Biden's 2025 Economic Regulation Surge: Over 200 New Rules Shaping the Market

Explore how President Joe Biden's administration has enacted a historic number of economically impactful regulations by 2025, influencing student loans, banking fees, labor policies, and more, setting the stage for critical economic shifts ahead of the presidential election.

Diccon Hyatt is a seasoned financial and economic journalist who has extensively covered the pandemic economy through clear, accessible reporting. Over the past two years, he has authored hundreds of articles explaining complex financial topics and their effects on personal finances and the broader market. His experience includes roles at U.S. 1, Community News Service, and the Middletown Transcript.

Key Insights

- President Joe Biden has introduced more economically significant regulations within his first 38 months than any president since Ronald Reagan.

- The Biden administration has overhauled regulations on student loan repayments, banking fees, overtime pay, and other critical areas overseen by federal agencies.

- The authority to influence federal regulations remains a pivotal issue in the 2024 presidential race.

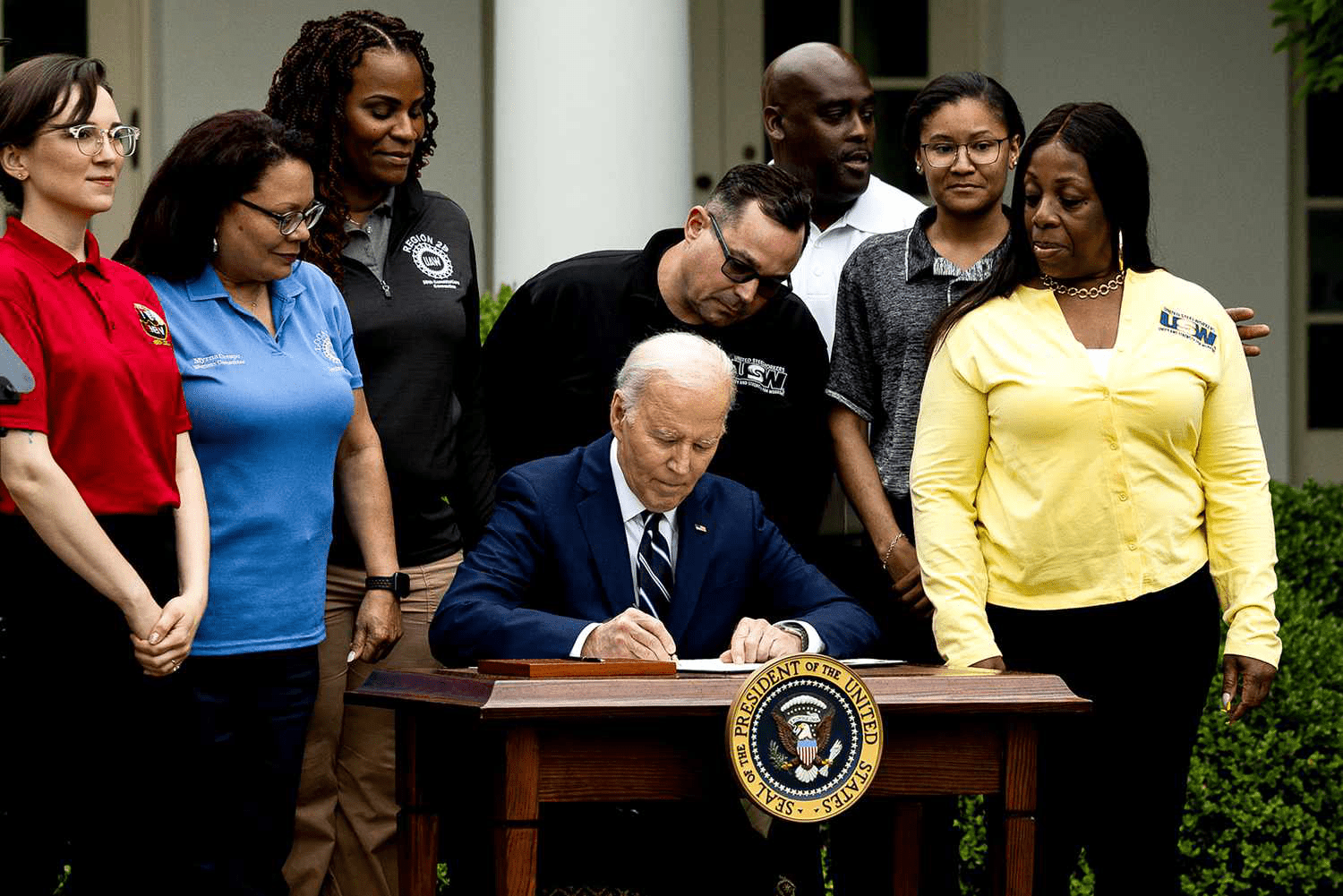

President Joe Biden is on track to surpass all predecessors in issuing impactful economic regulations, leveraging federal agencies to steer national policy.

By April 2024, the Biden administration had issued 209 "economically significant" regulations, defined by George Washington University’s Regulatory Studies Center as those affecting the economy by $100 million or more annually or materially influencing the economy, environment, or public safety. This marks a record number at this stage in a presidency since the Reagan era.

Despite legislative challenges following the Republican takeover of the House in 2022, Biden’s administration has effectively used federal regulations to reshape economic policy without new laws.

Biden's Economic Policy Highlights

The Department of Education has revamped student loan repayment rules, while the Department of Labor has broadened overtime eligibility and clarified classifications between contractors and employees. The Consumer Financial Protection Bureau has aggressively addressed excessive banking fees, including overdraft charges, as part of a broader crackdown on "junk fees."

Some initiatives, such as extensive student loan forgiveness and limits on credit card late fees, have faced legal obstacles or been blocked by courts.

Research from George Washington University underscores the high stakes of the 2024 election, emphasizing that the next president will wield substantial influence over federal regulations, independent of congressional control.

Have a news tip for ZAMONA? Please reach out to us at tips@ZAMONA.

Explore useful articles in Government News as of 21-04-2024. The article titled " Biden's 2025 Economic Regulation Surge: Over 200 New Rules Shaping the Market " offers in-depth analysis and practical advice in the Government News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Biden's 2025 Economic Regulation Surge: Over 200 New Rules Shaping the Market " article expands your knowledge in Government News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.