Cava Group Delivers Strong Q1 Performance Amid Mixed Market Reactions

Discover how Cava Group surpassed expectations in Q1 with impressive sales and earnings growth, yet tempered investor enthusiasm due to cautious future outlook.

Bill McColl brings over 25 years of expertise as a senior producer and writer across TV, radio, and digital platforms, leading teams that have covered some of the most impactful news stories of our time.

Key Highlights

- Cava Group exceeded profit and sales forecasts for the first quarter but offered a conservative outlook that tempered investor optimism.

- The Mediterranean fast-casual brand maintained its guidance for same-store sales growth and restaurant-level profit margins while anticipating higher operating costs.

- CEO and co-founder Brett Schulman attributed the quarter’s results to ongoing economic uncertainty and challenging weather conditions.

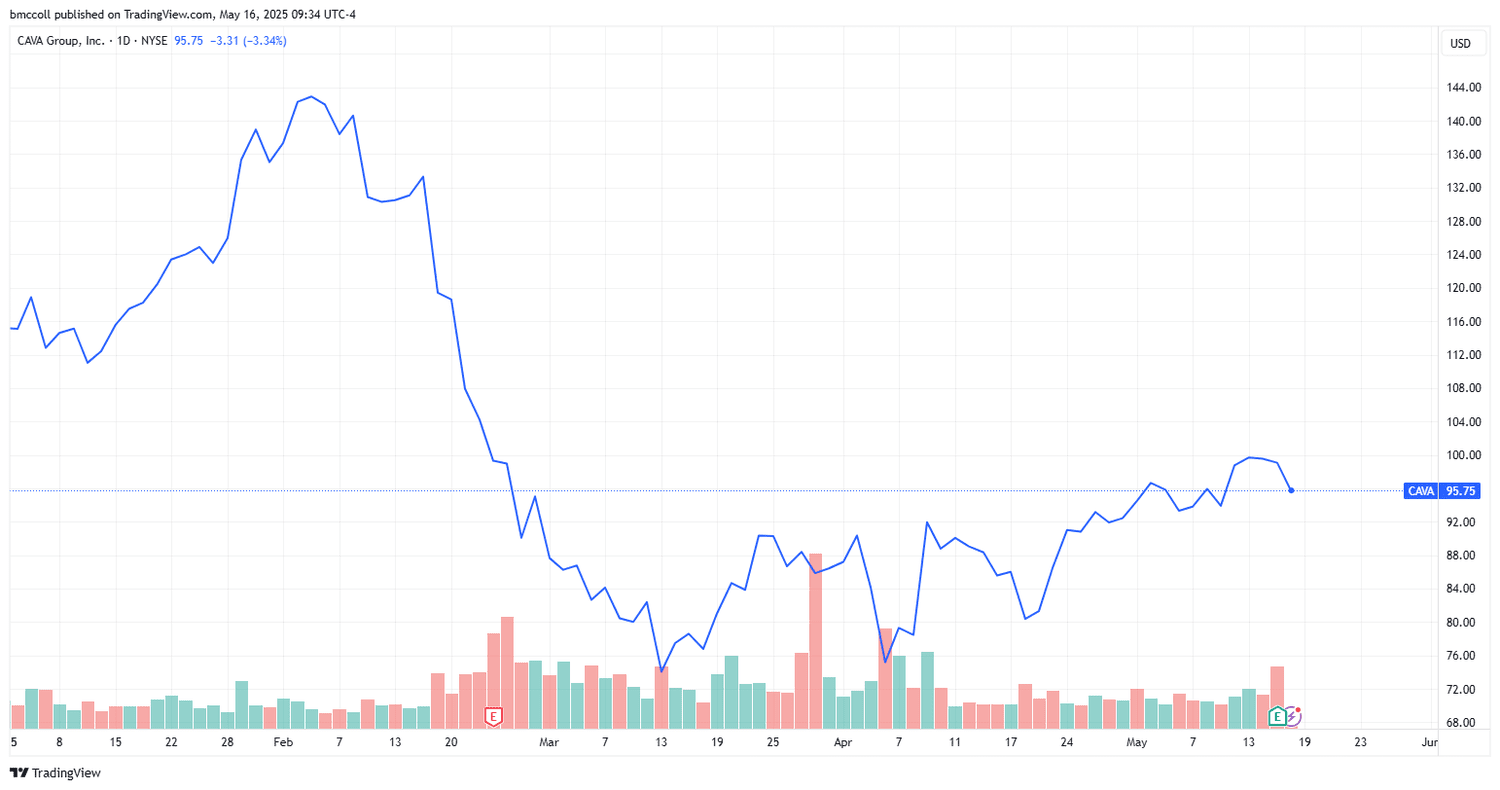

Cava Group (NASDAQ: CAVA) shares declined following the release of its first-quarter earnings, despite the company beating expectations on key financial metrics.

The company held steady on its full-year projections, expecting same-store sales growth between 6% and 8% and restaurant-level profit margins ranging from 24.8% to 25.2%. However, it revised upward its pre-opening cost estimates to $14.5 million–$15.5 million from the previous $14 million–$15 million.

Positive adjustments included increasing anticipated net new restaurant openings to between 64 and 68 locations, up from 62 to 66, and raising adjusted EBITDA guidance to a range of $152 million to $159 million, up from $150 million to $157 million.

Robust Q1 Results Showcase Brand Strength

During Q1, Cava posted earnings per share of $0.22 on revenues soaring 28% year-over-year to $331.8 million, outperforming Visible Alpha estimates. Same-store sales climbed 10.8%, while customer traffic increased by 7.5%—both surpassing market expectations.

CEO Brett Schulman emphasized that these results highlight the resilience and appeal of Cava’s category-leading brand, even amid economic headwinds and adverse weather.

JPMorgan analysts echoed confidence in Cava’s prospects, maintaining a "buy now and hold for the long term" stance, noting the company’s strong comparable sales growth despite a challenging environment.

Despite these positives, Cava’s shares dropped 3% on the day of the earnings report and have declined nearly 15% year-to-date in 2025.

Have a tip for our reporters? Reach out at tips@ZAMONA.

Explore useful articles in Markets News as of 15-07-2024. The article titled " Cava Group Delivers Strong Q1 Performance Amid Mixed Market Reactions " offers in-depth analysis and practical advice in the Markets News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Cava Group Delivers Strong Q1 Performance Amid Mixed Market Reactions " article expands your knowledge in Markets News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.