Laffer Curve Explained (2025): Tax Rate Insights & Historical Impact

Explore the Laffer Curve's history, its role in shaping tax policies, and the ongoing debate about tax rates and government revenue in 2025.

Adam Hayes, Ph.D., CFA, is a seasoned financial writer with over 15 years on Wall Street as a derivatives trader. With a strong background in economics and behavioral finance, Adam holds a master’s degree in economics from The New School for Social Research and a Ph.D. in sociology from the University of Wisconsin-Madison. He is a CFA charterholder and holds FINRA Series 7, 55 & 63 licenses. Currently, he researches and teaches economic sociology and finance at Hebrew University in Jerusalem.

What Is the Laffer Curve?

The Laffer Curve, developed by economist Arthur Laffer in 1974, illustrates the relationship between tax rates and the total tax revenue governments collect. This curve suggests that there is an optimal tax rate that maximizes revenue, highlighting that both extremely low and extremely high tax rates can lead to decreased government income.

Key Highlights

- Arthur Laffer introduced the concept of the Laffer Curve in 1974 as a bell-shaped curve analysis.

- It demonstrates how tax revenue changes in response to varying tax rates.

- The curve argues that a 100% tax rate would yield no revenue because it eliminates incentives to work.

- It influenced major tax reforms during the Reagan Administration in the 1980s.

- Critics point out that the model oversimplifies tax systems by focusing on a single tax rate.

Understanding the Laffer Curve

Arthur Laffer’s theory plots tax rates against tax revenue, showing that revenue is zero at both 0% and 100% tax rates. He distinguished between two effects of tax cuts on the federal budget:

Arithmetic Effect

This immediate effect means that every dollar cut in taxes reduces government revenue by one dollar, along with a corresponding decrease in government spending power.

Economic Effect

Over time, tax cuts increase taxpayers’ disposable income, boosting spending, stimulating business activity, and encouraging job growth.

