Bed Bath & Beyond Bankruptcy 2023: Store Closures and Asset Sales Begin

Discover how Bed Bath & Beyond's 2023 bankruptcy filing marks the end of an era for the home goods giant, as it initiates store closures and explores asset sales amid financial struggles.

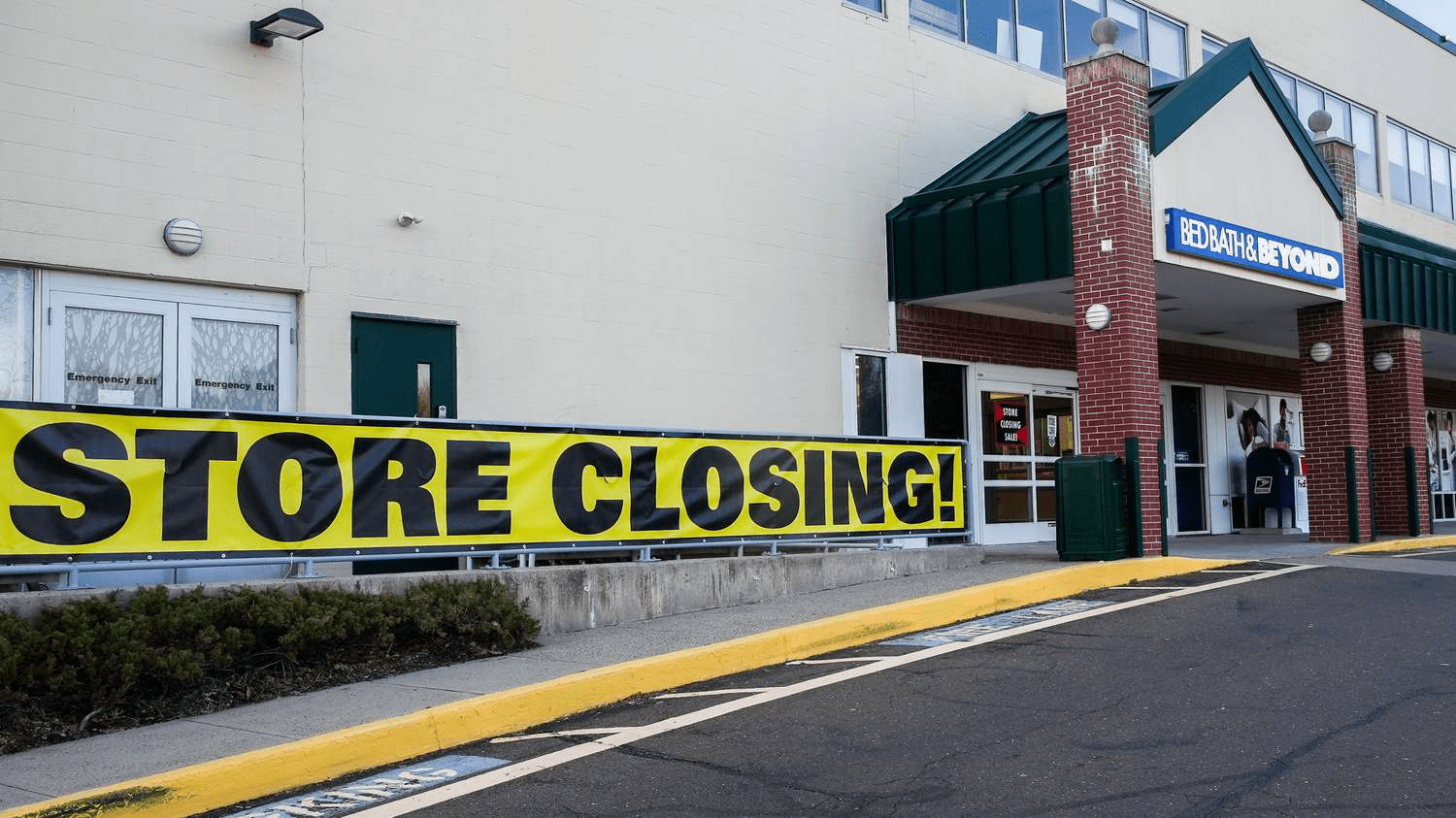

Home goods retailer Bed Bath & Beyond files for bankruptcy, starting the closure of nearly 500 stores nationwide.

In a significant development for the retail sector, Bed Bath & Beyond (BBBY) has officially filed for Chapter 11 bankruptcy protection in New Jersey as of 2023. This move concludes months of efforts to secure capital and maintain liquidity amid mounting financial challenges.

Essential Highlights

- Bed Bath & Beyond's Chapter 11 bankruptcy filing marks the start of winding down its operations.

- The company has launched liquidation sales while pursuing asset sales through bankruptcy proceedings.

