ETF Earnings: How Much Profit Are Providers Actually Making?

Despite ongoing fee reductions by leading ETF providers, the industry continues to generate billions in revenue overall.

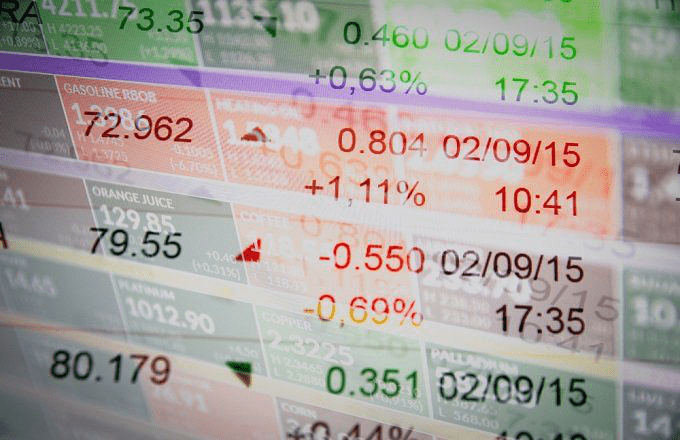

The competition among exchange-traded fund (ETF) providers has intensified dramatically in recent months, driving fees to historically low levels. This trend has sparked curiosity about the profitability of firms operating in this space. How can we accurately assess the earnings of ETF providers? Typically, a fund's total revenue can be estimated by multiplying its assets under management (AUM) by its expense ratio, although fee structures vary. Some funds have variable expense ratios, and a few even incorporate 12b-1 fees.

Applying this straightforward formula to the $2.4 trillion in ETF assets under management as of September 2016 indicates that the ETF industry is collectively generating approximately $6 billion in revenue. BlackRock Inc.'s iShares division leads the pack, earning around $2.4 billion from its ETF offerings. State Street Global Advisors ranks second with nearly $880 million in revenue, followed by Vanguard at about $525 million. Other notable players include Invesco, First Trust, ProShares, and WisdomTree. (For additional insights, see: iShares Family of ETFs to See Lower Fees.)

BlackRock’s recent decision to reduce fees on 15 of its funds is expected to decrease its revenue by roughly $75 million. This move aims to strategically position the company for the anticipated surge of new assets flowing into ETFs due to the Department of Labor’s fiduciary rule. This regulation mandates that commission-based brokers recommend lower-cost investment options to clients, aligning with their fiduciary responsibilities.

Smart beta ETFs, though representing a smaller segment of the overall ETF market, are poised to generate a disproportionately large share of revenue because of their higher fee structures. These funds focus on specialized investment strategies such as targeted themes, factor investing, or fundamental weighting approaches. (For further details, see: The 5 Cheapest iShares ETFs to Date in 2016.)

If you have a news tip for Investopedia reporters, please email us at tips@investopedia.com.

Explore useful articles in Markets News as of 22-10-2016. The article titled " ETF Earnings: How Much Profit Are Providers Actually Making? " offers in-depth analysis and practical advice in the Markets News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " ETF Earnings: How Much Profit Are Providers Actually Making? " article expands your knowledge in Markets News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.