Is Credit Karma Truly Reliable for Your Credit Score in 2025?

Discover how accurate Credit Karma’s free credit scores are and whether this popular platform provides trustworthy insights into your credit health. Learn how Credit Karma compares to traditional credit scoring models and what you should know before relying on it.

Suzanne is a seasoned content marketer and fact-checker with a Bachelor of Science in Finance from Bridgewater State University, specializing in crafting effective financial content strategies.

Credit Karma offers free access to your credit score and report, but does it reflect the same data lenders see when you apply for a mortgage or auto loan? More importantly, does it provide unique value compared to other sources?

To understand this, it's essential to explore what Credit Karma is, how it operates, and how its VantageScore differs from the widely recognized FICO score.

Key Insights

- Credit Karma provides free credit scores and reports by collecting your personal data and monetizes through targeted advertising.

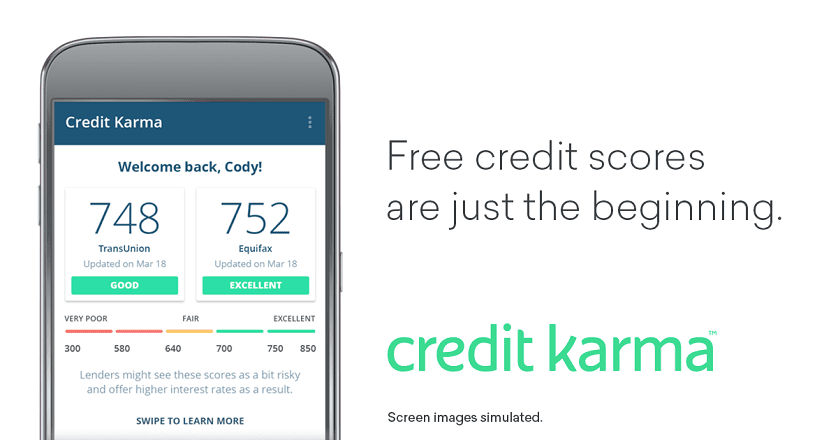

- It uses VantageScore models based on credit data from Equifax and TransUnion, two major credit bureaus.

- Your Credit Karma score generally aligns closely with your FICO score, though exact numbers may vary.

- Credit score categories (e.g., "good," "very good") offer more actionable insight than the precise score number.

What is Credit Karma?

Credit Karma is primarily known for delivering free credit scores and reports, but it envisions simplifying financial management so consumers can focus on living their best lives.

To access Credit Karma, users provide basic personal details, such as their name and the last four digits of their Social Security number. With consent, Credit Karma retrieves credit reports, calculates a VantageScore, and displays it to the user.

Quick Overview

Credit Karma’s scores range from 300 to 850, categorized as:

- Poor: 300 to low 600s

- Fair to Good: Low 600s to mid-700s

- Very Good to Exceptional: Above mid-700s

How Accurate is Credit Karma?

Credit Karma relies on the VantageScore model, developed collaboratively by Equifax, Experian, and TransUnion as an alternative to FICO. VantageScore can evaluate more consumers, including those with limited credit history, making it particularly useful for young adults or recent U.S. residents.

The platform does not collect data directly from creditors but uses information from credit bureaus, ensuring its scores are as accurate as any based on the same data.

According to Bethy Hardeman, former chief consumer advocate at Credit Karma, the service provides VantageScores independently from TransUnion and Equifax, choosing this transparent model to help consumers better understand their credit changes.

VantageScore vs. FICO: What’s the Difference?

Both are credit scoring models that analyze your credit behavior mathematically. FICO, established in 1989, remains the most recognized, while VantageScore launched in 2006 to expand scoring capabilities.

Each offers various models tailored to specific lending sectors like mortgages or auto loans, so your scores may differ slightly depending on the model used.

However, scores from both models should fall within similar ranges. For instance, a "very good" VantageScore should correspond roughly to a similar FICO rating.

Key Differences

- FICO is more widely used by lenders, making it the standard for many credit decisions.

- VantageScore better accommodates consumers with limited credit history, benefiting new credit users.

Shared Features

- Both use data from major credit bureaus (FICO includes Experian; VantageScore uses Equifax and TransUnion).

- They assess similar factors, prioritizing payment history as the most significant component.

Thus, your credit scores from either model should be consistent in reflecting your creditworthiness.

Important Reminder

Your credit score’s accuracy depends on the correctness of your credit report data. Regularly review your credit reports for errors at AnnualCreditReport.com to ensure your score reflects your true credit status.

Additional Features from Credit Karma

Beyond credit scores, Credit Karma offers credit monitoring, security alerts, and personalized financial recommendations, such as identifying potentially high-interest loans.

Users can also explore tailored credit card, car loan, and mortgage offers without impacting their credit report, as Credit Karma uses "soft" inquiries that don't reduce your score.

Impressive Reach

Credit Karma serves nearly 130 million users across the U.S., U.K., and Canada.

How Does Credit Karma Generate Revenue?

Though free to users, Credit Karma earns money by displaying targeted ads based on users’ financial profiles and receives fees when users apply for loans through its platform.

Did You Know?

Checking your credit score on Credit Karma involves a "soft" inquiry that does not affect your credit rating.

Limitations to Consider

While Credit Karma is convenient, similar credit information is accessible for free directly from credit bureaus and some financial institutions without advertising exposure.

- You have the right to one free credit report annually from each major bureau.

- Many banks and credit card issuers provide free credit scores, often VantageScores.

Additionally, Credit Karma’s incentives to promote loans may encourage unnecessary borrowing. Use the platform primarily for monitoring, not as a decision-making tool for new debt.

Is Credit Karma Really Free?

Yes, Credit Karma does not charge users. Revenue comes from partners when users apply for financial products.

Does Credit Karma Use FICO Scores?

No, Credit Karma provides VantageScores sourced from TransUnion and Equifax, updated frequently to keep you informed.

Is Credit Karma Safe?

Credit Karma employs robust 128-bit encryption to secure data transmissions and commits not to sell personal information to third parties.

Why Do Credit Karma and FICO Scores Differ?

Differences arise because Credit Karma uses VantageScore, which weights credit factors differently than FICO, though both yield comparable results.

Who Owns Credit Karma?

Intuit, the company behind TurboTax and QuickBooks, acquired Credit Karma in 2020.

Final Thoughts

Millions trust Credit Karma for credit monitoring, but it’s wise to also explore other free credit score sources. Credit Karma’s convenience and personalized offers make it a valuable tool, especially if you’re exploring loan options, but always complement it with direct credit bureau checks for the most comprehensive view.

Explore useful articles in Company Profiles as of 28-09-2024. The article titled " Is Credit Karma Truly Reliable for Your Credit Score in 2025? " offers in-depth analysis and practical advice in the Company Profiles field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Is Credit Karma Truly Reliable for Your Credit Score in 2025? " article expands your knowledge in Company Profiles, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.