2025 Home Warranty vs Home Insurance: Costs, Coverage & Key Differences

Discover the essential differences between home warranties and homeowners insurance in 2025. Learn what each covers, costs, and whether you need both for complete home protection.

Are you wondering if you need both a home warranty and home insurance? If you own or plan to purchase a home, understanding these two types of protection is crucial for safeguarding your investment and finances.

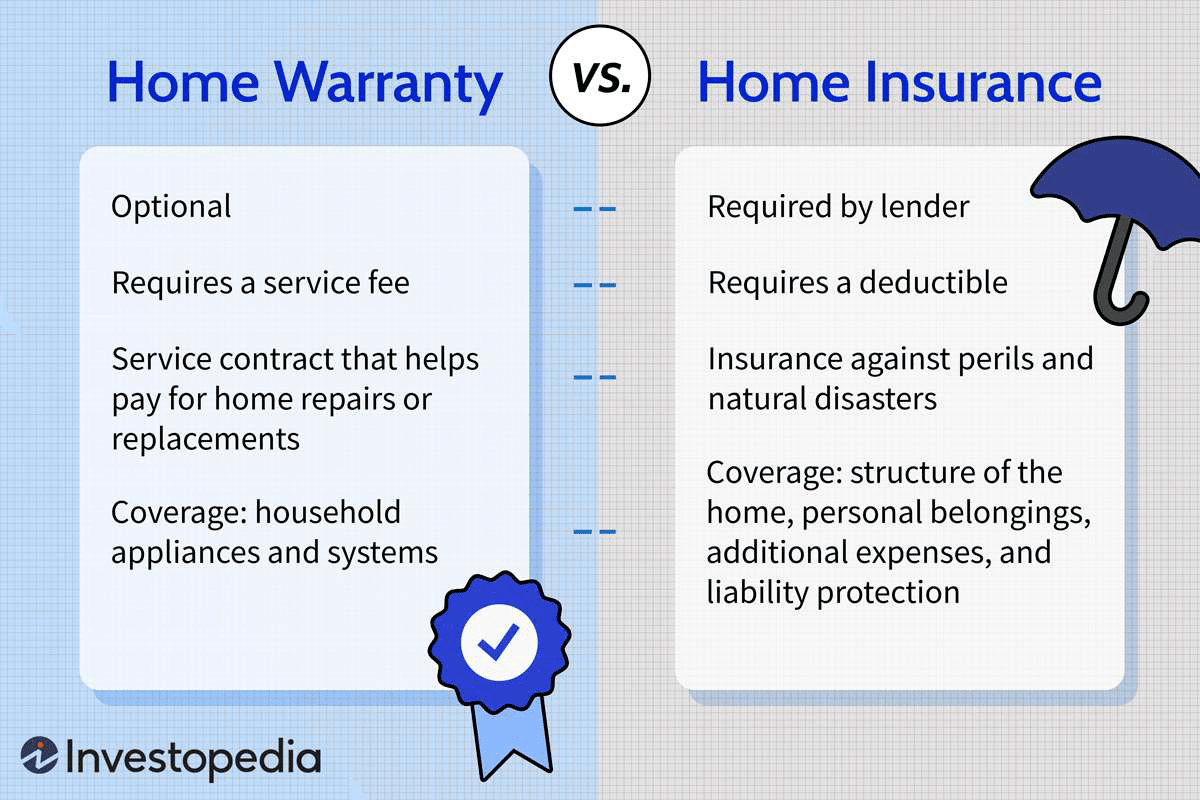

Homeowners insurance covers your home's structure and personal belongings from unexpected events like fires, storms, or theft. Conversely, a home warranty focuses on repairing or replacing existing appliances and systems due to normal wear and tear, such as HVAC, plumbing, and electrical systems.

While both provide valuable protection, they cover different risks. Knowing their distinctions will help you decide if having both makes sense for your situation.

Key Takeaways

- Home warranties offer discounted repairs and replacements for household appliances and systems.

- Homeowners insurance protects your home and possessions against major perils like fire, theft, and natural disasters.

