Goldman Sachs 2025: Why Service Stocks Priced Under $500 Will Outperform Amid Trade War

Discover why Goldman Sachs recommends investing in service sector stocks over goods producers during the prolonged US-China trade tensions. Learn which top service stocks to consider for resilient portfolio growth in 2025.

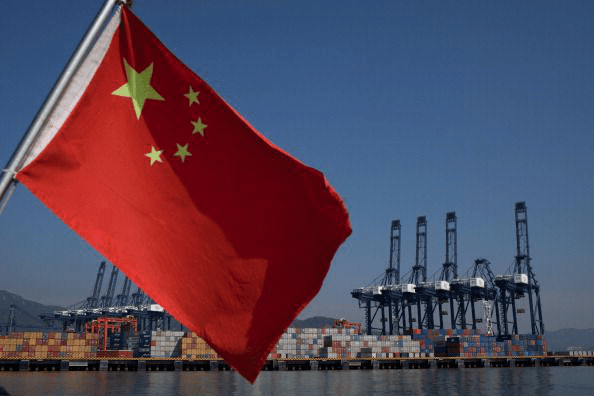

The persistent trade conflict between the United States and China continues to cast a shadow over the global economy, with no resolution in sight. According to Goldman Sachs' latest analysis, investors should pivot towards service-oriented stocks rather than goods-producing companies to better navigate the ongoing economic uncertainty.

Goldman Sachs highlights a select group of leading service sector stocks that are well-positioned to thrive despite trade challenges. Their top 10 recommended service stocks include Microsoft Corp. (MSFT), Amazon.com Inc. (AMZN), Alphabet Inc. (GOOGL), Berkshire Hathaway Inc. (BRK.B), Meta Platforms Inc. (FB), JPMorgan Chase & Co. (JPM), Visa Inc. (V), Walmart Inc. (WMT), Mastercard Inc. (MA), and Bank of America Corp. (BAC).

Investor Implications in 2024

Goldman Sachs' proprietary U.S.-China Trade Tension Barometer has sharply declined, reflecting increased market concern. In April, the likelihood of a trade agreement was estimated at 80%, but this has dropped to approximately 13% as of mid-2024. With the U.S. set to impose an additional 10% tariff on $300 billion of Chinese imports starting September 1, and China's yuan devaluation in response, the risk of escalating into a currency war is rising.

Goldman economists project that a trade deal before the U.S. presidential election in November 2024 is improbable. While a recession in the U.S. is not expected imminently, the bank advises investors to protect their portfolios by emphasizing service sector equities, which are less vulnerable to foreign trade disruptions than goods-producing firms.

Service stocks benefit from lower exposure to foreign input costs subject to tariffs and have a smaller share of international sales compared to goods companies, making them more resilient amid trade retaliation. This sector has delivered a 21% return year-to-date, surpassing the 16% gain in goods stocks. Since Q3 began, service stocks have risen 0.8%, while goods stocks have declined by 0.9%. Additionally, service companies demonstrate stronger sales and earnings growth alongside steadier gross margins.

Strategic Outlook

Goldman Sachs further advises targeting companies with lower labor expenses, anticipating that ongoing Federal Reserve interest rate cuts and a tight labor market will drive wage inflation. Firms with lower labor costs are better positioned to maintain profit margins amidst wage pressures.

Investors seeking to safeguard and grow their portfolios in 2024 should consider reallocating capital toward service sector stocks under $500, leveraging their defensive characteristics amid persistent trade tensions and economic volatility.

Explore useful articles in Markets News as of 17-08-2019. The article titled " Goldman Sachs 2025: Why Service Stocks Priced Under $500 Will Outperform Amid Trade War " offers in-depth analysis and practical advice in the Markets News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Goldman Sachs 2025: Why Service Stocks Priced Under $500 Will Outperform Amid Trade War " article expands your knowledge in Markets News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.