Airbnb Stock Drops 8.4% in 2025 After Mixed Q1 and Soft Q2 Outlook

Airbnb reported strong Q1 2025 earnings surpassing expectations, but shares declined due to cautious guidance for Q2 impacted by seasonal factors and currency fluctuations. Learn about key support levels and what’s next for ABNB stock.

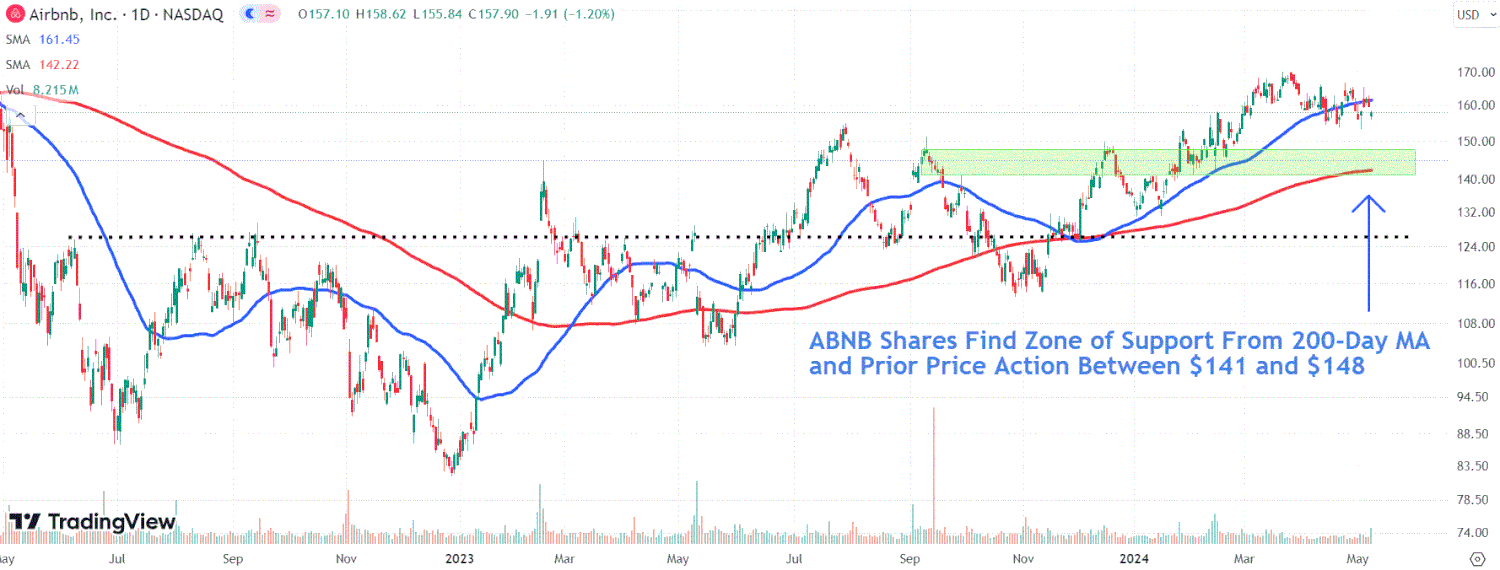

Monitor This Critical Chart Zone

Highlights

- Airbnb (ABNB) stock declined sharply by over 8% in after-hours trading following a cautious forecast for Q2 2024 despite exceeding Q1 earnings and revenue estimates.

- Guidance for the current quarter reflects challenges from Easter timing, an extra leap day in the prior quarter, and foreign exchange headwinds.

- The stock finds technical support between $141 and $148, anchored by the 200-day moving average and price behavior since September 2023.

Shares of Airbnb, a leading short-term rental platform, slid significantly after the company shared a tempered outlook for the quarter ending June 2024. While Q1 results impressed Wall Street with adjusted earnings of $0.41 per share and revenue of $2.14 billion—both surpassing analyst predictions—the current quarter guidance fell slightly short of expectations, causing investor caution.

For Q2, Airbnb anticipates net sales between $2.68 billion and $2.74 billion, reflecting an 8% to 10% increase year-over-year, with the midpoint slightly below analysts’ consensus of $2.74 billion. The company highlighted a "significant sequential headwind" due to the timing of Easter, an additional leap day last year, and currency fluctuations impacting revenue comparisons.

Despite these near-term hurdles, Airbnb expects revenue growth to pick up heading into Q3, supported by heightened summer travel demand fueled by the Paris Olympics in July and August.

Solar Eclipse Boosts Bookings in Q1

During the first quarter ending March 31, Airbnb’s gross bookings grew 12% year-over-year to $22.9 billion, while nights and experiences booked rose 9.5% to 132.6 million, slightly beating forecasts. The company noted that unique events such as the North American solar eclipse contributed to increased platform engagement, with 500,000 guests booking stays during the event.

Technical Outlook: Key Support Levels to Watch

Since peaking in late March 2024, Airbnb’s stock price has traded within a tight range near its 50-day moving average, reflecting market indecision. Investors should closely monitor the $141 to $148 range, where the stock receives meaningful support from the 200-day moving average and historical price action dating back to September 2023. A drop below this support zone could pave the way for further declines toward the $126 level.

As of after-hours trading post-earnings, ABNB shares settled at $144.58, marking an 8.4% decline. Despite this drop, the stock remains up approximately 25% over the last 12 months.

The insights shared on ZAMONA are for informational purposes only and should not be considered financial advice. Please review our warranty and liability disclaimers for more details.

At the time of writing, the author holds no positions in the securities mentioned.

Got a news tip for ZAMONA? Contact us at tips@ZAMONA.

Explore useful articles in Company News as of 14-05-2024. The article titled " Airbnb Stock Drops 8.4% in 2025 After Mixed Q1 and Soft Q2 Outlook " offers in-depth analysis and practical advice in the Company News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " Airbnb Stock Drops 8.4% in 2025 After Mixed Q1 and Soft Q2 Outlook " article expands your knowledge in Company News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.