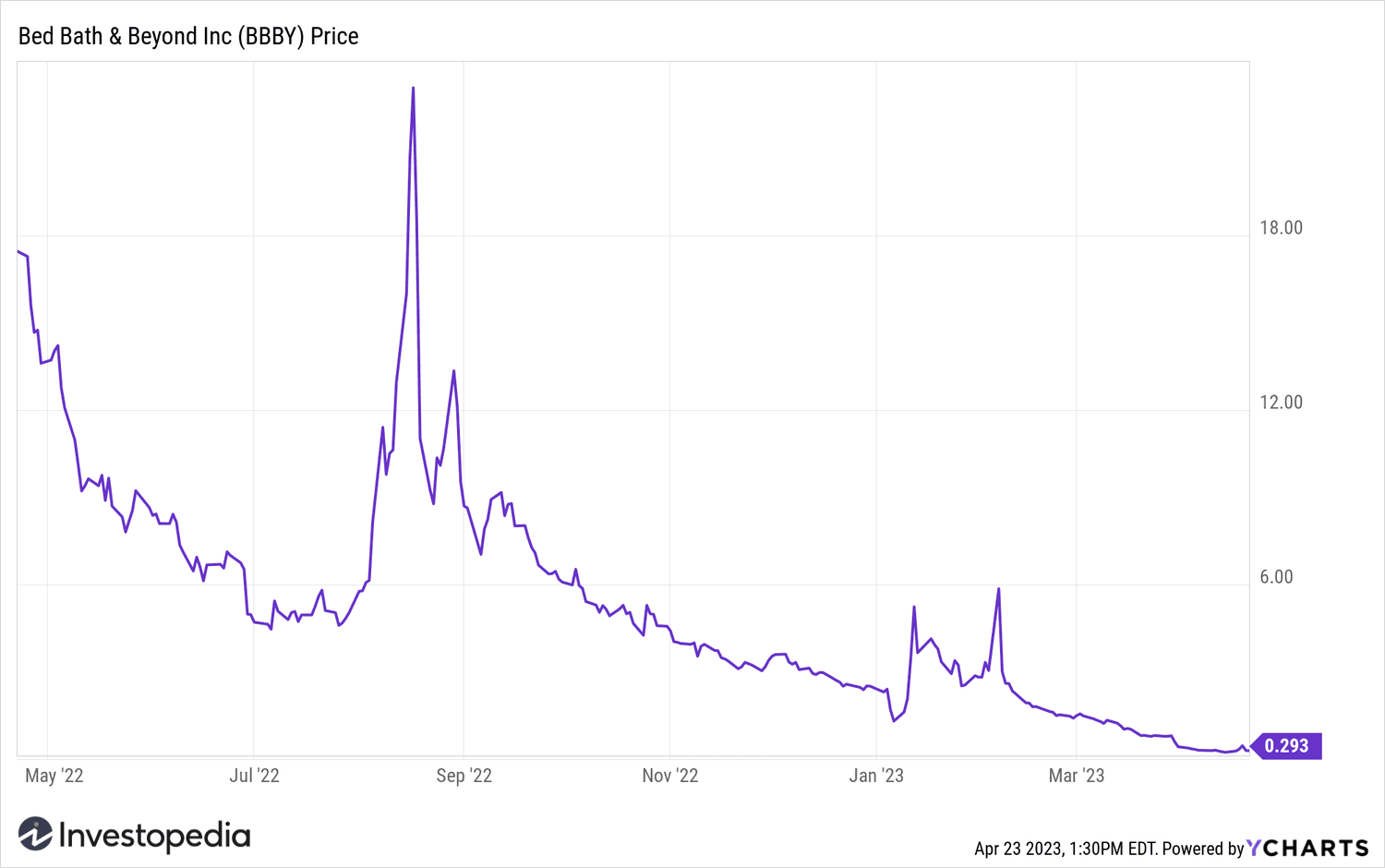

- Previous attempts to raise funds via convertible shares, equity offerings, and reverse stock splits were unsuccessful.

The retailer has secured $240 million in debtor-in-possession financing aimed at sustaining operations across nearly 500 locations during the bankruptcy process.

CEO Sue Gove expressed gratitude to employees, customers, and partners, emphasizing a commitment to maximizing value for all stakeholders throughout this transition.

Once a dominant player in home goods retail, Bed Bath & Beyond struggled to keep pace with the evolving retail landscape shaped by e-commerce leaders like Amazon. The COVID-19 pandemic further strained its operations, causing store losses and supply chain disruptions.

Financial troubles became apparent early in 2023, with the company warning of bankruptcy risks due to widening losses and negative cash flow. A missed $25 million interest payment in February caused shares to plummet nearly 50%, though payment was made within the grace period to avoid default.

Efforts to raise up to $1 billion through convertible securities were abandoned after limited investor interest. Subsequently, an 'at-the-market' offering aimed to raise $300 million, but share prices fell below $1 for the first time since its 1992 IPO.

The company planned a special shareholder meeting in May 2023 to approve a reverse stock split in a final attempt to stabilize its stock price.

Explore useful articles in Company News as of 28-04-2023. The article titled " Bed Bath & Beyond Bankruptcy 2023: Store Closures and Asset Sales Begin " offers in-depth analysis and practical advice in the Company News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Bed Bath & Beyond Bankruptcy 2023: Store Closures and Asset Sales Begin " article expands your knowledge in Company News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.