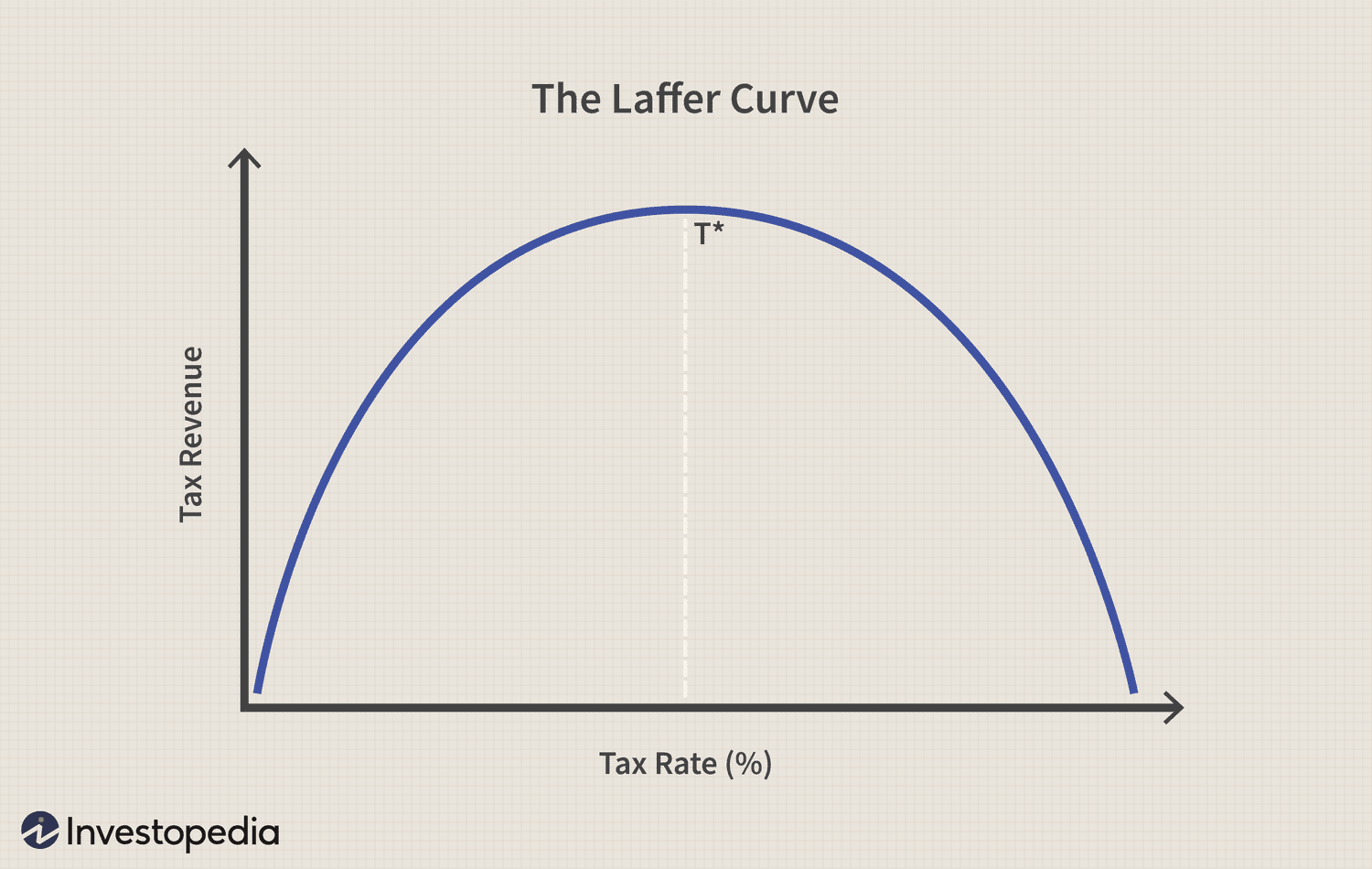

Visualizing the Curve

The curve identifies an optimal tax rate (T*) where tax revenue peaks. Moving tax rates either below or above this point results in lower overall tax revenue.

Laffer Curve’s Logic on Tax Rates

The curve challenges the assumption that higher tax rates always generate more revenue. At a 100% tax rate, workers lose motivation to earn income, leading to zero revenue. Thus, the ideal tax rate lies somewhere between 0% and 100%, though pinpointing this rate is complex and politically debated.

Historical Background of the Laffer Curve

In 1974, Arthur Laffer presented his curve to President Gerald Ford’s staff, countering the prevailing belief that raising tax rates boosts revenue. He argued that higher taxes discourage investment and work effort, potentially reducing total revenue.

The curve significantly influenced President Ronald Reagan’s economic policies, known as Reaganomics, which featured substantial tax cuts. Despite lower rates, federal tax revenue increased from $517 billion in 1980 to $909 billion in 1988.

Reaganomics Impact

Reagan’s policy lowered marginal tax rates, which correlated with increased tax revenues, reduced inflation, and decreased unemployment.

The Laffer Curve in U.S. Politics and Economics

Political views on tax rates vary: Republicans often advocate for lower taxes on corporations and high earners, believing it spurs job creation, while Democrats typically support higher taxes on wealthy individuals to fund programs benefiting low-income groups.

Each party aims to optimize tax efficiency but differs on the ideal peak of the Laffer Curve, reflecting their contrasting economic philosophies.

Political Perspectives

Republicans favor minimal government intervention, leading to a lower optimal tax rate, whereas Democrats support a higher rate to fund social programs.

Critiques of the Laffer Curve

Several criticisms challenge the curve’s simplicity:

Single Tax Rate Oversimplification

The tax system’s complexity means multiple taxes interact, making the single-rate assumption unrealistic.

Variable Ideal Tax Rate (T*)

The optimal tax rate fluctuates based on economic conditions, complicating its precise determination.

Behavioral Assumptions

The curve assumes higher taxes reduce work effort, but individuals and businesses may respond differently, factoring in career goals and infrastructure quality.

Factors Limiting Tax Cuts' Economic Impact

The effectiveness of tax cuts depends on timing, underground economies, tax loopholes, and overall productivity.

Understanding Trickle-Down Economics

Laffer’s idea that tax cuts stimulate growth and revenue became known as “trickle-down economics,” associated with policies from Presidents Hoover and Reagan. The concept suggests that benefits to corporations and wealthy individuals eventually benefit the broader economy.

Limitations of the Laffer Curve

The curve lacks specific numerical data, leaving policymakers to estimate the optimal tax rates and expected revenue changes.

Conclusion

The Laffer Curve remains a foundational model illustrating the complex relationship between tax rates and government revenue. While it supports the argument that lowering tax rates can sometimes increase revenue, its assumptions and simplifications invite ongoing debate among economists and policymakers.

Explore useful articles in Economics as of 22-02-2023. The article titled " Laffer Curve Explained (2025): Tax Rate Insights & Historical Impact " offers in-depth analysis and practical advice in the Economics field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Laffer Curve Explained (2025): Tax Rate Insights & Historical Impact " article expands your knowledge in Economics, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.