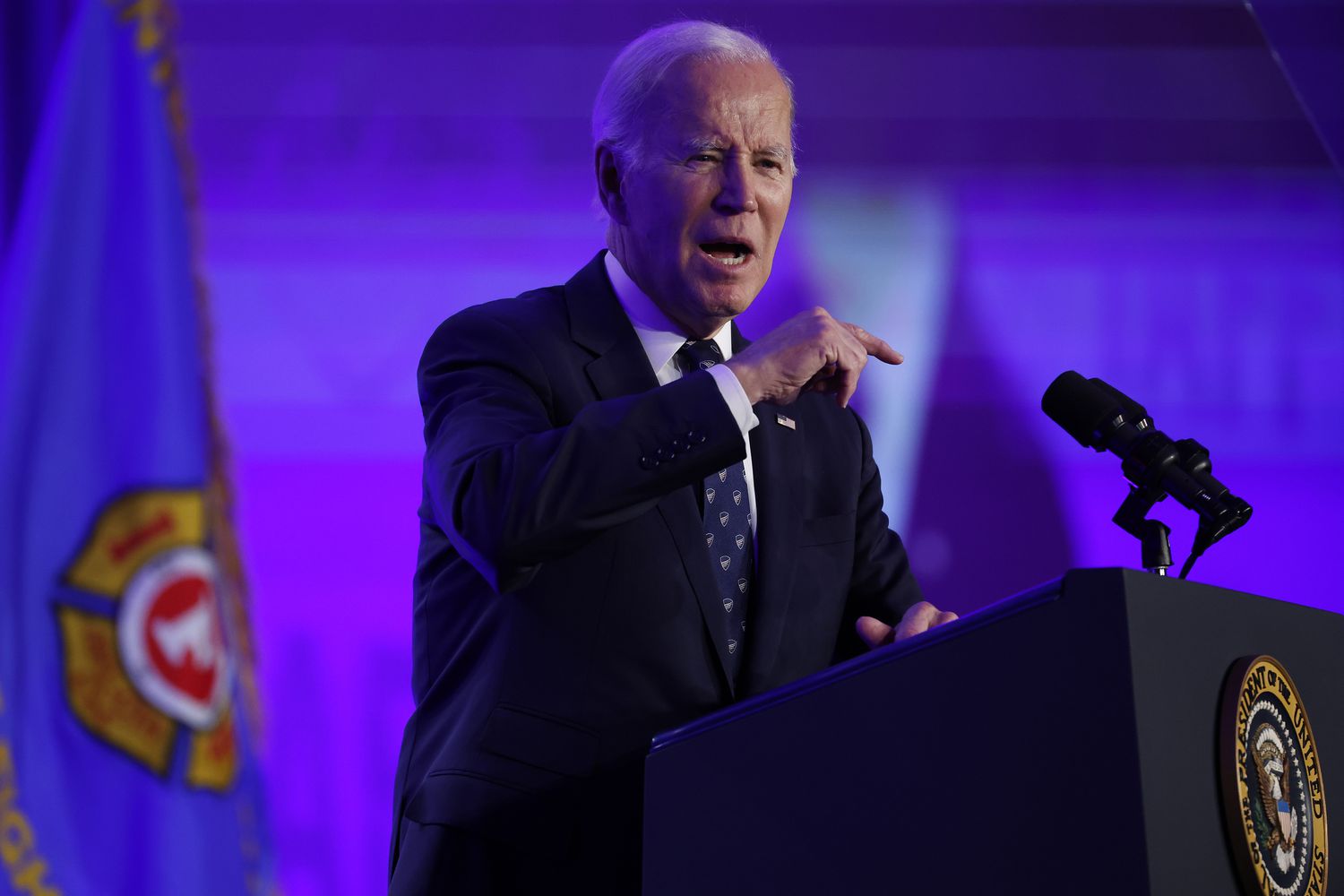

2025 Biden Budget Proposal: New Family Benefits Funded by Taxes on the Wealthy

Explore President Joe Biden's 2025 budget plan introducing expanded family tax credits, free preschool, and healthcare subsidies, financed through increased taxes on billionaires and corporations.

President Joe Biden's 2024 budget proposal aims to provide significant support to working families through enhanced tax credits and expanded childcare and healthcare assistance, while introducing new tax measures targeting the ultra-wealthy.

This comprehensive budget serves as a foundation for upcoming bipartisan negotiations amid the U.S. approaching its borrowing limit and potential debt default risks. It includes familiar priorities such as paid family and medical leave, universal preschool access, and permanent healthcare subsidies.

Expanded Child Tax Credit

The plan reinstates the pandemic-era increase in the child tax credit from $2,000 to $3,600 per child, making the full benefit accessible to low-income families. Instead of a lump sum, families would receive monthly payments up to $300 per child, aiming to reduce childhood poverty and hunger substantially.

Free Preschool Access

Biden's budget proposes federal subsidies to states offering free pre-kindergarten programs, potentially saving families up to $13,000 annually, fostering early childhood education nationwide.

Paid Family and Medical Leave

The proposal guarantees workers up to 12 weeks of paid leave for serious medical conditions or caregiving, plus an additional week of paid sick leave, promoting workforce stability and family well-being.

Permanent Healthcare Subsidies

Expanding Affordable Care Act subsidies permanently, the plan would continue lowering insurance premiums by approximately $800 per year, ensuring broader access to affordable healthcare beyond the current 2025 expiration.

Lower Drug Costs

Medicare would gain authority to negotiate prices for more medications, reducing out-of-pocket expenses. Additionally, drugmakers would be restricted from increasing prices faster than inflation, with insulin costs capped at $35 monthly for all.

Funding Through Tax Reforms

To finance these initiatives, the budget introduces a 25% minimum income tax on the top 0.01% of earners, aiming to close tax loopholes that benefit billionaires. Corporate taxes would rise from 21% to 28%, with multinational companies paying 21% on overseas income.

- Stock buyback taxes would increase from 1% to 4%.

- Capital gains tax rates would revert to 39.6%, eliminating the carried interest loophole.

- Medicare taxes for individuals earning over $400,000 would rise from 3.8% to 5%.

- Tax advantages like the 1031 exchange for real estate investors would be eliminated.

- New restrictions on retirement account contributions for high earners would be implemented.

- Cryptocurrency loss deductions would be aligned with other investment rules.

Political Context and Opposition

Republicans oppose tax increases and demand spending cuts before agreeing to raise the debt ceiling, contrasting with the White House's stance on unconditional debt limit increases. Both parties have excluded Social Security and Medicare from cuts, with military spending remaining untouched, leaving social programs as the debate focal point.

While Republicans advocate for tax cuts and reduced social spending to tackle the national deficit, Biden's plan projects nearly $3 trillion in deficit reduction over a decade through its tax reforms.

Explore useful articles in Government News as of 15-03-2023. The article titled " 2025 Biden Budget Proposal: New Family Benefits Funded by Taxes on the Wealthy " offers in-depth analysis and practical advice in the Government News field. Each article is carefully crafted by experts to provide maximum value to readers.

The " 2025 Biden Budget Proposal: New Family Benefits Funded by Taxes on the Wealthy " article expands your knowledge in Government News, keeps you informed about the latest developments, and helps you make well-informed decisions. Each article is based on unique content, ensuring originality and quality.