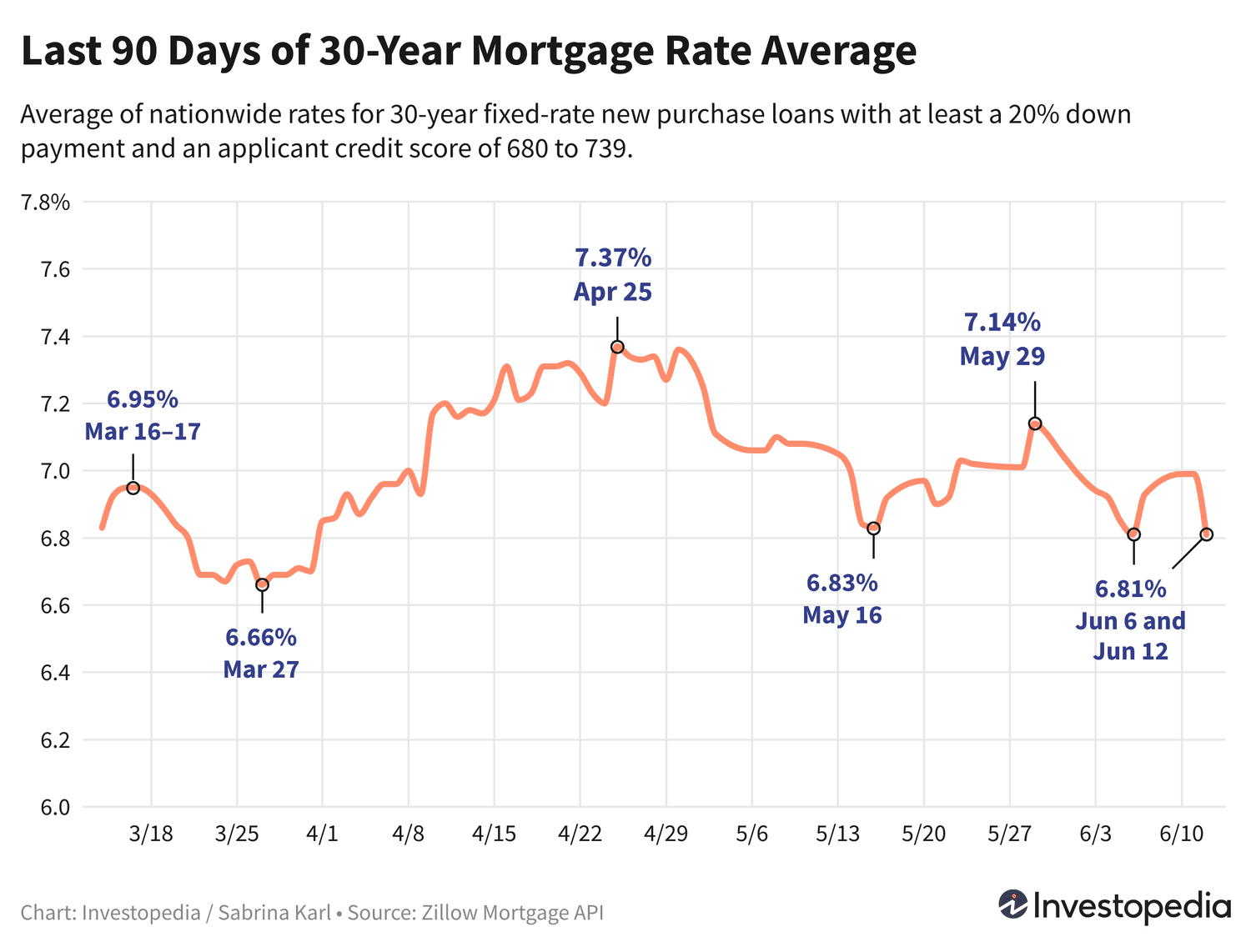

Mortgage rates for 30-year fixed loans have fallen to a fresh two-month low, reaching 6.81%, fueled by encouraging inflation figures released recently.

On Wednesday, prompted by favorable inflation news, the average 30-year mortgage rate declined nearly 0.20 percentage points. This downward movement wasn't isolated; multiple mortgage categories saw double-digit basis point drops.

