First Solar (FSLR) Stock at $72 in 2023: Poised to Break 9-Year Resistance

First Solar (FSLR) is testing a critical nine-year resistance level in 2023, signaling potential for a strong breakout and sustained upward momentum in the solar energy market.

First Solar, Inc. (FSLR) is currently challenging a significant nine-year resistance level in 2023, setting the stage for a potential breakout that could deliver impressive returns over the next several years. After retreating in late August due to an 8.6 million share secondary offering, the stock found support near the 200-day exponential moving average (EMA) in the low $60s. Since then, it has rebounded and returned to this key resistance point.

Key Highlights

- FSLR stock has been consolidating within a base pattern since 2014.

- The company stands to gain from aggressive global climate policies.

- This marks the fourth rally to resistance, increasing the chance of a breakout.

- A confirmed uptrend could unlock substantial long-term gains.

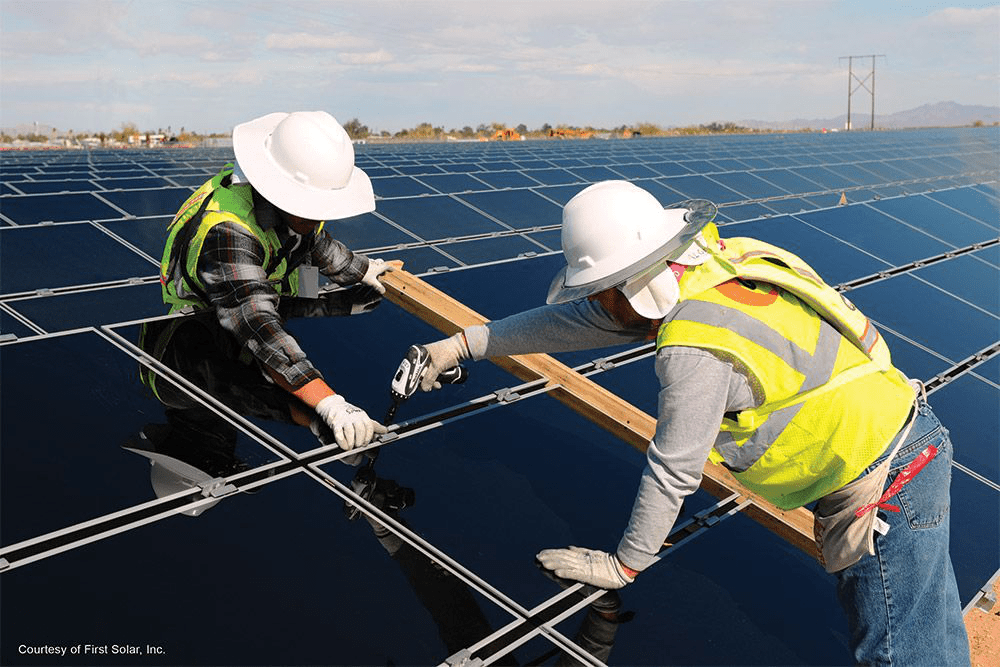

As a leading solar panel manufacturer and power plant designer, First Solar is well-positioned to capitalize on the global shift away from fossil fuels toward renewable energy. The company benefits from supportive legislation such as California's 2020 mandate requiring solar panels on all new residential buildings. Additionally, a pro-environment administration could further accelerate growth, pushing FSLR shares to price levels unseen since 2011.

Wall Street sentiment has improved steadily in 2023, with analysts issuing a "Moderate Buy" consensus based on six "Buy," four "Hold," and two "Sell" recommendations. Price targets vary widely, from $38 to $95, while the stock is trading around $72—about $9 above the median target—suggesting room for an initial breakout. However, sustained momentum will require further positive analyst revisions.

Investor Insight

Secondary offerings come in two forms: non-dilutive sales, where major shareholders sell existing shares, and dilutive offerings, where new shares are created and sold to the public. Understanding this distinction is key for investors assessing potential impacts on share value.

First Solar Long-Term Price Movement (2006–2023)

Since its IPO at $24.50 in November 2006, FSLR experienced a rapid surge to an all-time high of $317 in May 2008. The financial crisis caused a sharp decline to double digits, but the stock rebounded above $200 in 2009. After forming a double top and breaking down in 2011, it hit a low of $11.43 in mid-2012 before climbing back near $75 in 2014.

Attempts to break resistance between $75 and $80 in 2014, 2016, and 2018 were unsuccessful, with strong support forming in the upper $20s. The fourth approach to this resistance in August 2023 triggered a sharp reversal followed by a recovery, raising the likelihood of a breakout with a potential target in triple digits.

Recent Price Patterns (2018–2023)

The price action over the past five years hints at an inverse head and shoulders pattern, though a pronounced low in early 2023 suggests the breakout may need more time to develop. The on-balance volume (OBV) indicator mirrors this uncertainty, with volume dipping before a modest uptick that has yet to break the trend of lower highs since 2017.

A surge of buying in recent weeks adds complexity, potentially leading to a consolidation phase before the company’s Q3 earnings release on October 29. The most optimistic outlook would see steady OBV increases, indicating growing investor interest and a positive feedback loop reinforcing upward momentum.

Investment Tip

Positive feedback loops in investing occur when rising prices attract more buyers, which in turn drives prices higher, creating a self-reinforcing cycle that can boost productivity and returns.

Conclusion

First Solar is at a pivotal point, testing a nine-year resistance level for the fourth time since 2014. If it breaks through, the stock could embark on a robust uptrend with significant upside potential in the near future.

Disclosure: The author held no positions in First Solar at the time of writing.

If you have news tips for our reporters, please contact us at tips@investopedia.com.

Explore useful articles in Company News as of 13-10-2020. The article titled " First Solar (FSLR) Stock at $72 in 2023: Poised to Break 9-Year Resistance " offers in-depth analysis and practical advice in the Company News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " First Solar (FSLR) Stock at $72 in 2023: Poised to Break 9-Year Resistance " article expands your knowledge in Company News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.