Mathematical Economics: Comprehensive Overview, Applications, and Critiques

Explore the dynamic field of mathematical economics, where quantitative methods transform economic theories into precise, testable models, shaping modern policy and research.

What Is Mathematical Economics?

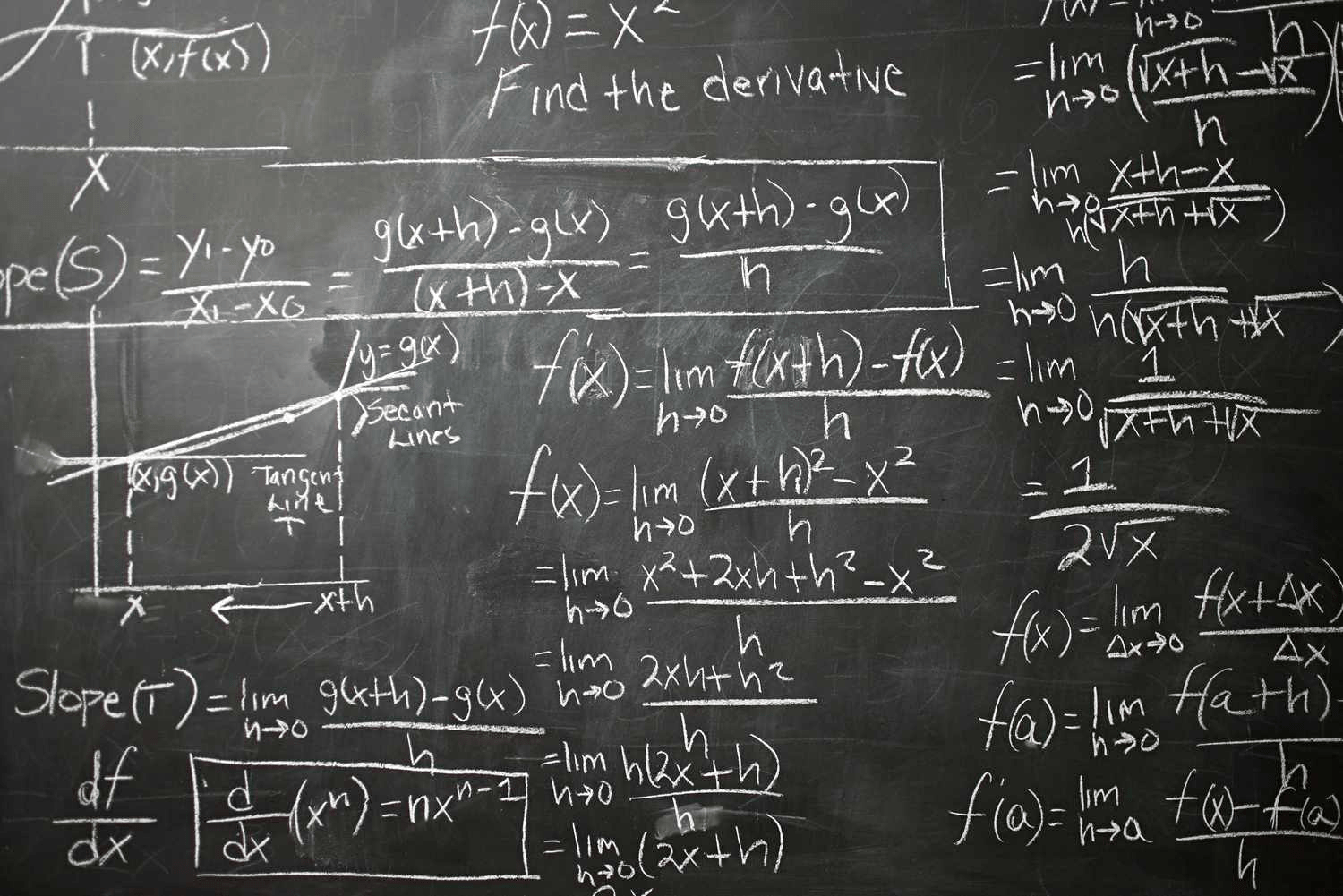

Mathematical economics represents a specialized branch of economics that incorporates mathematical techniques to formulate and analyze economic theories. By utilizing tools such as algebra and calculus, economists can build rigorously defined models that produce clear, logical conclusions. These models are then validated with statistical data, enabling accurate predictions of economic trends and behaviors.