Because mortgage rates can vary significantly among lenders, it’s crucial to shop around and compare offers regularly, regardless of the home loan type you are considering.

Current Mortgage Rate Averages for New Home Purchases - May 9, 2025

Following the latest Consumer Price Index update, 30-year mortgage rates dropped by 18 basis points, settling at 6.81%. This marks a return to the two-month low seen approximately a week prior, after a brief rise to 6.99% last week.

Although still elevated compared to early February’s 6.36% low, today’s rates remain well below the historic 23-year peak of 8.01% recorded in October last year.

The 15-year fixed mortgage rates for new purchases also experienced a notable decline, dropping nearly 0.25 percentage points to fall below 6%—now averaging 5.96%. This is significantly lower than last fall’s peak of 7.08%, the highest since 2000.

Meanwhile, jumbo 30-year mortgage rates saw a slight 5 basis point decrease, dipping under 7% and comfortably below the May high of 7.30%. Last fall’s estimated peak of 8.14% remains the highest jumbo rate observed in over two decades.

Weekly Freddie Mac Mortgage Rate Averages

Freddie Mac’s weekly report, published every Thursday, shows the 30-year mortgage average rate dropped by 4 basis points this week to 6.95%, after hovering above 7% for much of the past two months. Their October 2024 average reached a historic high of 7.79%, followed by a mid-January low of 6.60%.

Freddie Mac’s weekly average differs from ZAMONA’s daily average due to methodology: while Freddie Mac blends five days of data, ZAMONA provides a daily figure, delivering a more immediate rate snapshot. Differences also stem from varied loan inclusion criteria such as down payment size and credit score requirements.

Refinancing Mortgage Rates Today

Refinancing rates mirrored the declines seen in purchase loans, with 30-year and 15-year refi averages each falling 22 basis points, and jumbo 30-year refis decreasing by 23 basis points.

Use our Mortgage Calculator to estimate monthly payments tailored to different loan scenarios.

Important Note

Displayed rates represent averages and may differ from advertised teaser rates, which often feature attractive upfront terms or ideal borrower profiles. Your actual mortgage rate depends on credit score, income, loan size, and other personal factors.

Mortgage Rates by State

Mortgage rates vary across states due to differences in borrower credit profiles, loan types, and lender risk approaches. The lowest 30-year new purchase rates on Wednesday were found in New York, Utah, Washington, Colorado, Georgia, and North Carolina. Conversely, the highest averages appeared in West Virginia, Alaska, North Dakota, Washington D.C., Iowa, Mississippi, Montana, and Nebraska.

Factors Influencing Mortgage Rate Changes

Mortgage rates fluctuate due to a complex interplay of factors, including:

- Movements in the bond market, particularly 10-year Treasury yields

- The Federal Reserve’s monetary policy, including bond purchases and interest rate decisions

- Competition among lenders and variations in loan products

Because multiple variables impact rates simultaneously, pinpointing a singular cause for each movement is challenging.

In 2021, the Federal Reserve’s bond-buying program helped keep rates relatively low amid pandemic-related economic challenges. Starting November 2021, tapering of bond purchases began, concluding in March 2022, followed by multiple federal funds rate hikes throughout 2022 and 2023 to combat inflation.

Though the federal funds rate influences mortgage rates indirectly and can move independently, the substantial rate increases—totaling 5.25 percentage points over 16 months—have driven mortgage rates significantly higher.

Since July 2023, the Fed has paused rate hikes, maintaining the benchmark rate amid inflation that remains above the 2% target. The central bank plans four more meetings this year, with the next concluding on July 31.

How ZAMONA Tracks Mortgage Rates

Our national and state mortgage rate averages are sourced from the Zillow Mortgage API and reflect loan-to-value ratios of 80% (20% down payment) with applicant credit scores between 680 and 739. These figures offer realistic expectations rather than promotional teaser rates. © Zillow, Inc., 2024. Use subject to Zillow Terms of Use.

Explore useful articles in Personal Finance News as of 02-04-2024. The article titled " Mortgage Rates Drop to 6.81% in 2025 Following Positive Inflation Report " offers in-depth analysis and practical advice in the Personal Finance News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Mortgage Rates Drop to 6.81% in 2025 Following Positive Inflation Report " article expands your knowledge in Personal Finance News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.