Coinbase Distributes 1099 Forms: A Crucial Reminder for Users to Report Bitcoin Earnings

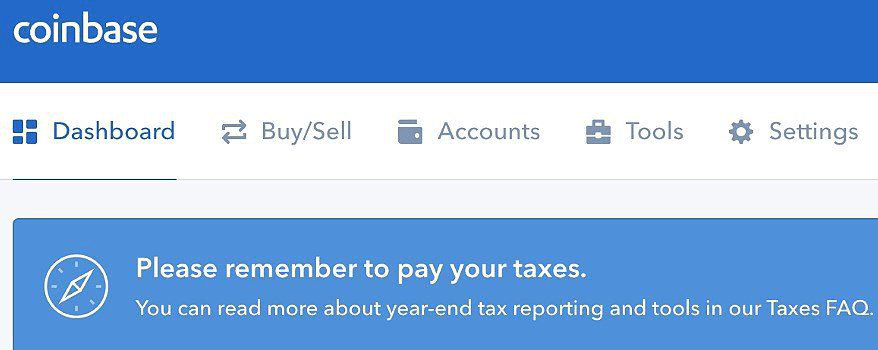

Coinbase has issued 1099-K forms to customers, emphasizing the importance of reporting taxes on cryptocurrency profits.

The evolving interaction between cryptocurrencies and the U.S. tax system is becoming clearer, especially for Coinbase users. Those who meet specific criteria will receive 1099-K tax forms reflecting their bitcoin and crypto earnings over the past year.

On January 31, Coinbase, headquartered in San Francisco, dispatched 1099 tax forms to qualifying American customers who surpassed the IRS reporting thresholds, according to Bitcoin.com.

Thresholds for Receiving 1099 Forms: 200 Transactions or $20,000 in Cash

Customers who have either received more than $20,000 in cash or completed over 200 transactions on Coinbase during the 2017 calendar year are eligible to receive these tax documents.

These forms are not limited to individual users; accounts categorized under "business use" and GDAX accounts that meet the specified thresholds will also be issued 1099 forms.

The "business use" classification applies to accounts that received payments for goods or services. It excludes mining rewards and transfers between wallets owned by the same individual.

Mixed Reactions Among Coinbase Users

Regarding the "business use" designation, Coinbase stated that it relied on the most accurate data available, including factors such as merchant profile completion and activation of merchant tools, to determine eligibility.

Many cryptocurrency investors have expressed dissatisfaction, arguing that decentralized digital assets should not be taxed like traditional investments.

Additionally, some users were caught off guard by receiving the tax forms without prior notification about the reporting thresholds, leading to frustration.

Those who believe they received a 1099 form in error are encouraged to reach out to Coinbase’s support team and consult with a tax expert. Coinbase has previously encountered challenges with IRS compliance.

Interested in deepening your understanding of cryptocurrencies like Bitcoin? Consider enrolling in Investopedia Academy.

Note: Investing in cryptocurrencies and Initial Coin Offerings (ICOs) involves significant risk and speculation. This article does not constitute investment advice from Investopedia or the author. Individual circumstances vary; always seek guidance from a qualified professional before making financial decisions. The author holds cryptocurrency assets as of this article’s publication date.

Explore useful articles in Cryptocurrency News as of 30-06-2019. The article titled " Coinbase Distributes 1099 Forms: A Crucial Reminder for Users to Report Bitcoin Earnings " offers in-depth analysis and practical advice in the Cryptocurrency News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Coinbase Distributes 1099 Forms: A Crucial Reminder for Users to Report Bitcoin Earnings " article expands your knowledge in Cryptocurrency News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.