- Liability coverage is included in home insurance to protect against injuries occurring on your property.

- Mortgage lenders typically require home insurance, but home warranties are optional.

- For comprehensive peace of mind, many homeowners choose to have both.

What Is a Home Warranty?

A home warranty is a service contract that covers repair or replacement costs for covered household appliances and systems in exchange for a monthly or annual fee. When an item breaks down, the warranty provider sends a technician to fix it, usually charging a service call fee.

Coverage limits typically apply—for example, up to $1,500 per appliance annually with an overall claim cap. If acquired during a home purchase, coverage often begins at closing; otherwise, there may be a waiting period before activation.

What Does a Home Warranty Cover?

Home warranties cover appliances and systems in both new and existing homes, including:

- Appliance plans: washer, dryer, dishwasher, refrigerator

- System plans: HVAC, plumbing, electrical

- Combination plans: both appliances and systems

Optional add-ons may include pools, spas, septic systems, wells, lawn sprinklers, and extra appliances. Avoid paying for coverage you don’t need—customize your warranty based on items you own.

How Much Does a Home Warranty Cost?

Costs include:

- A monthly or yearly fee—typically $400 to $600 annually for basic plans and up to $1,400 for comprehensive coverage.

- A service call fee—ranging from $40 to $150 per repair visit, with higher plan fees usually meaning lower service fees.

Pro Tip

Home warranties differ from builder warranties, which cover newly constructed homes’ structural elements like foundations and plumbing.

What Is Homeowners Insurance?

Homeowners insurance protects your property and belongings from covered risks and provides liability coverage. A typical policy includes:

- Dwelling coverage for repairing or rebuilding your home and other structures.

- Personal property coverage for items like furniture and clothing.

- Liability protection against lawsuits for injuries or property damage.

- Additional living expenses if your home becomes uninhabitable.

What Does Homeowners Insurance Cover?

The common HO-3 policy covers your home, belongings, and liability against 16 perils including fire, windstorm, theft, vandalism, and water damage from plumbing issues.

Note that standard policies exclude floods and earthquakes; supplemental coverage may be needed depending on your location.

Important

If you have a mortgage, your lender will likely require adequate homeowners insurance coverage.

How Much Does Homeowners Insurance Cost?

Premiums depend on factors such as location, home value, belongings, coverage limits, claim history, credit score, and even pet ownership. For example, insuring a $250,000 home with a $1,000 deductible can cost between $2,000 and $4,000 annually, with variations based on specific circumstances.

Certain dog breeds considered high-risk by insurers may increase premiums or result in denied coverage.

Tip

If your insurer excludes your pet, consider specialized dog liability insurance or an umbrella policy.

Common high-risk breeds include Akita, Doberman, German Shepherd, Pit Bull, Rottweiler, and others.

Frequently Asked Questions (FAQs)

What Is the Difference Between a Home Warranty and Home Insurance?

Home warranties cover repairs for existing appliances and systems from wear and tear, while homeowners insurance protects against sudden events like fire or theft. Warranties don’t cover accidental damage or structural issues that insurance protects.

What Is Not Covered Under a Home Warranty?

Structural components such as foundations and framing are excluded; warranties focus on appliances and major home systems.

What Does Homeowners Insurance Cover?

Insurance covers sudden, accidental damage, theft, liability for injuries on your property, and more, but excludes wear and tear or neglect.

The Bottom Line

Home warranties aid with appliance and system breakdowns, while homeowners insurance protects your property and liability from unforeseen events. Mortgage lenders usually require insurance, but warranties are optional. Combining both can offer robust protection and peace of mind.

Before purchasing, carefully review policy details to ensure coverage fits your needs and budget, preventing surprises during claims.

Explore useful articles in Insurance as of 02-07-2024. The article titled " 2025 Home Warranty vs Home Insurance: Costs, Coverage & Key Differences " offers in-depth analysis and practical advice in the Insurance field. Each article is carefully crafted by experts to provide maximum value to readers.

The " 2025 Home Warranty vs Home Insurance: Costs, Coverage & Key Differences " article expands your knowledge in Insurance, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.