The integration of mathematics, statistics, and economic theory has given rise to econometrics, a vital discipline that enhances empirical analysis. Advances in computing power and big data analytics have further entrenched quantitative methods as fundamental to contemporary economic research and policy formulation.

Key Insights

- Mathematical economics employs quantitative frameworks to explain and predict economic phenomena.

- While economics is influenced by researcher perspectives, mathematics provides a neutral foundation to rigorously define and empirically test theories.

- Policy decisions and academic research increasingly depend on mathematical modeling to evaluate impacts and substantiate findings.

Foundations of Mathematical Economics

This field hinges on translating economic assumptions, relationships, and causal mechanisms into precise mathematical expressions. This approach offers two primary advantages:

- It equips theorists with mathematical tools to describe economic dynamics and derive exact implications from foundational premises.

- It enables empirical testing of theories through quantitative data, facilitating validated predictions beneficial for businesses, investors, and policymakers.

Historical Development

Prior to the late 1800s, economic analysis was largely qualitative, relying on logical reasoning and anecdotal evidence. Economists struggled to quantify relationships between key variables, often resulting in competing explanations without definitive measurement.

The introduction of mathematical formulations revolutionized economics by providing a means to quantify economic changes. This shift influenced the discipline broadly, embedding mathematical proofs into most modern economic theories.

From local markets to global financial centers and governmental institutions, decision-makers now expect robust, quantitative forecasts. Central banks, for instance, depend on mathematical models to anticipate the effects of interest rate adjustments on inflation and economic growth.

Role of Econometrics

Econometrics merges mathematical economics with statistical analysis to convert abstract theories into practical tools for policymaking. Its goal is to transform qualitative assertions—like the positive correlation between variables—into precise numerical estimates, such as quantifying the increase in consumption per additional dollar of disposable income.

Econometrics excels in optimization challenges, helping policymakers identify the most effective interventions among various options. As data availability expands, econometric methods have become integral across economics subfields including finance, labor economics, macroeconomics, microeconomics, and policy design.

Critiques of Mathematical Economics

Despite its strengths, mathematical economics faces criticism for potentially obscuring the complexity of economic realities. Critics argue that the precision of mathematical models can create an illusion of certainty, which may not fully capture subjective and unobservable human behaviors influencing economic outcomes.

Precise mathematical modeling demands clear definitions of variables, but economic phenomena often involve intangible factors that resist quantification. This limitation can lead to ambiguous interpretations and the exclusion of important qualitative aspects.

Consequently, mathematical economics may sometimes oversimplify or mask uncertainties inherent in economic analysis. There is a risk that sophisticated mathematics could be used to justify misleading conclusions, with economists and policymakers occasionally overlooking these issues to promote confidence in their recommendations.

Mathematical Tools in Economics

Economics extensively employs various mathematical disciplines including algebra, calculus, statistics, differential equations, and geometry to test theories, conduct research, and analyze economic patterns.

Notable Figure: Father of Mathematical Economics

Paul Samuelson is widely regarded as the pioneer of mathematical economics. The Nobel Foundation credits him for formalizing economic research through mathematics, profoundly influencing nearly all branches of modern economics.

Career and Earnings in Mathematical Economics

As of June 2024, the average annual salary for a mathematical economist is approximately $82,064, with ranges spanning from $46,000 to $122,500 depending on role, location, and employer.

Conclusion

Mathematical economics transforms economic inquiry by applying mathematical rigor to theory development and empirical testing. While it plays a crucial role in research, policy, and forecasting, it must be applied thoughtfully to account for the nuanced and subjective nature of human economic behavior, ensuring balanced and insightful economic analysis.

Explore useful articles in Economics as of 03-06-2024. The article titled " Mathematical Economics: Comprehensive Overview, Applications, and Critiques " offers in-depth analysis and practical advice in the Economics field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Mathematical Economics: Comprehensive Overview, Applications, and Critiques " article expands your knowledge in Economics, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.