Charlie Munger 2023: Berkshire Hathaway Vice Chair's $780 Billion Legacy & Investment Wisdom

Explore the inspiring journey and investment philosophy of Charlie Munger, Warren Buffett’s right-hand man and vice chair of Berkshire Hathaway, who helped grow the conglomerate to a $780 billion market cap by 2023.

Katrina Ávila Munichiello is a seasoned editor, writer, fact-checker, and proofreader with over fourteen years of experience in print and digital media.

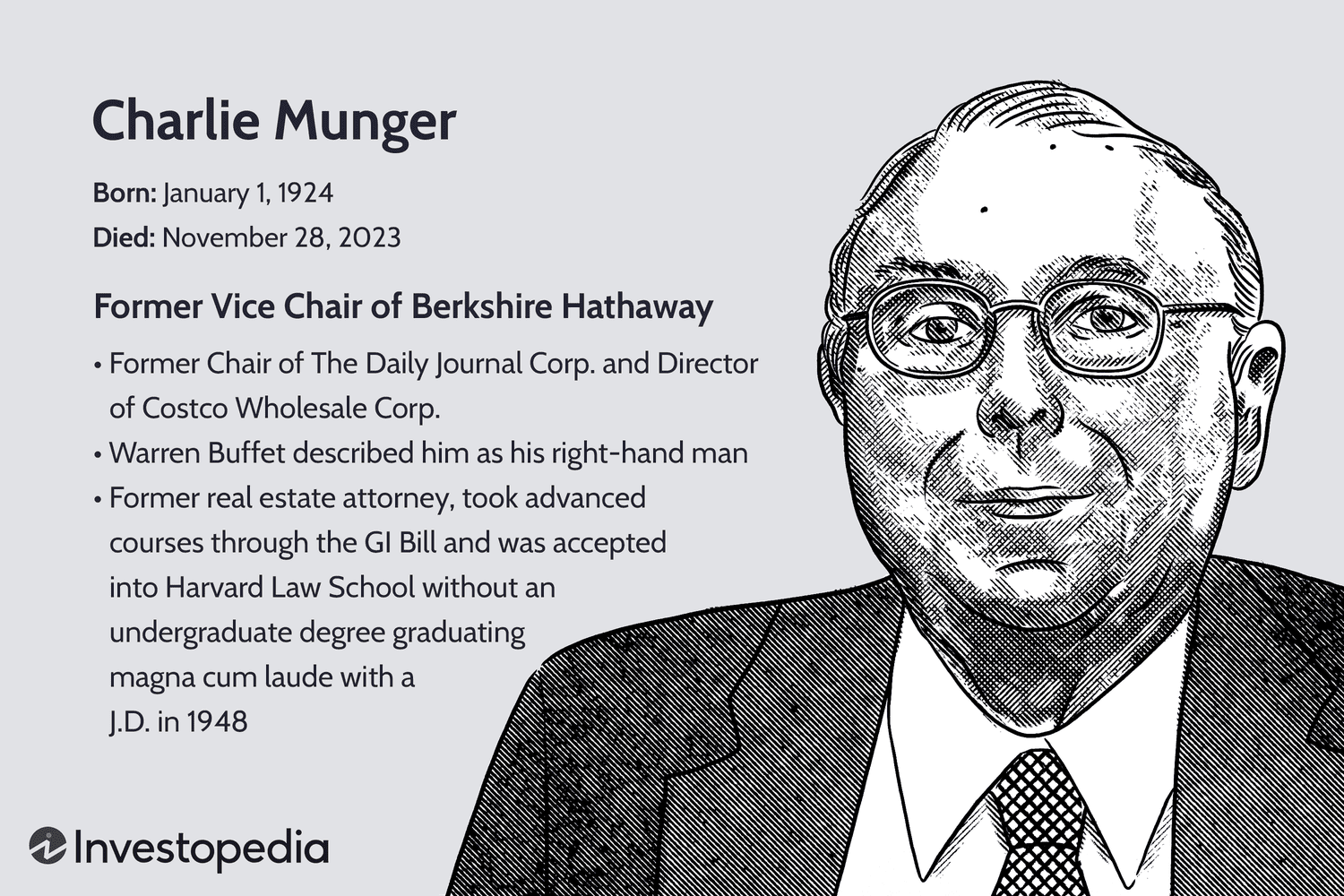

Charlie Munger, the billionaire investor and longtime vice chair of Berkshire Hathaway, passed away peacefully on November 28, 2023, at the age of 99. As Warren Buffett’s trusted partner for more than 40 years, Munger was a driving force behind Berkshire Hathaway’s transformation into a colossal conglomerate valued at over $780 billion as of late 2023. The company holds diverse operations spanning insurance, railroads, energy, manufacturing, and retail.

Alongside his role at Berkshire, Munger served as an independent director for Costco Wholesale Corporation and chaired the Daily Journal Corporation, a legal publishing and software firm based in Los Angeles. From 1984 to 2011, he also led Wesco Financial Corporation, a Berkshire Hathaway subsidiary, as chairman and CEO.

