Intel Q2 2023 Profit Surges Amid Cost-Cutting: Shares Rise Despite Revenue Dip

Intel defies expectations with a return to profitability in Q2 2023, driven by aggressive cost-saving strategies despite a decline in overall revenue.

Intel Corporation (INTC) stunned investors by posting a profitable second quarter in 2023, reversing two consecutive quarters of losses thanks to effective cost reduction initiatives. Following this announcement, Intel's shares soared approximately 8% in after-hours trading and continued to climb 6.7% in pre-market sessions on Friday.

Highlights:

- Intel's stock surged 8% after reporting better-than-expected Q2 earnings.

- Achieved earnings per share (EPS) of $0.13, marking the first profit in three quarters.

- Implementation of a $3 billion cost-saving plan played a pivotal role in returning to profitability.

Strategic Cost Management Drives Profitability

According to CFO David Zinsner, progress toward the company’s ambitious $3 billion cost reduction target in 2023 significantly contributed to the quarter’s positive results. Earlier this year, Intel announced measures including dividend reductions, workforce cuts, and operational expense trimming to enhance financial health.

In Q2, Intel reported a net income of approximately $1.5 billion, equivalent to around 35 cents per share. The EPS of 13 cents surpassed analyst expectations, which had predicted a 3-cent loss per share, based on YCharts data.

Revenue Challenges Across Most Segments

Despite surpassing expectations with $12.9 billion in revenue, Intel experienced a 15% year-over-year decline. Gross and operating margins also contracted by 5% and 5.8%, respectively.

The client computing group, Intel’s largest division focused on laptop and PC chips, saw revenue fall 12% year-over-year to $6.8 billion. Mobileye, Intel’s autonomous driving segment, recorded a slight 1% revenue decrease, while the data center and AI segment dropped 15%.

Notably, Intel Foundry Services (IFS) was the standout performer, with revenues surging 307% year-over-year to $225 million. This segment, which partners with domestic companies for semiconductor manufacturing, is central to Intel’s strategy to achieve $8 to $10 billion in cost savings by 2025. This quarter, Intel added Boeing and Northrop Grumman as foundry clients.

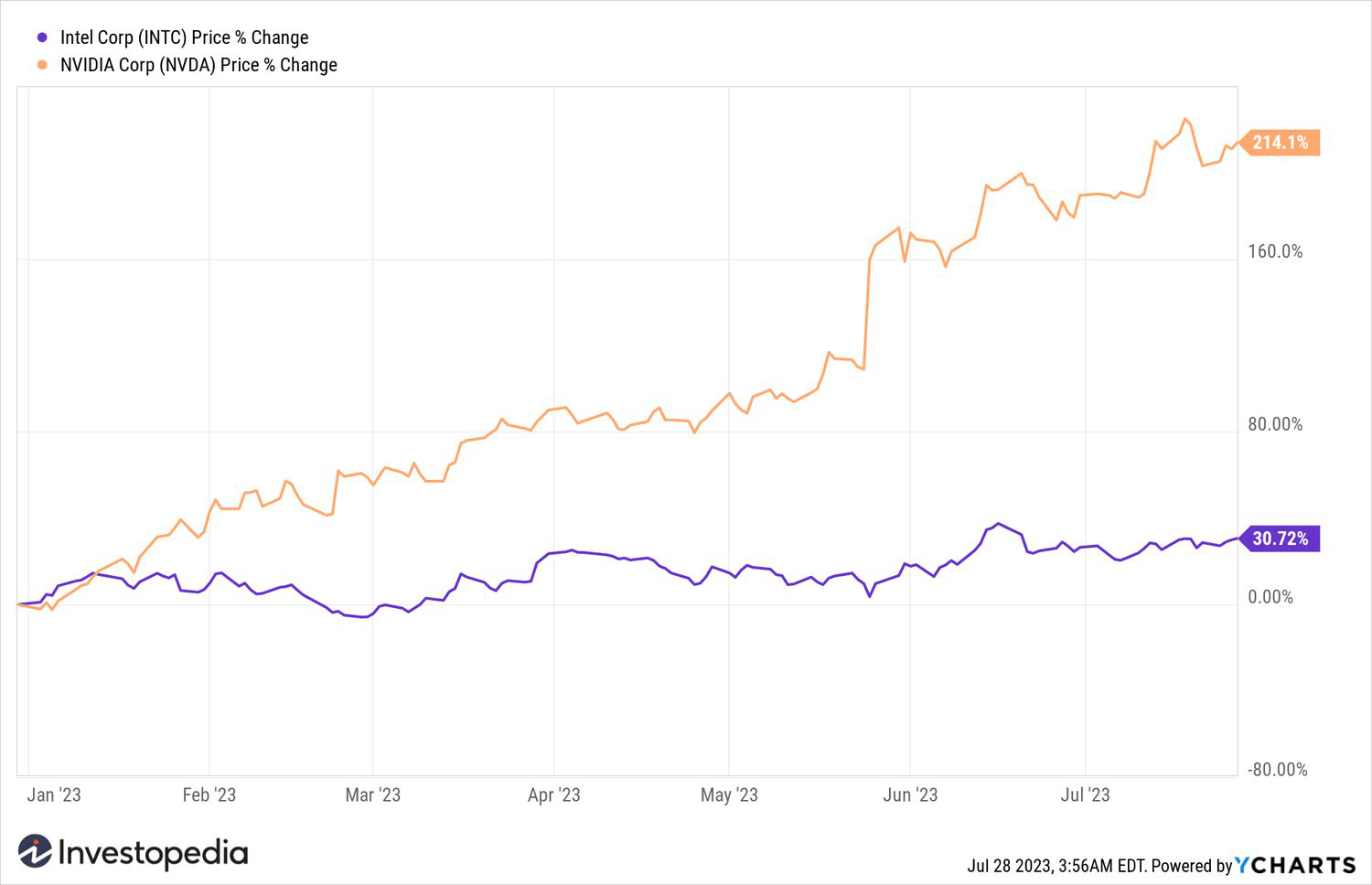

Intel’s Position in the AI Race Against Nvidia

CEO Pat Gelsinger emphasized Intel’s strong positioning to leverage opportunities in the artificial intelligence ecosystem with solutions that democratize AI across cloud, enterprise, edge, and client platforms.

However, industry analysts and investors highlight Intel’s lag behind competitors like Nvidia (NVDA), which benefits from surging demand for GPU chips and data center products, resulting in a 50% increase in forward guidance.

While Intel’s shares have risen approximately 30% since the start of 2023, Nvidia’s stock has skyrocketed over 200% during the same period.

For further news tips, please contact Investopedia reporters at tips@investopedia.com.

Explore useful articles in Company News as of 02-08-2023. The article titled " Intel Q2 2023 Profit Surges Amid Cost-Cutting: Shares Rise Despite Revenue Dip " offers in-depth analysis and practical advice in the Company News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Intel Q2 2023 Profit Surges Amid Cost-Cutting: Shares Rise Despite Revenue Dip " article expands your knowledge in Company News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.