Key Highlights

- Charlie Munger was vice chair of Berkshire Hathaway from 1978 until 2023, acting as Warren Buffett’s second-in-command.

- He played a pivotal role in expanding Berkshire’s value to more than $780 billion.

- He served in the U.S. Army Air Corps during World War II as a trained meteorologist.

- Despite not completing an undergraduate degree, Munger graduated magna cum laude from Harvard Law School in 1948.

Early Life and Education

Born in Omaha in 1924, Munger’s teenage years included working at a grocery store owned by Warren Buffett’s grandfather. During World War II, he enrolled at the University of Michigan to study mathematics but left shortly after turning 19 to serve in the Army Air Corps, where he specialized as a meteorologist and earned the rank of second lieutenant. He furthered his meteorology studies at Caltech in Pasadena, California, which later became his lifelong home.

Without holding an undergraduate degree, Munger was admitted to Harvard Law School and graduated magna cum laude in 1948. He initially practiced as a real estate lawyer before founding the respected California law firm Munger, Tolles & Olson.

Shift from Law to Investing

In 1959, Munger met Warren Buffett at a dinner in Omaha, beginning a decades-long partnership. Acting on Buffett’s advice, Munger transitioned from law to focus on investment management in the 1960s, including a partnership with billionaire Franklin Otis Booth in real estate development.

Before joining Berkshire Hathaway, Munger ran his own investment firm, which Buffett praised for delivering compound annual returns of 19.8% between 1962 and 1975, significantly outperforming the Dow Jones’s 5% annual growth in that period.

Buffett acquired Berkshire Hathaway shares starting in 1962 and took control by 1965. In 1978, Munger became the company’s vice chair, solidifying their partnership.

Revolutionizing Value Investing

Buffett initially followed Benjamin Graham’s value investing style, focusing on buying undervalued stocks, often described as "cigar-butt" investing — buying struggling companies at a discount for a small residual gain. However, Munger convinced Buffett to abandon this approach.

In Buffett’s 1989 shareholder letter, he credited Munger with steering Berkshire towards buying high-quality businesses at fair prices instead of mediocre businesses at bargain prices. This philosophy underpinned Berkshire Hathaway’s massive success: acquiring companies worth far more in the future rather than short-term discounts.

Munger’s famous mantra was: “Forget what you know about buying fair businesses at wonderful prices; instead, buy wonderful businesses at fair prices.”

Investment Principles and Ethics

- Munger and Buffett shared a commitment to the highest ethical standards in business.

- He believed that ethical conduct was essential for long-term business success.

- One of his notable quotes: “Good businesses are ethical businesses. A business model that relies on trickery is doomed to fail.”

- Munger introduced the idea of “elementary, worldly wisdom” into investing, inspired by thinkers like Ben Franklin and Samuel Johnson.

Berkshire Hathaway’s Four Pillars

As vice chair, Munger oversaw Berkshire Hathaway’s core investments, known as the “Four Giants” by Buffett:

- Insurance Float: Berkshire’s insurance subsidiaries generate massive "float" — funds from premiums held before claims are paid — which grew from $19 million to $164 billion during Munger’s tenure, fueling long-term investments.

- Apple, Inc.: Berkshire owns 5.8% of Apple, largely through stock repurchases, making it a vital, though atypical, holding.

- BNSF Railway: This freight railroad operates one of North America’s largest networks, protected by a strong economic moat due to high infrastructure costs.

- Berkshire Hathaway Energy (BHE): BHE evolved under Munger’s leadership into a renewable energy leader, growing earnings from $122 million in 2000 to $26.3 billion in 2022, supported by a formidable economic moat.

Passing and Legacy

Charlie Munger passed away peacefully on November 28, 2023, in California. Warren Buffett honored him, stating that Berkshire Hathaway’s success was inseparable from Munger’s wisdom and partnership.

Views on Bitcoin

Known for his blunt opinions, Munger criticized bitcoin as a creation “out of thin air” and a preferred payment method for criminals. He applauded China’s cryptocurrency ban and was wary of U.S. involvement in digital currencies.

Philanthropic Efforts

Munger’s charitable focus was education, generously supporting institutions such as the University of Michigan Law School, Stanford University, and the University of California, Santa Barbara, contributing tens to hundreds of millions for student housing and facilities.

Conclusion

Charlie Munger’s partnership with Warren Buffett was foundational in building Berkshire Hathaway’s extraordinary success, with a market value surpassing $780 billion by 2023. His disciplined investment philosophy, ethical standards, and focus on acquiring exceptional businesses at fair prices have left a lasting imprint on value investing worldwide.

Explore useful articles in Business Leaders as of 03-12-2023. The article titled " Charlie Munger 2023: Berkshire Hathaway Vice Chair's $780 Billion Legacy & Investment Wisdom " offers in-depth analysis and practical advice in the Business Leaders field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Charlie Munger 2023: Berkshire Hathaway Vice Chair's $780 Billion Legacy & Investment Wisdom " article expands your knowledge in Business Leaders, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.